Anarchist Investor Weekly

Your weekly review of the Anarchist Investor Newsletter

Anarchist Investor Book Recommendations

These three books are life changing.

THE ANARCHIST INVESTOR

APR 29, 2024

I’m not a huge reader. Which is to say that I’m not constantly reading. I do however go through concentrated periods of reading. As such, I’m not the most accomplished consumer of the written word. However, there are several books throughout my adult life that have impacted me greatly. I would like to share them with you and hopefully they will impact you in a similarly positive way.

1. Economics in One Lesson by Henry Hazlitt

This is the single best way for anyone to get introduced to Economics and how it functions. Hazlitt uses simple examples to demonstrate the major economic forces at work in the world. It’s accessible to most readers because of this approach. What readers also get is a complete understand of how government intervention in to markets do more to harm them than help. If you were every looking for a gateway into Austrian Economics, this is the book to start with. And if you order it, please do so from The Mises Institute; a non-profit named after Ludwig Von Mises who is the godfather of many of the best economics minds from the 20th century and beyond.

https://mises.org/library/book/economics-one-lesson?d7_alias_migrate=1

2. The Other 8 Hours by Robert Pagliarini

If you were every looking to read a book that inspires you to become an entrepreneur and materially change your life for the better, this is one of the first places to look. The Other 8 Hours refers to the period of time every day where you’re not sleeping or working your primary job. It focuses on the time during the day where most folks have the opportunity to build a business or at least build an entrepreneurial acumen that will benefit them for the rest of their lives. This book is filled with some ‘life hacks’ to save time during the day and preserve those 8 hours (keep in mind it’s an older book so some of them may be outdated). It then lays out a roadmap to getting to where you want to be from an earning standpoint. This takes the form of full fledged business ownership to embracing an entrepreneurial mindset as one of the highest performers in someone else’s business.

This book inspired me to take the leap and co-found an insurance brokerage in 2017. It also is part of the reason I’m writing this newsletter you’re reading right now!

https://www.amazon.com/Other-Hours-Maximize-Create-Purpose/dp/0312571356

3. The Hobbit by J.R.R. Tolkien

Yes, I’m a giant nerd. Yes, this is a fictional tale about little people who save a fictional world called Middle Earth. No, I don’t go to comic con’s regularly dressed as a Hobbit. Yes, this book can help inspire change in your life if you let it.

The Hobbit lit me up in a way that I hadn’t really felt reading all sorts of other types of fiction. I hadn’t been on many epic adventures in my life. The story focuses on a character who doesn’t want for much in the way of everyday comforts or needs. However, what he doesn’t have is excitement. The life immediately around him doesn’t change much. As fate would have it, the opportunity for excitement comes to his doorstep. Ultimately, he has to choose to step out on the adventure. But once he does, his view of the world completely changes.

There have been many times in my life where I felt like things were stale or too predictable. Quite often that feeling coincided with complacency on my part as well as some very unhealthy habits. It wasn’t until I got out of my comfort zone and ‘took an adventure’ that I found new ways of living life and thinking.

If you have never read this book, give it a shot. And if you have but it was a long time ago, give it another go. You won’t be disappointed either way.

https://www.amazon.com/Hobbit-J-R-R-Tolkien/dp/0618260307/ref=sr_1_3?s=books&sr=1-3

I Am A Fractional Real Estate Investor

My experience so far with Lofty.ai

THE ANARCHIST INVESTOR

APR 30, 2024

Investing in Real Estate can be costly and have a steep learning curve as a result. You need to know about CAP rates and funding levels as well as have a team that can help with legal documents like leases and a kick ass accountant. Starting in the real estate investment world can be daunting as a result. Several startups have sprung up to help open the door to this type of investing. I’ve spoken prior about Ground Floor for accredited investors. If you are not wealthy and just getting started, there are other options. This is where I got introduced to Lofty.ai.

Fractional Real Estate Investing

The digital age and blockchain have unlocked investment opportunities that didn’t exist in the past. One of these is fractional ownership of large assets…like real estate.

Fractional ownership is when an investor purchases a percentage or share of an asset instead of paying the full price. This enables those with less access to capital or looking to diversify over several kinds of assets to get a stake in areas like real estate, aviation, and fine art. Depending on the type of fractional ownership, the owner may also obtain partial usage rights in addition to an equity stake. - Investopedia

This isn’t to say that you should shy away from investment in real estate if you’re able to foot the 20% down payment and the other hurdles that are associated with being an investor. However, if you are looking to get into this type of investment and not risking your shirt, fractional real estate investing is a potential entry point.

