I think I'm enjoying sharing my Bitcoin analysis with you. In a previous post on the 23rd of March I gave some clues of the possible movements of this asset, before the end of the month, just based on volume and some simple indicators that I use.

So... 😅 now we have a cover. We can do this at the beginning of the month and before the end of the month, right?

Let's remember:

After pointing this out in that post you can see here, I said:

...the market tells me that there is a lot of volume and a small body for that candle, so BTC is likely to see new highs in the coming months.

Then I added:

(You can go check that post before continuing with this one, but let's see what happened and what is happening right now.)

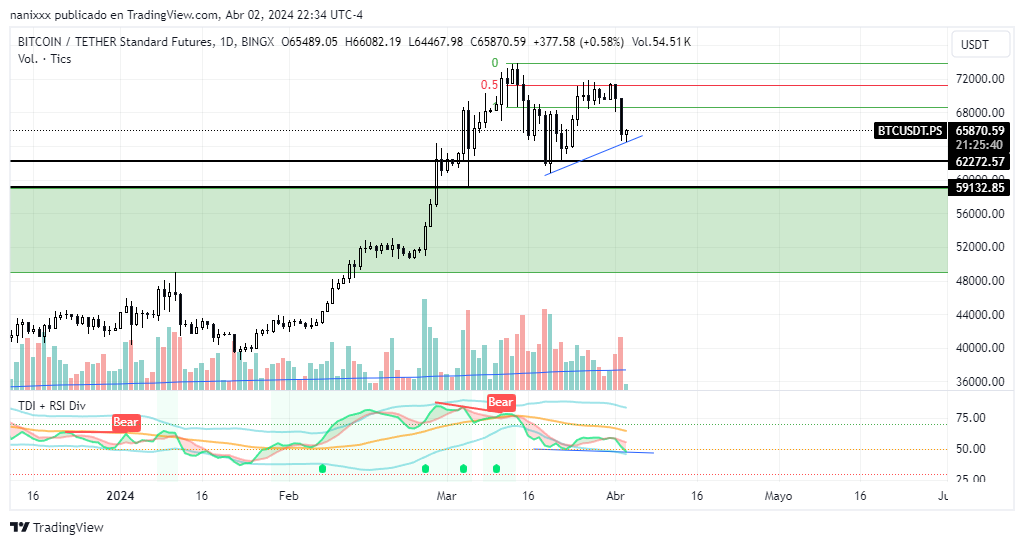

The last few days of the month were a time of growth for the thin candle I was pointing to. This is very important to note, if you want to learn to read the market. The trading volume represented by the bar below was not in line with the body of that candle. So, exactly what the market was announcing happened, buying. Then you can see that the March candle closed with a little more body. However, it still did not match the volume below.

This discrepancy opened a monthly candle that looks (for the moment) bearish. It is expected, as I explained, that the large imbalance that caused the rise and its liquidity void will be filled or corrected, and then continue to rise.

We are in a monthly timeframe. Let's look at the daily and also keep an eye on the divergences.

Between 71300 and 71800 there is a very strong resistance which the price could not break. There seems to be a selling consensus where the price has been sideways for a while, but you can see this clearly if you look at the one hour chart.

Before I show you that image, look at the hidden divergence between the chart and my TDI indicator. I marked it with two trend lines. The price should fall until it corrects that divergence.

