Hey All,

If you're thinking of buying a home, chances are you'll need a home loan from a reputable bank. The percentage of people opting for home loans varies significantly across different countries and regions. Taking India as an example, approximately 3% of the adult population currently has an outstanding home loan, according to a recent report by Mordor Intelligence. In this post, I will discuss whether it's advisable to prioritize loan prepayment or explore alternative financial options for investing these funds to potentially generate greater wealth, supported by an example.

Invest or prepay the home loan?

Lets take an example here; home loan interest rate is 7% and you have taken a loan of Rs. 1 Crore [$120K+] and the tenure to pay the loan is 20 Years. To calculate the Equated Monthly Installment (EMI) for a home loan, we can use the formula:

EMI = P * r * (1 + r)^n / ((1 + r)^n - 1)

where P is the principal loan amount, r is the monthly interest rate (annual rate divided by 12), and n is the loan tenure in months. Hence computing the values by above formulae the Equated Monthly Installment (EMI) for a home loan of Rs. 1 Crore, with a tenure of 20 years (240 months) at an annual interest rate of 7%, would be approximately be Rs. 75,539 or $925+ Approximate

PS:: the above image is just an example; whereas in my calculations I am taking return investment rate 7% only...

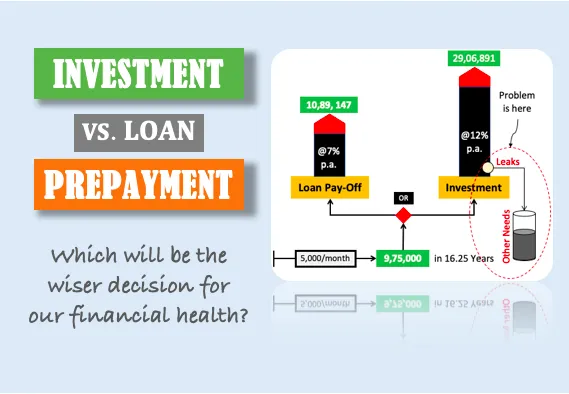

Loan Prepayment Vs Investing - Plan to Prepay Rs. 10 Lakhs - $12K

What if you prepay Rs. 10 Lakhs - $12K at the end of 5 years; and I dont change my EMI as well - lets see how much interest you will save. After 5 years, with prepayment of Rs. 10,00,000.

Total payments (first 5 years) = 75,539×60 = 45,32,340

Next, we'll calculate the remaining payments after prepayment. Suppose the new loan tenure (n') calculated is approximately 159 months:

Total payments (next 159 months) = 75,539 × 159 = 1,20,85,801

Total payments with prepayment:

Total payments (with prepayment) = 45,32,340 + 1,20,85,801 +

10,00,000 = 1,76,18,141

Total interest paid with prepayment:

Total interest (with prepayment) = 1,76,18,141−1,00,00,000 = 76,18,141

Interest Saved:

Interest saved = 81,29,360 − 76,18,141 = 5,11,219

Hence, by making a prepayment of Rs. 10 lakhs after 5 years, and keeping the EMI the same, one would have saved approximately Rs. 5,11,219 in interest on their home loan.

Invested the Prepayment Amount - Calculations::

Invested that Rs. 10 Lakhs - $12K for 7% Rate of Interest that is compounded annually - what will be the amount that I will get in 15 Years. Lets compute this with the compound interest formula:

CI = P( 1 + r/n)nt - P. In this formula, P( 1 + r/n)nt represents the compounded amount. the initial investment P should be subtracted from the compounded amount to get the compound interest.

Where:

- A is the amount of money accumulated after tt years, including interest.

- P is the principal amount (Rs. 10,00,000).

- r is the annual interest rate (7% or 0.07).

- t is the time the money is invested for (15 years).

Computing the Values::

A = 10,00,000(1+0.07) raise to power 15

A=10,00,000(1.07) raise to power 15

Now, we need to calculate (1.07)^15 = 2.759

Thus:

A = 10,00,000 × 2.759

A = 27,59,000

Therefore, if you invest Rs. 10,00,000 at a 7% annual interest rate compounded annually for 15 years, the total amount you will accumulate will be approximately Rs. 27,59,000. So you can clearly see the difference which is better giving a prepayment of home loan saves you approximately Rs. 5 lakhs and whereas if you had invested the prepayment amount with the same ROI [rate of interest] you are better off getting almost 4x return and in our examples Rs. 27+ lakhs approx. The message is Invest rather then prepay and get going building more wealth for yourself... happy investing.. cheers

Loan Prepayment Vs Investing Further - Which option is better for our financial health?

#homeloan #loan #prepayment #investment #finance #compunding #loanprepayment #bank #strategy #investmentplanning

Have Your Say On - Invest or Prepay The Home Loan? - Loan Prepayment Vs Investing Further..

Do you have a Home Loan running? Paying EMI [Equated Monthly Installments] - Planning to pay off the loan early by making prepayments or do you invest in other investment plans? Please let me know your views in the comment section below...cheers

Image Credits:: getmoneyrich

Best Regards

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in Blockchain & Cryptos and have been investing in many emerging projects.