Blockchain in Real Estate

Within the past couple years, blockchain and crypto have begun decentralizing the world of real estate ownership and investment. Through DAO’s (decentralized autonomous organizations) and tokenizing property, startups can now break a larger piece of property into smaller units and identify a DAO that owns the overall asset while managing the various participants that own those tokens and thus an ownership piece in the property. Here’s an example: you want to sell your house but no single buyer emerges. You can setup a DAO on a blockchain and break your house into 1,000 tokens that represent the overall value of your home. The public then gets to purchase and/or bid on the tokens in the DAO to own a piece of your home at whatever price they purchased the token at. The overall value of the property is the result of the most recent token purchase applied to all of the tokens outstanding (kind of like a stock). This means that purchasing a token on your property for $1,000 makes all the tokens worth $1,000 and thus the overall property is worth $1,000,000 ($1,000 x 1,000 tokens).

Lofty.ai

Ground floor is a great option for exploring real estate investment in fractional shares if you are an accredited investor. However, not everyone makes $200,000 a year in income or have a net worth of $1 million excluding the value of our primary residence. Lofty.ai provides a platform to tokenize a property, transact those tokens, and realize gains both through the rise in the value of that real estate as well as daily/monthly rental payments. You also have the option of participating in a little DeFi as well. Not interested in owning the property and simply being a creditor? That’s available too. You’re one of the first in line if the property goes bust to get paid back and you’re getting monthly interest payments. However, you’re also limiting your upside in terms of the price appreciation of the real estate. I will be participating in both sides of this investment platform as I want to diversify my exposure to loss as well as participate in the future price appreciation these properties may experience.

The sign up was a little painful from the standpoint of the Know Your Customer (KYC) hurdles. I’m not a huge believer in KYC as it is basically government tracking of your financial information. They do require 2-factor authentication (which is a plus) and you have to provide them with a picture of your ID as well as biometric scans of your face (can’t stand this). It was a pain to get done too because I don’t carry a Real ID driver’s license. This means I had to run and get my passport to complete the process.

The marketplace is fairly easy to navigate. Keep in mind you are basically setting up a crypto wallet that is on their platform and can only transact their tokens on their marketplace. This means liquidity issues will be present and you’re not totally in custody of the tokens. These are both less than ideal. However, I’m not pointing to this platform as the be all, end all for real estate investment in your portfolio. It’s a bridge to other steps such as directly purchasing real estate. You will also need to understand how limit orders work. You’re essentially picking the maximum price you would like to pay for the token when you put in your order. If the current price is higher than that, it won’t execute. I put my orders in with a limit of what the tokens were valued at today and both transactions went through immediately. In the future, I want to develop an idea of what the properties are really worth today to inform me on which tokens I should be purchasing and at what price.

My First 2 Investments

I purchased a single token each for two commercial properties. The residential properties I need to dig into a little deeper. Some of them seem riskier than they might be at first glance. There are also a lot of properties from areas like Chicago and Miami where I’m not too interested in investing in until after the reverse COVID migration peters out.

A Strip Mall in Iowa

Token Cost: $54

Projected Annual Return: 8.6%

Projected Rent Yield: 6.0%

The main reasons I picked this as my first investment had to do with the anchor tenants (3 national chains being McDonald’s, Domino’s, and US Cellular) along with a reasonable projected return both in terms of the rent (6%) and the overall return (8.6%) once you factor in the overall value appreciation of the property.

A Hotel Room in Tulum, Mexico

Token Cost: $50

Projected Annual Return: 17.27%

Projected Rent Yield: 9.27%

The overall property is operated by Blue Luxury which is an upscale hotel operator. The location as a resort destination in Mexico (Riviera Maya) is another attractive attribute. It is my belief that in the near term the affluent consumer will continue to be able to spend while everyone else cuts back. This should at least keep the vacancy in the hotel to a minimum. I need to dig into the financials a bit more because the projected yield on this property is high which means the risk is high. I would anticipate there is some potential for loss here. I just need to put it into context related to the overall return. There is also a guaranteed 12% return on this unit for the first 5 years which is a nice bonus. It should add some insurance when the economy turns down.

There is an option to automate the investments each month. I will begin looking into this too as I identify the properties I really want to weight my portfolio towards. This will also provide some protection in the form of dollar cost averaging if the overall value drops in the coming weak market.

