Is this all you got?

As a survivor of the hostile takeover on this chain I can't help but chuckle at all the newbies who are uncomfortable with everything going on right now. What is everyone so worried about? Does nobody have any fight in them whatsoever? Did everyone just think that upending the entire financial system (founded on a core of violence) was going to be easy-mode?

The SEC is paving the way for mainstream adoption right now with a metaphorical bulldozer of frivolous lawsuits and demands. The government demands to be in charge of everything. Well... too bad? The entire point of this technology was to get away from that outcome. There was always bound to be a lot of friction along the way. None of this was unexpected.

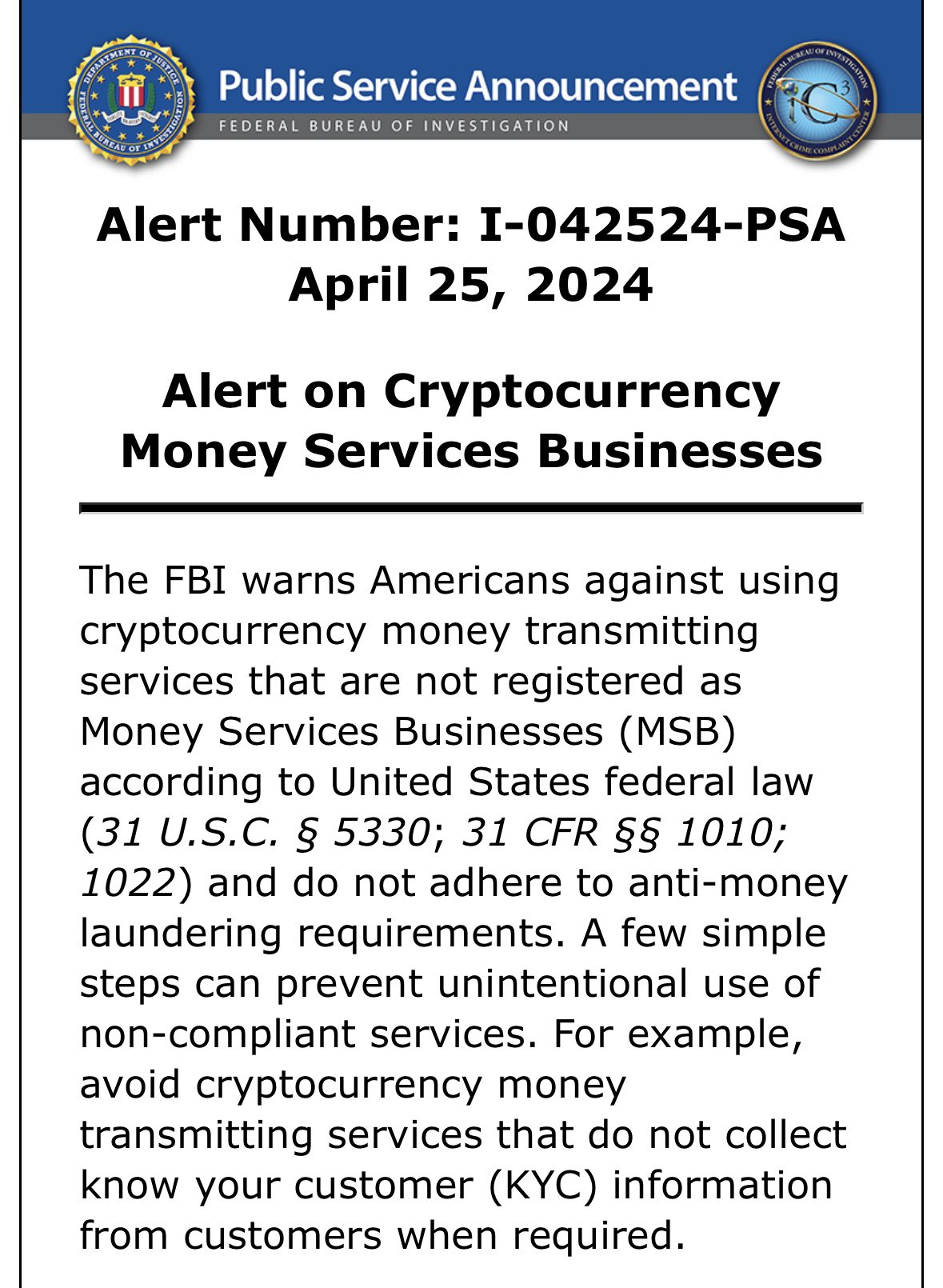

FBI Warning

In the latest from Clown World and off the heels of regulators making absurd claims about "illegal money transmitters" the FBI has decided to spice it up a bit and broadcast a blanket statement that attacks all cryptocurrencies in existence. "Be sure to KYC everything otherwise you might be breaking the law." lol, yeah... that's bullshit.

