March 22 - Investment Moves

- Investment Trades for March 22

- 3 Blockchain stocks to 100x

- Balance Sheet: Bitcoin > Cash

- The 1% / 2% / 5% holdings.

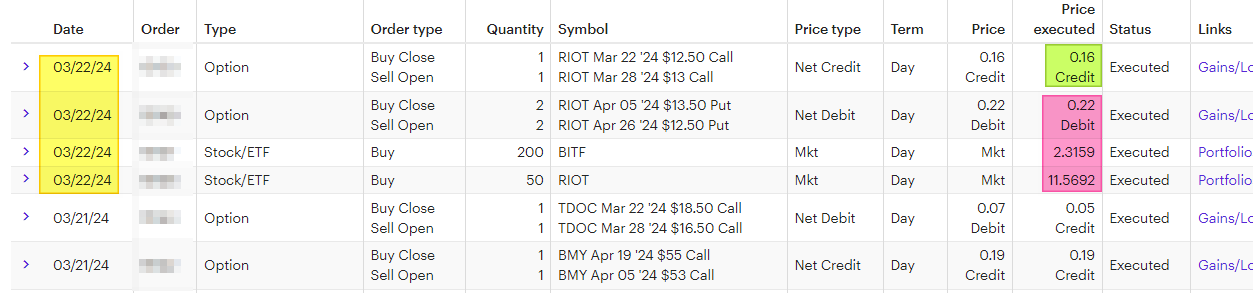

Investment Trades for March 22

Here are my trades for today:

It is around BITCOIN price in the coming year.

- Rolled a covered call up and out to $13 for next week.

- Rolled a CSP (cash-secured put) down and out.

- Added Bitfarms ($450) stock position.

- Added RIOT ($550) stock position.

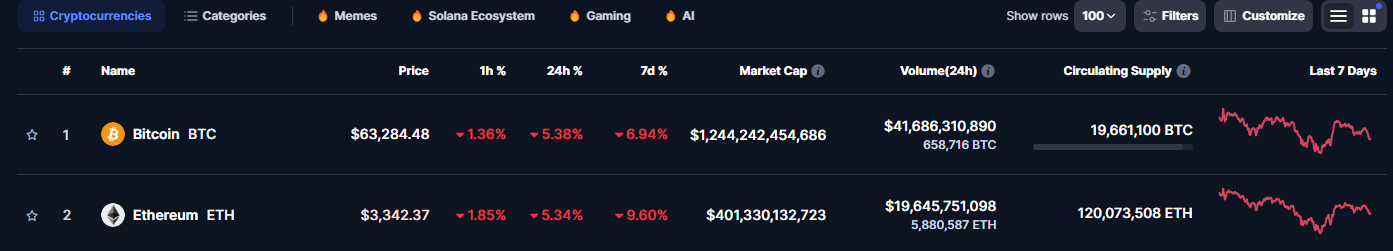

Why would I add more LONG positions to the Bitcoin play when Bitcoin is at ~64K?

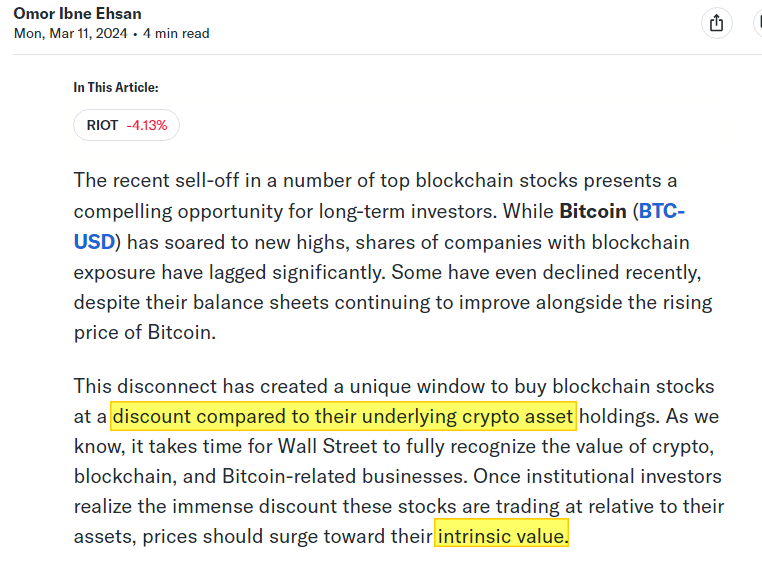

3 Blockchain stock to 100x

Here is an article from March 11.