If you’re interested in checking out Lofty.ai as well as signing up to try it out, I would appreciate it if you used my referral link. You will also get $50 once you deposit or make a purchase on their platform!

https://lofty.ai/refer?grsf=afyjpd

Health Makes Wealth

Changes are happening for the good!

THE ANARCHIST INVESTOR

MAY 01, 2024

It’s Federal Reserve Day! Affectionately known as FUD day. The investment world is telling everyone that this will be the most important FED meeting yet. Why in the world am I writing an article about changes in my personal health routine? Because it’s more important than the Federal Reserve, that’s why. It will also have huge, positive affects on my investment activities moving forward.

The Current State of Things

After COVID, a number of family tragedies, and a lot of change my body isn’t what it used to be. I’ve had to do a lot of spiritual work but it hasn’t translated into mental and physical health gains…until now! I’m overweight, lethargic, cranky, and dealing with side effects that go along with those things. My alcohol consumption is through the roof along with processed foods. My morning routine has diminished to waking up, letting the dogs out, getting a cup of coffee, and immediately sitting down at the computer for 4 hours. This is a far cry from how things were going just a year ago. On another blog I did a 30 day whole life challenge that completely changed things for the better. I just didn’t stick to it. Well it’s time to stick to it.

I’m not going to give regular updates on this aspect of my life because I’m certain you’re more interested in talking about investment, markets, economics, and how those affect your portfolio. I will check in occasionally on this path however because healthy minds and bodies typically make healthier investment decisions. They are intertwined.

What Will Change?

I will recreate my 30 day whole life challenge with the intent of keeping it going for my whole life. Luckily, I have been off nicotine for over a year and have no intent of going back. The thought of smoking makes me a little queasy.

However, my alcohol consumption needs to go to near 0. The only compromise will be the bottle of wine my wife and I split on our livecast of Ungovernable on Sunday nights. Besides that one evening, I will be stone cold sober! Alcohol is destructive and in large quantities or with sustained consumption over a long period of time, it will wreak havoc on your body and mind.

My diet will return to only eating real food. I was previously plant based but that has begun to change because there are too many processed foods and alternatives that started as a small component of my diet and grew to become the majority of it. They were far too carbohydrate heavy and included awful ingredients such as seed oils. I have also been on a journey that has led me to interview regenerative farmers that have sold me on the foundation of raw milk and purely organic meat that will be supplemented by a round diet of veggies and fruit with a bit of whole grains thrown in.

The non-existent morning routine will be born again with walking in the early sun, drinking some essential salts first thing, delaying caffeine and food intake until 11 am, cold showers, meditation, and journaling.

I will also continue a practice that developed from an intention I made during a soul star session led by my wife. I am and will continue to drink at least 1 gallon of water every day. I’m certain the vast majority of folks in the western world are dehydrated all the time. Between the limited pure water intake and the ingestion of dehydrating substances like alcohol, nicotine, and caffeine, there is no way in my mind that most folks are hydrated. And prolonged dehydration can also destroy the operations within your body. I in fact have had serious GI and digestive issues over the past two years. During my 30 day cleanse they disappeared. I’m going to get back to that.

Finally, it is my intent to work out regularly to increase my muscle mass as well as athletic endurance. Muscle burns a lot more calories than fat. It’s time to embrace this reality and get a little SWOL.

Accountability

My accountability will be via my wife as a partner, my kids as the ultimate truth tellers, and you all when I occasionally check in.

I also want to hear what you’re doing to invest in your personal health whether it be mental, spiritual, and/or physical!

I am looking forward to this journey because as Andy Dufresne says in Shawshank, “I guess it comes down to a simple choice, really. Get busy living, or get busy dying.”

The Federal Reserve Just Cut

But not how you might think.

THE ANARCHIST INVESTOR

MAY 02, 2024

Yesterday, the Federal Reserve chair, Jerome Powell, explained that the Federal Reserve Open Market Committee was unanimous in its’ decision to leave the Federal Funds rate at the current level of 5.25-5.50%. As such, most news coverage today has been about the Fed’s lack of clarity on whether inflation is under control and headed back to 2% as well as the reduced potential for rate cuts later this year. Once again, the media has missed the most crucial part, The Fed Cut Yesterday.