You know what else has an FBI warning?

Movies on VHS

The vibes on this crypto warning are pretty clear.

It very much reminds me of torrenting movies and music back in the day. They can only prosecute the tippy-top offenders, and even that will be difficult. It's much more important to scare people entering the space and keep them off-chain rather than actually try to enforce such a ridiculous statement. After all: they are basically saying that everything we're building is potentially illegal and the only access we should have to it is what centralized exchanges/institutions are providing... which is basically nothing. All the real stuff requires the direct use of keys and self-custody. This is the entire point, as the centralization of custodianship completely breaks the business model of every legit tool within the space.

Take Hive for example.

If someone were to take this advice to heart then all they can do is hold Hive on an exchange. That's the only KYC there is. There isn't even a way to KYC your Hive wallet with the government. They are demanding compliance without even offering a way in which people can comply in the first place. Classic crypto/government relationship.

... avoid cryptocurrency money transmitting serivces that do not collect KYC information WHEN REQUIRED.

When... required?

lol wut?

Even their own language betrays itself. What does that even mean "when required"? It's never required (unless it is, in which case you're forced to do it and the point is moot). Does that mean everything is all good?

I'm actually curious if someone could take this into court and argue it successfully. "Well the FBI guidelines said I only needed to KYC when it was required... and it wasn't required so what's the problem?" These kinds of statements are hilariously vague and borderline nonsensical. This tracks because they have to be vague, as legitimate regulation is fully off the table as that would be an admission that they can't really control any of this stuff.

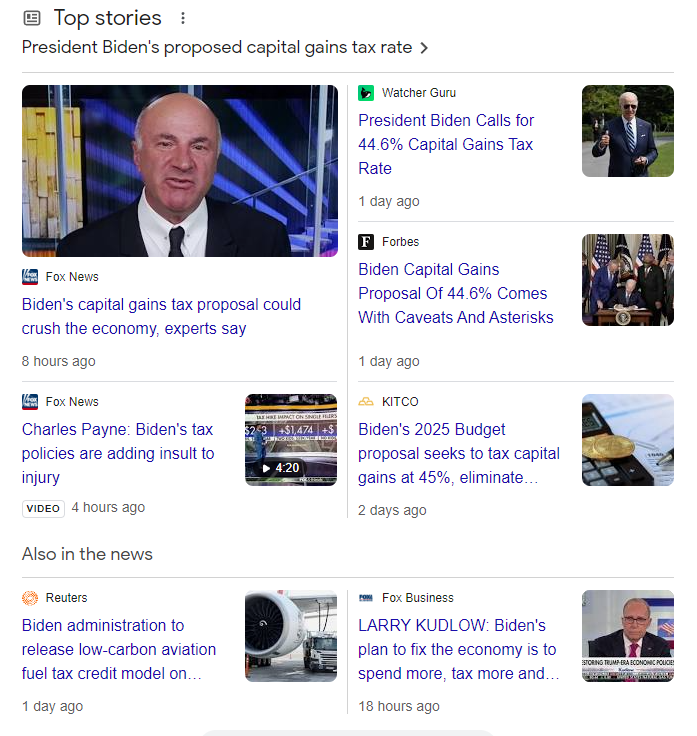

Unrealized capital gains tax

The other bombshell that's making shockwaves is that Biden is once again providing "tax the rich" lip-service to the democrats. I keep trying to tell people that this type of tax is impossible to implement but nobody seems to understand why.

First of all..

Biden has been babbling about unrealized taxes on the rich since he took office in 2020. This linked re-post comes from @nealmcspadden, timestamped in 2020 on the blockchain. Everyone hearing the news today thinks that this is a new thing. It is not a new thing. It's a very old, boring, and stupid thing; just like the president himself. It's also an impossible thing.

Sooooo... lol?