Do I believe these will 100x? I don't.

Do I believe they can 2x or 3x? Sure.

Do I believe they can 10x? Maybe.

Do I believe they can 30x? Given enough time but not by 2028.

The play on these stocks right now is a higher risk because of the Bitcoin halving. The market understands that the halving will cut revenue by 50% come April 20. Every Bitcoin miner will suffer the same thing.

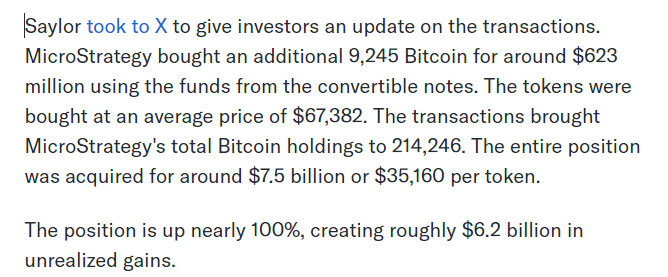

The question becomes does the revenue matter or the "Bitcoin" on the balance sheet? MicroStrategy borrows 700 Million dollars and then uses that to purchase Bitcoin recently (average price of $67,382).

MicroStrategy holds lots of bitcoin on its balance sheet. They have been doing this since 2020. But they issue debt to use to fund this type of move. The thinking is one of leverage to use to buy an asset that will be worth more in the FUTURE, like a typical REAL ESTATE investor would. They can sell 100 Bitcoins or whatever the amount is to pay down their debt using a Bitcoin that might be worth 250K each or 500K each.

What RIOT and BITF are doing is a bit different. These are Bitcoin Mining Companies that mine Bitcoin each day. Both are debt free and they sell BITCOIN to help offset their operations. The goal is to keep some BITCOIN from mining on the balance sheet and grow that bag. Both of these companies has been in the game since 2017 or before.

You can read more about RIOT here.

You can read more about BITF here.

Balance Sheet: Bitcoin > Cash

Traditional Wall Street Type looks at the balance sheet. They see assets and liabilities. Often, they like to see companies with little or zero debt and plenty of "cash" on hand. Debt is not a bad thing when it can be covered by ongoing business operations of a profitable brand.

Right now, they like Coinbase and MicroStrategy! They don't like the Bitcoin miner because of the halving that is cutting their revenue. Is this strange to you or not?

Sure, it is strange to say revenues in May 2024 will be half of what I earned in March 2024. But don't forget that RIOT and BITF are miners. They mine BITCOIN whether that asset is 40K or 100K. They sell some of that to offset operational costs and what remains is added to their balance sheet. If you believe Bitcoin will move to 100K, 250K, or 1 million dollars each, then it makes sense to add these types of companies to your stock portfolio. It's not easy for a Nike or a Coke to "5X" their assets on the balance sheet. As long as MicroStrategy continues to hold BTC, then I don't see much risk in following a similar play on RIOT and BITF.

The 1% / 2% / 5% holdings.

We all know that investors use different concentrations of holdings. Many younger folks are "all-in" on the Bitcoin move. Many older folks are "no- coiner", those that own zero coins. What is the right way to think about this?

Portfolio Diversification is very important part of risk management. This is true in the stock market and why the move toward the S&P 500 Index Fund has become the normal benchmark.

Suggestion of holdings:

- Unbelievers: 1% of net worth in BTC.

- Middle of the Road: 2% of net worth in BTC.

- Lover of Bitcoin: 5% of net worth in BTC.

Bitcoin is a high-risk asset class. Like with any investment, you can lose your money. Because of that understanding holding 1% is still better than holding ZERO %.

As a reminder, just because I did these moves, does not mean they are good for you to do. This is not financial advice, but rather sharing what I'm doing for educational purposes.

Posted Using InLeo Alpha