Quantitative Easing & Tightening

At the height of the Great Financial Crisis, the Federal Reserve under then Chair Ben Bernanke initiated a rescue that had never been done in US economic history. The Federal Reserve entered the private market and began buying both US Treasury Bonds as well as Mortgage Backed Securities (MBS) in an operation called Quantitative Easing. If you recall, MBS and the leveraged bets against them were at the heart of the crisis. The Fed’s purchases of these securities propped up their prices artificially and somewhat halted the run on banks that had gorged on them. Keep in mind that these securities might have been worthless. The Fed was purchasing them for above market prices and thus subsidizing the losses using tax payer money.

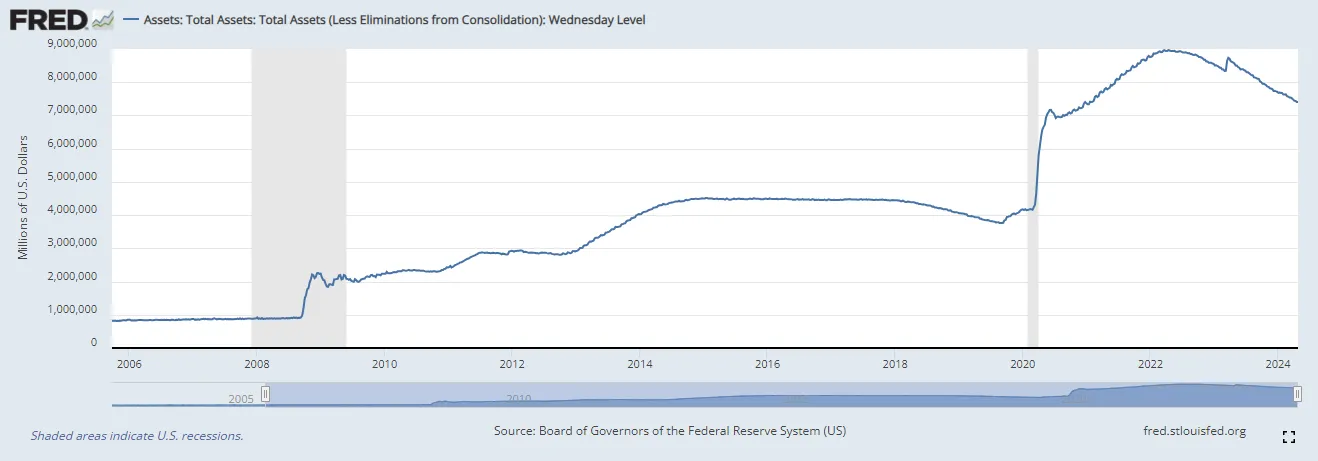

In turn, the Federal Reserve’s balance sheet ballooned from $1 Trillion to a maximum of $9 Trillion in 2022. Since the peak, these fixed income (debt) instruments have been sold down by the Fed in the reverse process called Quantitative Tightening. This means they are returning them to the private market and extracting cash. Arguably, this is more restrictive to economic activity than actual interest rate changes at the Federal Reserve’s borrowing window. Many argue that the Fed’s interest rate policy is simply a signal to the markets and has little to no actual impact on how transactions are completed within the financial sector.

Federal Reserve Balance Sheet (2006-2024)

If you notice there was a period of time between 2016 and 2019 where the Federal Reserve tried to do Quantitative Tightening. It resulted in a liquidity crisis at the banks that needed to be immediately reversed just prior to the COVID crisis in 2020. Had COVID not hit, the US was headed for a Great Financial Crisis 2.0. It’s possible that the crisis was only delayed by COVID and all of the Fiscal & Monetary support that was generated as a result of it. Did you know that the rate of Lottery Winners who declare bankruptcy is the same as the rate in the whole population? The only difference is it takes a little more time because poor spending habits can’t be fixed with more money. It just delays the inevitable.

The FED Cut

There was one major change to the Federal Reserve’s monetary program yesterday. The monthly cap on US Treasuries it would allow to mature and not be replaced from its balance sheet was reduced from $60 Billion to $25 Billion. This means that in the months prior to June 1, the Federal Reserve was rebuying up to $60 Trillion a month of US Treasuries that mature. The US Treasury was sending money to the Federal reserve for the face value of bonds that were maturing and the Federal Reserve was allowing $60 Billion worth to not be repurchased in the open market. As of June 1, it will reduce what ‘runs off’ meaning they are going to be more active in terms of buying US Treasuries to replenish their balance sheet. On net, the balance sheet will still go down but at a much slower pace.