Not only is an unrealized capital gains tax just a really stupid and childish idea... but it's also potentially illegal? Apparently the courts will figure that out soon... and considering billionaires are in charge of this pony show you can be damn sure they'll win. This posturing from the Biden administration is nothing but virtue-signaling "tax the rich" rhetoric & lip service... and they've been doing it since inception. These are not, and never have been, serious considerations. And I'll tell you why.

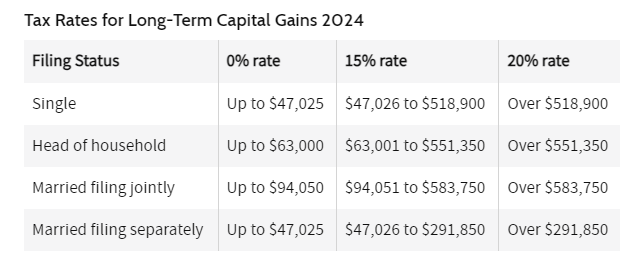

25% unrealized tax is not logistically possible.

Tacking on a 45% capital gains tax-bracket for the super wealthy past that 20% range is definitely possible, but still very unlikely. At that point no one even has any incentive to hold the asset for a year to get the long-term bonus in the first place.

25% unrealized tax, on the other hand, is unequivocally impossible.

As the title implies, UNREALIZED gains do not exist. They are paper vapor. So the Biden administration is literally pitching an idea that we should be taxing money that doesn't exist based on the market cap of the asset. Yeah, that's not going to fly.

Imagine investing in a penny-stock.

Okay so you've invested in this new startup company. Say it's going to be really successful like you're investing in Amazon when it was just Bezos working in a garage. Sounds pretty great right? Well not really with an unrealized gain tax.

So assume your penny-stock just went +100% and now you and every other investor owes 25% of those paper gains to the IRS. Yeah that's all well and good except that the money doesn't exist because the liquidity doesn't exist. This is forced selling on a fledging company that needs every last penny it can get. It is the opposite of investing; divesting.

As people sell the penny stock to pay their taxes in April... the value of the stock declines. Because penny stocks have no liquidity the value of the stock will nosedive and soon the stock will be worth so little value that even if investors sold ALL OF THEIR SHARES they'd still owe money to the IRS.

Example:

I put $100k into a penny stock. The penny stonk goes x2. Now I have $200k and I owe $25k to the IRS. By the time April rolls around I still owe $25k but the stock has dropped in price by 90% because everyone was forced to sell the gain to pay taxes. Now my entire position is worth $20k but the IRS says I owe them $25k even though I never sold anything. Durp. The liquidity in the markets simply does not exist to support any of this. Rather, unrealized taxes very much expect that the user can just sell an infinite amount of stock at the quoted price without that price going down. It's beyond ignorant, which is why we must simply assume it's completely fake news.

Market manipulation

Unrealized taxes also create a huge financial incentive to manipulate markets. How does one calculate the unrealized gain? Is the price we are using the price at the end of the trading session on December 31st? This gives a huge incentive to flash-crash the price at the end of the year down to the level it was the year before. This way nobody has to pay these kinds of taxes at all, as there was no gain to begin with. Again, this would be a very stupid incentive to give the market, as something like this could easily be done on leverage which hedged positions... and everyone knows it's coming so they can dogpile on.

Bitcoin example

The exponential nature of crypto is even worse. What happens if Bitcoin goes 11x from $1T to $11T? Now everyone collectively owes $2.5T in unrealized gains just because the price happened to be $11T at the end of the fiscal year? Well as we all know the amount of actual liquidity on the market is something like 1%-2%. This creates a market-cap ratio that is often 100:1. For every real dollar pumped or extracted from the market it will manipulate the market cap by x50-x100.

Given this example it's not hard to see that $2.5T actual dollars being dumped on the $11T market cap is going to flash-crash the price well over 90%. Again, when that happens people could sell everything they have and the IRS would still claim they're owed money. None of this is based in reality.

The second this happened pretty much everyone would be forced to simply not pay... because again THE MONEY DOESNT EXIST. The government would then be sued... basically by everyone. And they'd lose too. This is why unrealized taxes are a pure fantasy, and even the Biden administration knows this. It's all political lip-service bullshitting.

Conclusion

Have your say. Is the FBI warning a serious threat? Or is it just that thing as the beginning of the VHS tape that you completely ignore and go about your day? Is unrealized tax a serious concern. Or is the Biden admin blowing smoked up the democrat's asses? Give me stronger battles: this is easy-mode.

Posted Using InLeo Alpha