Hello everyone,

I wanted to share an update on the current state of Hive. 🚀

Source:

Graph data source 👉 binance.com "

Fear & index data source 👉 alternative.me

hive other data source 👉 coingecko.com

Data

🥇rank: 372

📈 Cap: 146974462 usd

📊Vol: 4993005 usd

24H -3.17368%🔴

7D -24.90118%🔴

30D -51.04873%🔴

For more information, you can visit the following links:

🔗 Hive

🔗 Hive Explorer

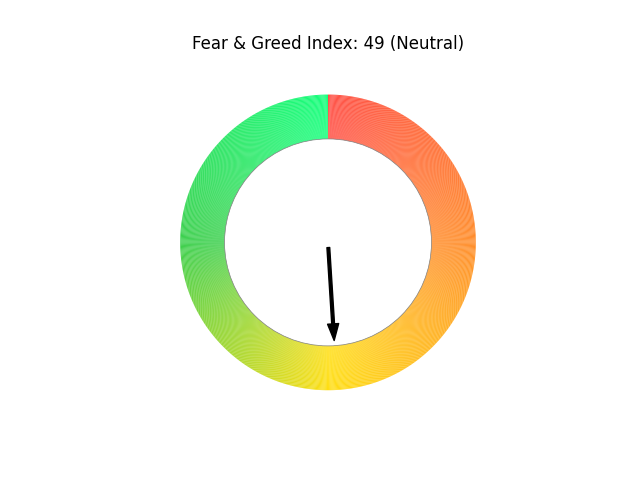

Actual Bitcoin fear & greed index:

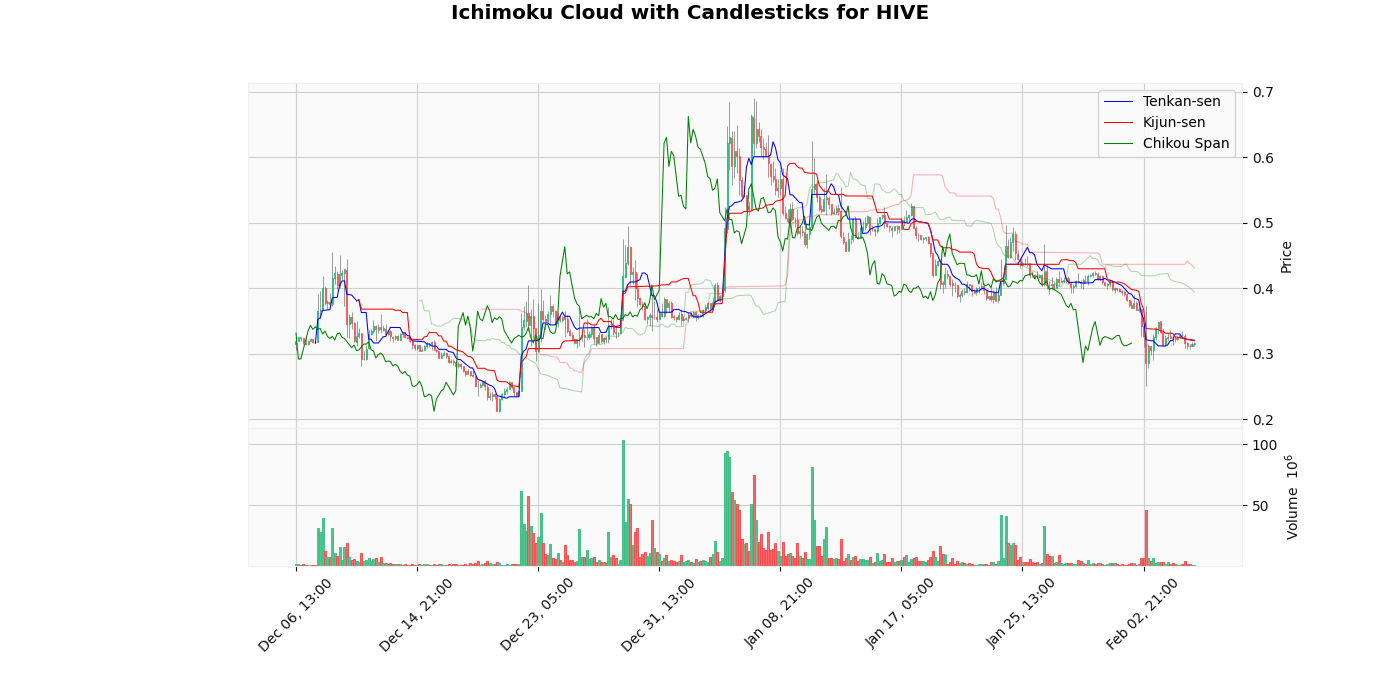

HIVE/USD Market Analysis

- Current Trend: Bearish (Cloud color: 🔴)

- Tenkan-sen: $0.3206 (Price below)

- Kijun-sen: $0.3197 (Price below)

- Support Level: $0.3945

- Resistance Level: $0.4311

- ADX: 29.07 (indicating a strength of trend high)

- RSI: 36.71 (indicate neutral)

- MACD: -0.01, Signal Line: -0.01, Histogram: 0.00

- Volume Strength: -23.97%

Interpretation

The current price of HIVE is located below the level of the Ichimoku cloud, indicating a bearish trend. With a volatility of 76.86%, it is advisable to monitor the price levels around the Tenkan-sen and Kijun-sen to detect signs of strengthening or possible reversal.

Personal Considerations

Bearish Trend

- At the moment, the HIVE market looks weak, with the current price ($0.3161) below the Kijun-sen ($0.3197). This indicates a potential bearish phase.

- The presence of the price below the Ichimoku cloud reinforces the negative trend, suggesting that the bearish is still in control.

- With a volatility of 76.86%, the risk of downward movement remains high. It is important to pay attention to key support at $0.3945 and evaluate any signs of reversal.

- For now, it is best to be cautious and watch if price can find support or if it will continue to lower levels.

Conclusions

- Given the current price of $0.3161, if it continues to respect the support level at $0.3945 and the resistance level at $0.4311, the trend could maintain its current direction.

- However, should the price break below the Tenkan-sen ($0.3206) or the Kijun-sen ($0.3197), it could signal potential weakness in the market, leading to a possible bearish phase.

- Conversely, if the price manages to break above the resistance level, it could indicate a strong bullish momentum, prompting further upward movement.

- The ADX value of 29.07 suggests that the current trend is strong, which should be taken into account when making trading decisions.

- The RSI value of 36.71 indicates that the market is neutral, providing additional context for potential reversals.

- The MACD line at -0.01 crossing above the signal line at -0.01 could indicate a bullish signal, while a cross below could suggest bearish momentum.

- Thus, traders should remain vigilant and consider these levels as critical points for potential entry or exit strategies.

- Monitoring the volatility, currently at 76.86%, will also be essential, as increased volatility may lead to rapid price movements and changes in market sentiment.

Link of analisys: Bitcoin-Fear---Greed-Index---Historical-Data

Link of volume analysis: Hive-Volume-Analysis