One of the key benefits of incorporating cryptocurrencies such as Bitcoin and Ether into investment portfolios is their uncorrelated nature with traditional assets like stocks and bonds. This lack of correlation means that the returns of cryptocurrencies do not move in tandem with those of traditional investments, providing diversification benefits. During periods of market volatility or economic uncertainty, cryptocurrencies have demonstrated the ability to serve as a hedge against traditional asset classes, helping to reduce overall portfolio risk.

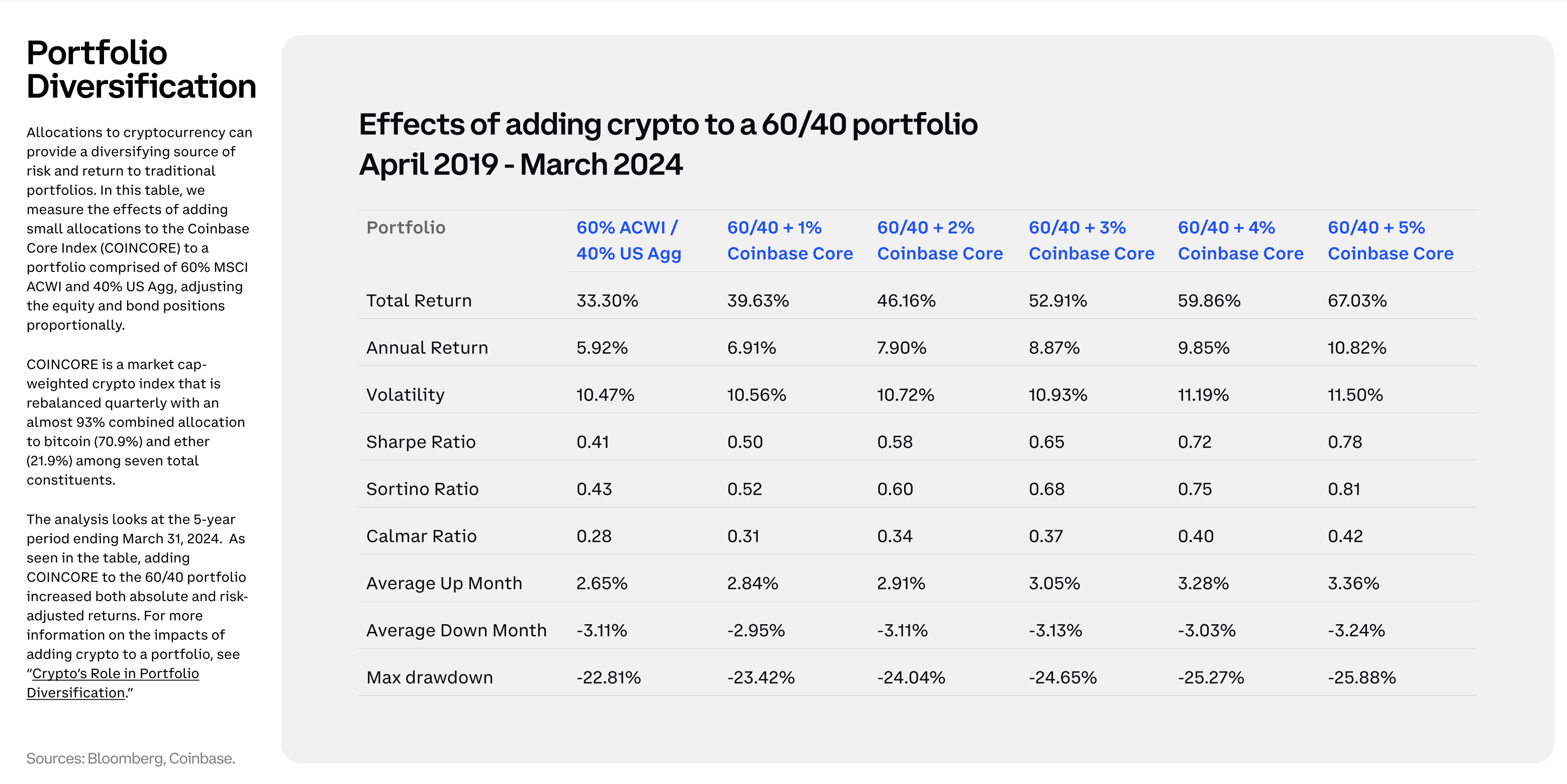

Furthermore, the historical performance of cryptocurrencies has shown that even small allocations to digital assets can significantly enhance portfolio returns. Studies have indicated that adding just one percent of cryptocurrencies to a traditional portfolio can result in more than one percent of compounded growth over time. Moreover, research suggests that a portfolio allocation of around five percent to cryptocurrencies can strike a balance between risk and reward, maximizing potential returns while minimizing volatility.

The growing accessibility of cryptocurrencies through investment vehicles such as exchange-traded funds (ETFs) has further fueled interest in integrating digital assets into traditional portfolios. With the launch of cryptocurrency ETFs, investors now have easier access to the asset class, facilitating broader adoption among institutional and retail investors alike. This increased accessibility is a positive development for the cryptocurrency market, signaling growing acceptance and recognition of digital assets as a legitimate investment option.

As investors continue to seek ways to diversify their portfolios and enhance returns, the case for including cryptocurrencies becomes increasingly compelling. With their proven ability to deliver uncorrelated returns and reduce portfolio volatility, cryptocurrencies offer a valuable opportunity for investors to enhance risk-adjusted returns and achieve greater portfolio resilience.

In conclusion, the benefits of adding cryptocurrencies to traditional investment portfolios are clear. From diversification and risk reduction to enhanced returns and growing accessibility, digital assets offer unique advantages that can complement and strengthen traditional investment strategies. As cryptocurrencies continue to gain mainstream acceptance and adoption, investors stand to benefit from the opportunities presented by this emerging asset class.

Discord: @newageinv

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities and services that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

My go to exchange is Coinbase; get bonuses for signing up!

The future of the internet is here with Unstoppable Domains! Sign up for your own crypto domain and see mine in construction at newageinv.crypto!

Always open to donations!

ETH: newageinv.eth

BTC/LTC/MATIC: newageinv.crypto

Disclosure: Please note that for the creation of these blog posts, I have utilized the assistance of ChatGPT, an AI language model developed by OpenAI. While I provide the initial idea and concept, the draft generated by ChatGPT serves as a foundation that I then refine to match my writing style and ensure that the content reflects my own opinions and perspectives. The use of ChatGPT has been instrumental in streamlining the content creation process, while maintaining the authenticity and originality of my voice.

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.