Bitcoin seems to have picked up some momentum...

But has it really? We've made it back to that first dead-bounce level that marked the end of the rally. Now we are trading in a no-man's-land channel between $69k and $72k. Is this bullish or bearish? Well it's completely indeterminant in my opinion. But there are certainly some random situations of note to go over.

The first one being that we just so happened to pump out of that bearish pennant on the day of the full moon. Hilarious. I had to close my shorts at a slight loss there at the yellow circle because of the threat... and then we immediately spiked upward, which was interesting.

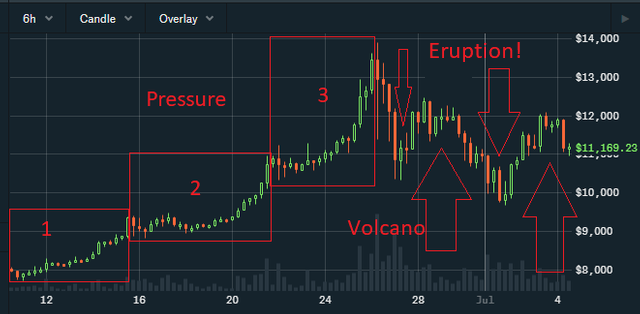

Here's the fractal I've been using as a template for the current run.

So how are we doing?

Ah well it's obviously not exact but it is looking pretty damn similar, even with this breakout in play. We even got three phases of pump followed by what looks like a blow-off top so far. The overall expectation is that we continue to get lower highs and higher lows until volatility drops off a cliff. Then when the THING happens: we crash.

The THING in this case is the halving event. It's not bullish. Hashrate is constantly at all time highs. Too many speculators bought in anticipation. When the block reward gets cut in half the ultimate game of PvP takes place. Which miners can handle that type of volatility, and which ones have to liquidate their assets and quit?

Some miners will sell quite a lot of Bitcoin to stay afloat during this time. We call this distressed selling. Imagine how much one would be willing to sell in order to keep their business going.

This is compounded by the fact that all the speculators who have been waiting for this moment collectively realize that the halving event is not some magic thing that makes number go up instantly. It takes 12+ months of lower emissions before it has a truly fundamental affect on the network. It seems like no matter how many times we run through these facts people are determined to make the same mistake over and over again.

But this time is different because ETF!

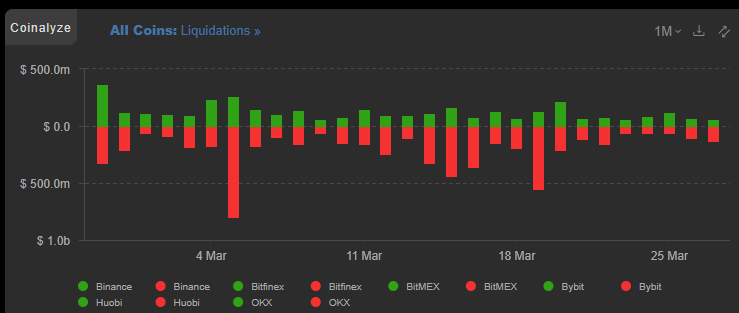

Yeah it's not, but it also is. In the short term, ETF inflows are a rounding error. Compared to the leverage of perpetuals markets these inflows don't mean a thing until they liquidate the shorts. The funny thing about that is it's the longs that have been getting busted the most as of late. The market is still wildly bullish on aggregate. Ironically the busted longs allow the ETFs to buy without pushing up the price as much as they would have otherwise. Greed at its finest.

So yeah essentially unless we are trading at all time highs again, which technically is only a 7% pump from the current spot price, there really is no reason to believe that anything has changed. This time is not different. The halving is bearish on the short term. I still expect to get back to that absolutely critical $58k level by the end of April.

How does Hive look?

For the first time in years Hive is looking like it has finally bottomed out against BTC. We are coiling at the bottom. Any price between 550-650 sats is a great place to buy in my opinion. I will personally be looking to make some big rotations into Hive and Rune at the end of April using Thorchain lending. I'll essentially deposit my BTC into the contract and go long on BTC (as collateral), RUNE, and HIVE all at the same time. That's how bullish I am on buying at the end of April.

Traditionally the end of April and September are always super safe times to buy in. Check the chart yourself for confirmation. However, normally when we'd get a good Q4/Q1 like we just did, summer would be a bust. I don't think summer is going to be a bust this time around. The environment is simply too wackadoo. The ETF and other macro variables are too strong to be crab walking for 9 months straight like we have done in the past. Exchanges like Coinbase now have less BTC in their retail vaults than they did in 2015. This is an unprecedented rally.

LIQUIDITY

One of Hive's biggest failures has been a lack of liquidity, with regulatory overreach choking us further, and we can see in real time that this problem is being addressed in a big way, from backdoor channels on LEO into Maya and Thorchain... to VSC contracts, wrapped BTC on Hive, and V4V Lightning integration. It's all coming together. This is the bottom. Any price under 80 cents is a big discount. Count on it.

Rank 365... lol?

It truly feels like a joke seeing Hive in the mid 300's on page three of Coingecko. Trust me, it's a buying opportunity. In retrospect it will be stupidly obvious. Simply getting back to rank 200 requires a token price of $1.07, and that assumes that the rest of this hyper-bullish market is just standing still. Reclaiming rank 100 requires $2.80, again assuming the market stands still. You aren't bullish enough, anon. Everything is boring and stagnant, until it isn't. And then you missed it. Oops!

Conclusion

April still looks bearish and astrological events still seem to entice the day-traders. One of the worst omens, Mercury in retrograde, starts April 1 and ends April 24... which coincidentally is the exactly period I was trying to avoid anyway. Go figure.

The real signal of this upcoming mega-rally isn't memecoins or AI nonsense that can't deliver; it's decentralized exchanges and social media within the emergent attention economy. We're positioned pretty well this time round. Try not to muck it up.

Posted Using InLeo Alpha