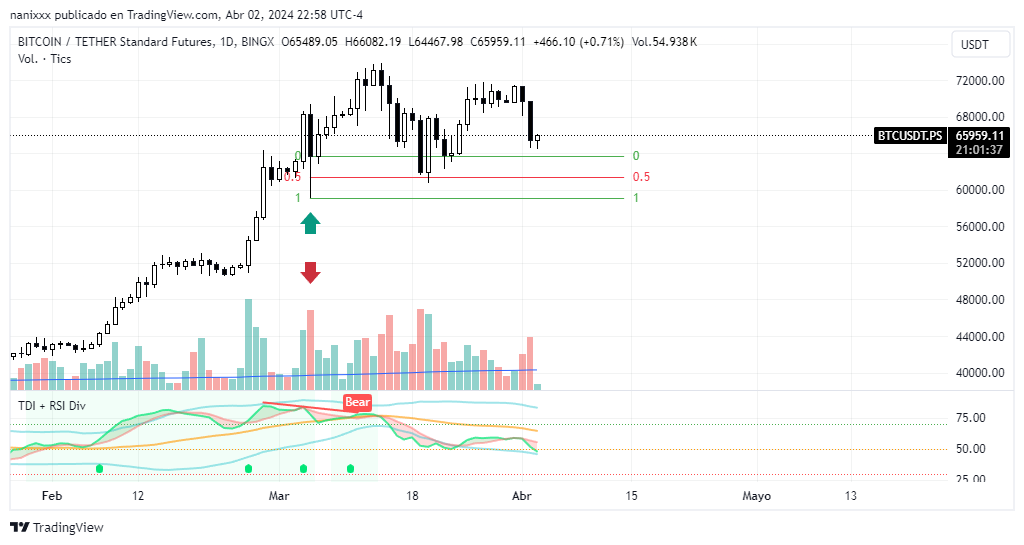

If you notice I have two black lines marked. This is an operative that I even shared in X.

Have a look at this thread:

https://x.com/nanixxx_FT/status/1774814805607551325?s=20

In other words, I am now waiting for the second price to make another entry. I said I was not going to trade short because BTC is bullish and I prefer to take only buy trades now. I said this in the previous post.

But as I pointed out, there is nothing to worry about. This is a natural market process and although we could be down for two months, it does not mean that we will not go up again.

What I do is precisely to be attentive to volume, divergences and follow my trading plan.

Do you have a trading plan? I can share mine in detail in the next post.

There has not been a change in the bullish structure here, this is a simple correction, so I see possible upward reactions in those prices I have marked in black.

(62272.57 and 59132.85)

When I talk about structure, I mean that the lows are getting higher and higher just as the highs are getting higher and higher. A change in trend would be lower highs and lower lows as well.

This is daily timeframe so a prediction here may take two or three weeks to occur, even longer.

That upward reaction zone has already been tested and held, but will it make it a second time?

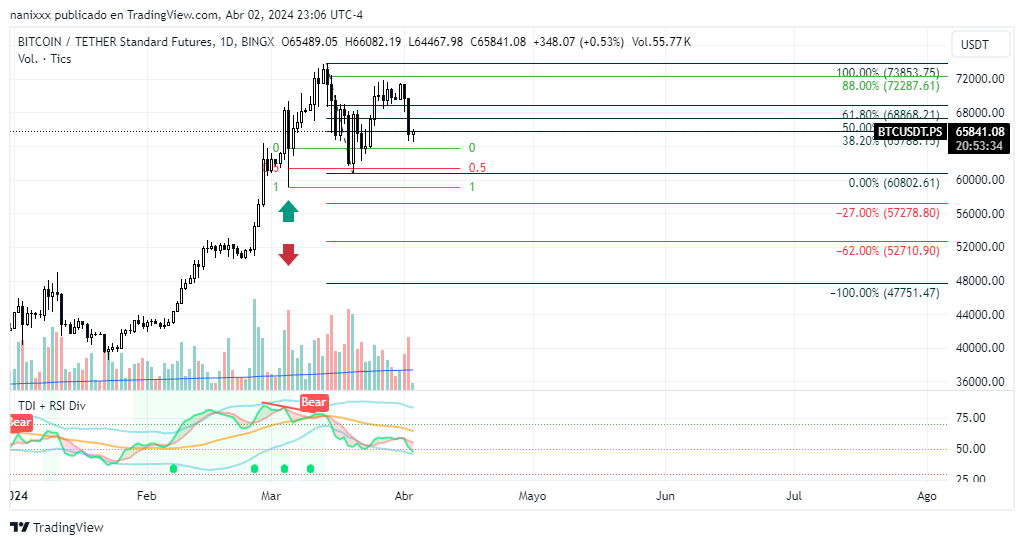

If I measure with Fibonacci I get important prices very close to what I expect.

😑 Ooops... The red levels... maybe I should correct my prices a bit hahahaha....

In short:

This I have just marked are possible moves and in my case I will only be watching for sharp changes in volume for my entries, although, as you can see, I already have points marked for them, and they are all buy.

We will see new highs but the correction is necessary and I repeat that a careful observation of these indicators (volume and TDI+RSI Div) can give clues about the market directionality.

Ask what you want to know in the comments and if you feel like it you can keep an eye on my trading that I share regularly on X.

😉

Original content by @nanixxx. All rights reserved ©, 2024.

Cover created in Canva. Image made by AI on ausbit's stuff and things discord channel (https://discord.gg/EJJ3XUcR).

Posted Using InLeo Alpha