This effectively increases the buying support for US Treasuries in the market. Because Treasury Bond prices move inversely to their yield (interest rate), this will have the effect of supporting prices of US Treasuries and slow or even reversing the rise of interest rates. This marks a significant shift in the Federal Reserve’s monetary policy and very few are talking about its’ impact.

Many borrowing rates reference US Treasury bond rates. Mortgages being a big one. Mortgage rates have risen and priced a lot of buyers out of the market. It has also begun thawing the prices within the market because sellers need to attract the few buyers that can still afford to take out a 7%+ mortgage on a home. Ironically, higher mortgage rates are also keeping potential sellers from pulling the trigger because they are locked in at a lower mortgage rate currently and don’t want to move only to take on a higher interest rate for doing so. Lower interest rates will reinvigorate buyers and sellers to loosen the property market. And as covered many times prior in my writings, housing supply issues are what is causing the majority of what the talking heads are telling you is “sticky inflation”.

Whether it gets reported or not, the Federal Reserve is discussing the residential and commercial real estate markets. They know there is a bomb about to go off if they can’t lessen the pressures in those areas. The worst case scenario is getting into a feedback loop where higher rates causes less construction and sales, which restricts supply, which causes higher prices (specifically for rentals), which necessitates higher rates. Real estate is stuck and The Fed just eased to try and help it get unstuck. We’ll see if it works.

Keep in mind that the worst of the market losses in the Wall Street Casino typically happen after the first Federal Reserve rate cut. I think that may have changed. It may now need to refer to the first Federal Reserve easing in monetary policy. Well it just happened.

June Giveaway Announcement

I'm giving away free paid subscriptions!!!

THE ANARCHIST INVESTOR

MAY 03, 2024

Every month is a giveaway and this month my subscribers are getting a shot at paid subscriptions to The Anarchist Investor. Whether you’re a paid subscriber already or a free subscriber, I’m giving away 4 full year passes. That’s 12 months of paid subscription. Each 1 year pass is worth $99.

What do paid subscribers get that makes it so special?

📚 Access to the full Anarchist Investor Archive (free subs are limited)

💰 My weekly model portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

➕ More to be added in the future!

How to Enter

If you’re already subscribed as a free or paid subscriber, you’re in! If you aren’t, use the link right here and get in on the action!

https://anarchistinvestor.substack.com

When is the Drawing

The drawing will happen on The Anarchist Investor LIVE! show at 12 pm est on Monday, June 3, 2024. Use any of the links in the footer of this article to subscribe and get notified of the live casts that happen every Monday through Friday at 12 pm est.

Sharing is Caring

Help out your friends and family by reblogging this and letting them get a shot at these perks!

A HUGE THANK YOU! 🙏

To everyone that is currently sub’d, I’m so thankful that you’ve chosen to come along on this ride with me and continue to read, listen, and watch my content. It’s my goal to help others with this information and hopefully I’ve helped you in some small way. I would love to continue putting out content that is of interest to you and addresses what you’re paying attention to or concerned about. So please use this opportunity to leave a comment with what you’d like future articles or live casts to focus on.

Affiliate Links

Get $10 in free Bitcoin and start stacking today with Swan Bitcoin: https://www.swanbitcoin.com/anarchistinvestor

Get $50 in credit toward Fractional Real Estate investment with Lofty: https://lofty.ai/refer?grsf=afyjpd

Automate your Gold & Silver Purchases with Vaulted:

https://vaulted.blbvux.net/g1EGKX

Save/Make Money on your Cell Phone Plan with Helium MOBILE:

https://my.hellohelium.com/ref/2FN2CHL

Anarchist Investor Links

Anarchist Investor on Substack: https://anarchistinvestor.substack.com

Anarchist Investor on Spotify: https://open.spotify.com/show/5bPTSl9UcLuDOlki25iBjU?go=1&sp_cid=195eae3f83bf1083418e06af7cb8af8f&utm_source=embed_player_p&utm_medium=desktop

Anarchist Investor on Rumble: https://rumble.com/c/c-6154833

Anarchist Investor on YouTube: https://www.youtube.com/channel/UChC2sQ_wL6esPg8e3_NsPDA

Matt_Archy on X: https://twitter.com/Matt_Archy

Matt’s Personal FB: https://www.facebook.com/matthew.struck.37

Matt’s Personal LinkedIn: https://www.linkedin.com/in/matthewstruck/

Matt-Archy on HIVE: https://peakd.com/@matt-archy

Matt-Archy on Vimm.tv: https://www.vimm.tv/c/matt-archy

****Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation****