Golden Movement for Gold this March!!

It’s a golden movement for Gold! It has made news by touching a record all-time price above $3,000 on March 17th, surpassing its previous all-time high (ATH) resistance range of $2,450.

Wow… !!

Trading view Gold Futures Price Chart >>

Gold as an investment asset has scored over BTC this year!

While, we crypto enthusiasts were earlier screaming that BTC is the best-performing asset of the decade, this year it hit us that Gold is outperforming Bitcoin.

This year Gold performance is 40% better than BTC!

Investor Sentiment: Preference for Gold over USD

*Now, consider Gold’s price began ascending from March to July 2024 poking above the previous ATH price of $2,453, at a time when USD’s strength in the DXY index kept increasing. *

Similarly, during Oct 2024 to Jan 2025 period, when USD strength was increasing, Gold’s price kept increasing as well.

*DXY index measures the strength of USD against a basket of 6 major global currencies - Euro, Japanese yen, Pound, Canadian dollar, Swedish krona

Trading view Gold Futures Price Chart >>

Points of time when Gold price increased in periods of time when USD strength in the DXY index increased!

This showcases a scenario of Gold getting purchased during times when USD value was appreciating and it was costly to procure Gold, as with an appreciating value of USD fewer amounts of GOLD can be purchased.

This reflects, investors losing confidence in the USD and preferring to hold Gold instead.

Clear Signs of Investors Losing Confidence in Dollar's Stable Value!

Consider also the scenario of investors turning to invest in Gold over US bonds. This further reinforces the point of investors' loss of confidence in the Greenback.

Trading view chart showing performence of Gold over Us 2 year bonds!!

Gold's increases in value over DXY

Gold’s out-performed DXY too by 40%, most likely rising in value against other major world currencies as well!

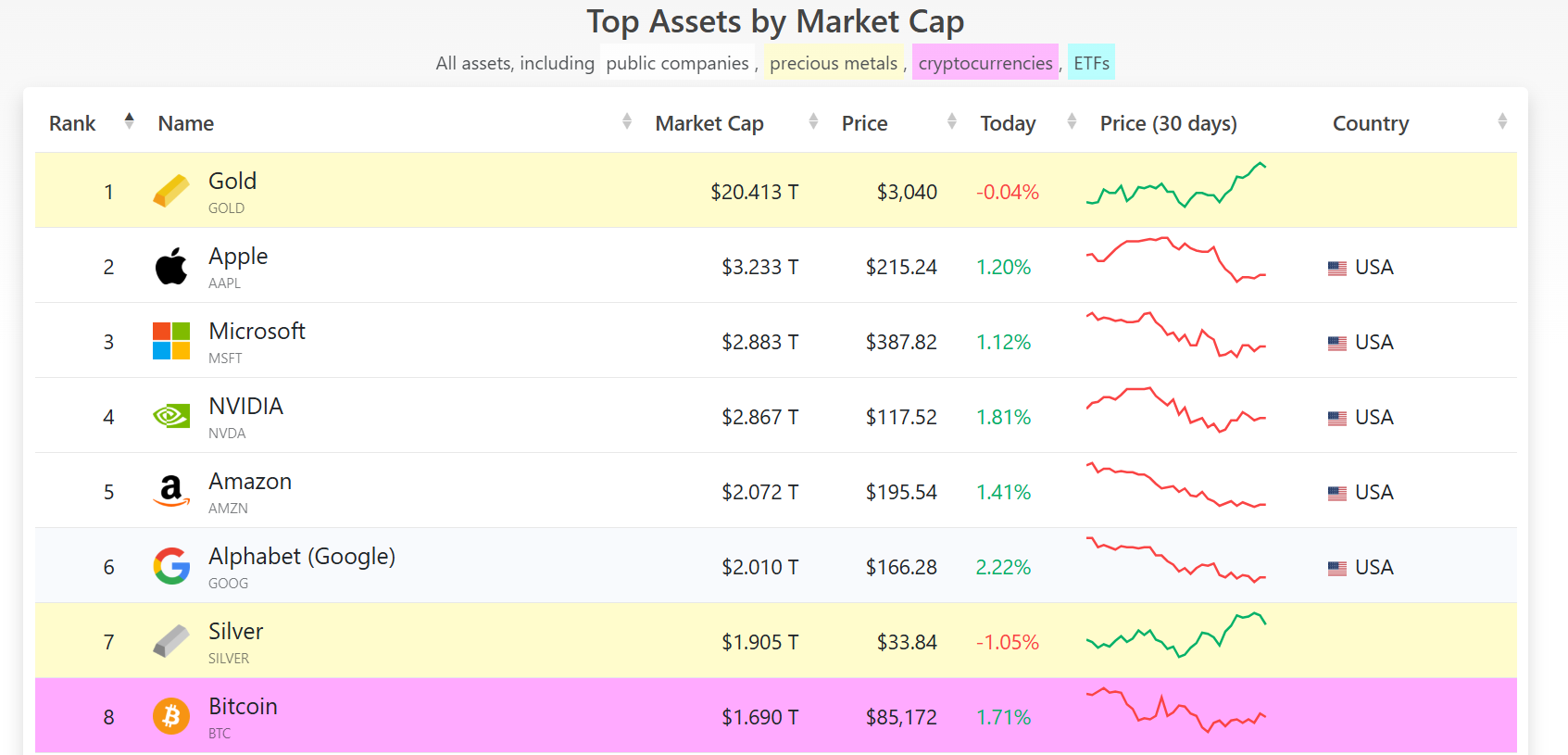

Gold is globally one of the top assets to hold!

Gold is now the most valuable asset in the current global financial market, with the largest market cap of $20.413 trillion at the time of writing.

The precious metal has outperformed major US stock indices, with Gold’s one-year performance surpassing Nasdaq, the US Technology index by 37%, S&P 500 by 35%, and DJI by 39%.

Gold vs Nasdaq Trading view chart >>

So, Gold become a great asset to hold again.

When stock indices fall and Gold rises, it shows investors moving toward safe-haven assets

President Trump deserves credit for making Gold great again!

Let’s evaluate if President Trump can be partly responsible for making Gold great again.

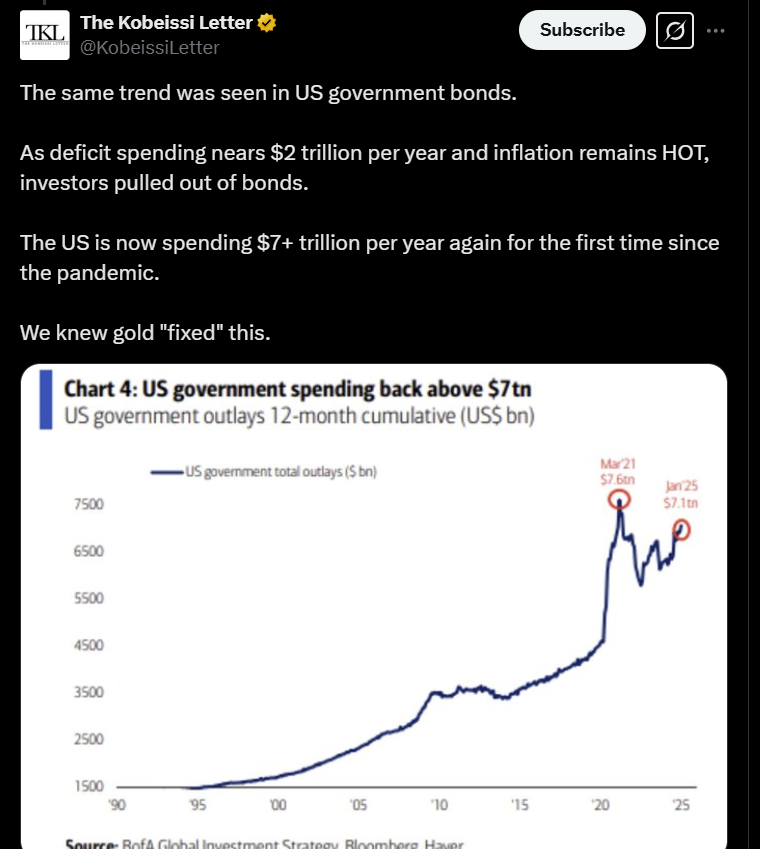

Interestingly, even though DOGE, led by Elon Musk, has made expenditure cuts by slashing fund allocation to many humanitarian organizations and federal agencies, government spending has skyrocketed to $7 trillion per year, the highest amount since the pandemic. The US deficit spending is close to $2 trillion annually.

Gold price rise analysis thread by The Kobeissi Letter>>

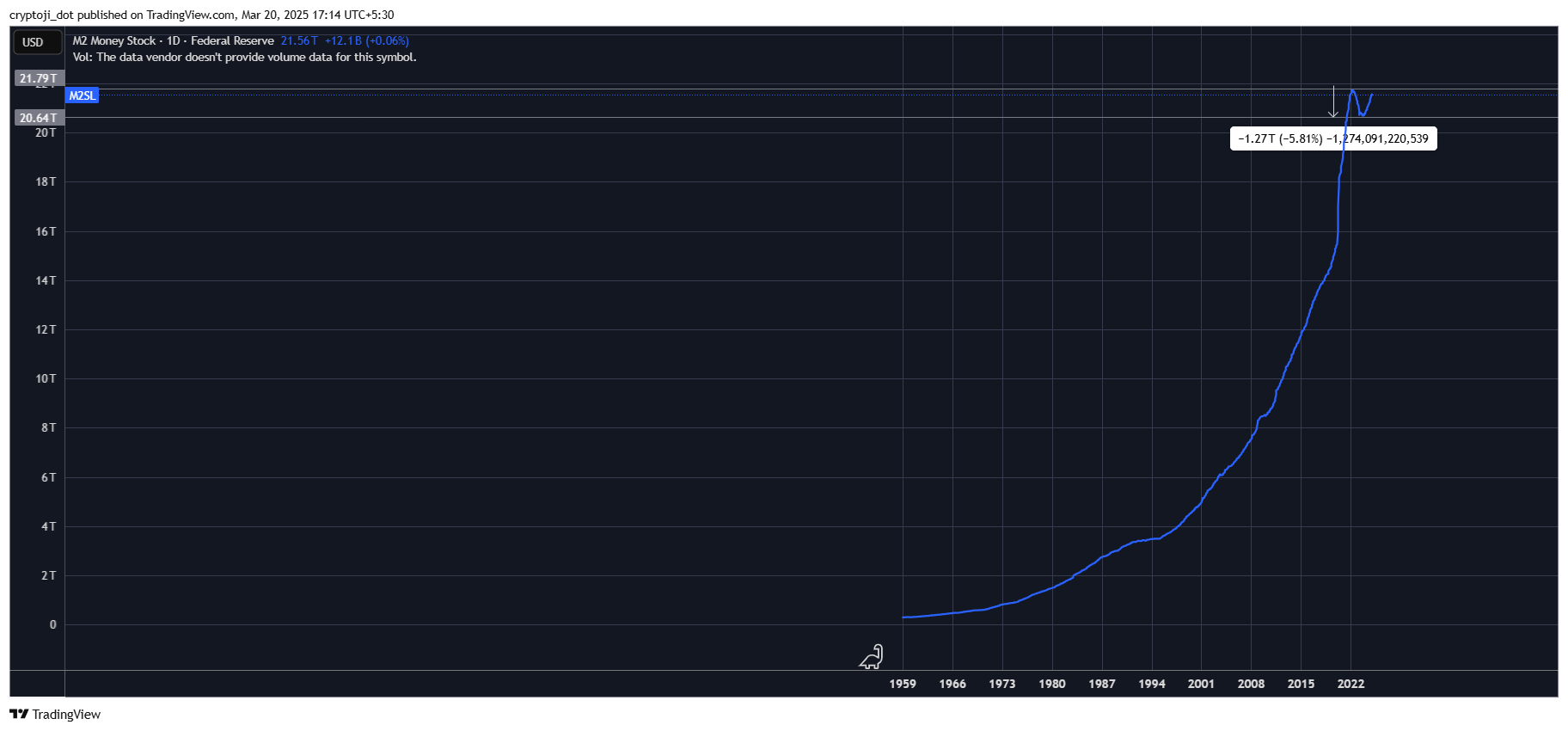

The M2 Money Supply, which measures the amount of money circulating in the economy—including M0 Money Supply, which measures the total amount of physical cash and coins—as well as other money instruments like travelers' cheques and deposits easily convertible to cash, has increased.

Trading view M2 Supply Chart>>

While US Fed’s monetary tightening policies with its rate hikes had reduced the circulating money supply in the economy, it has since increased back to earlier high levels as depicted in the chart.

President Trump was expected to be a factor in the rise of inflation levels due to increased fiscal spending by the government through money printing.

Add to this the additional inflation pressures resulting from high tariff measures of the Trump administration, that would increase costs of end products for US customers.

The Trump administration has brought market uncertainty, with fears of recession and inflation - factors that have contributed to Gold becoming great again.

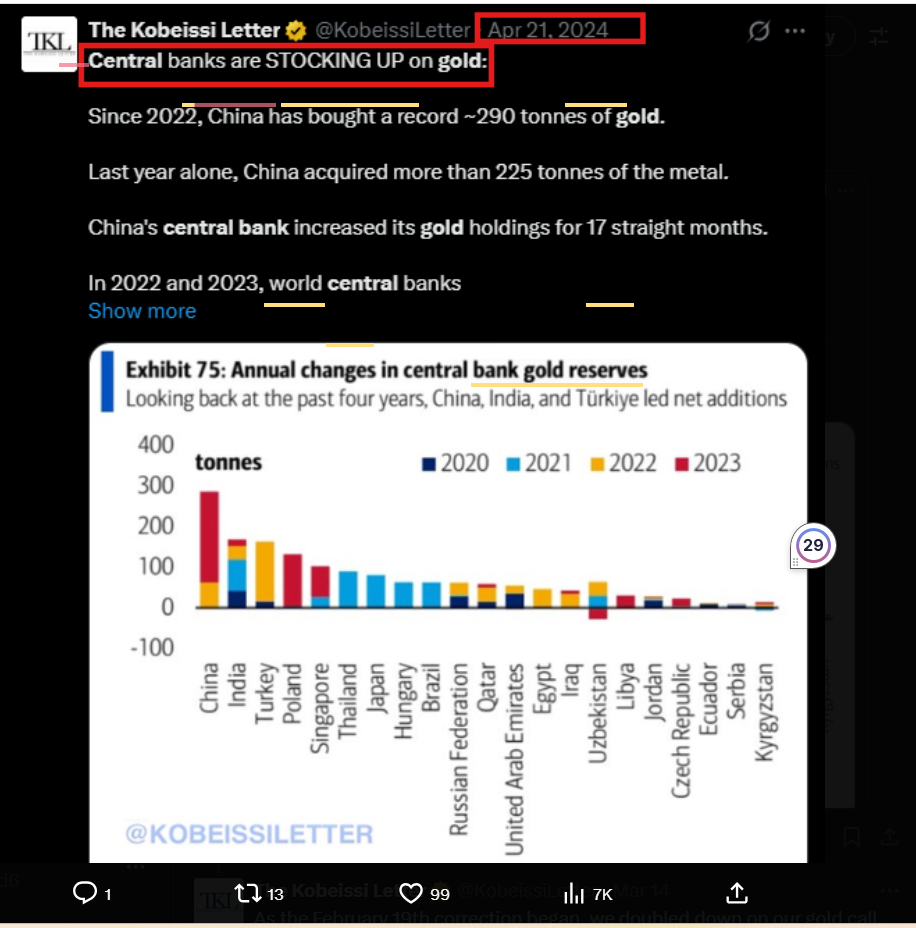

Tons of Gold Purchases by Global Central Banks Since 2020!

Central banks around the globe have been stockpiling Gold, with China leading by purchasing 290 tons of Gold since 2022. The year 2024 set a record for gold purchases, with central banks around the world acquiring over 1,000 tonnes!

Gold price rise analysis thread by The Kobeissi Letter>>

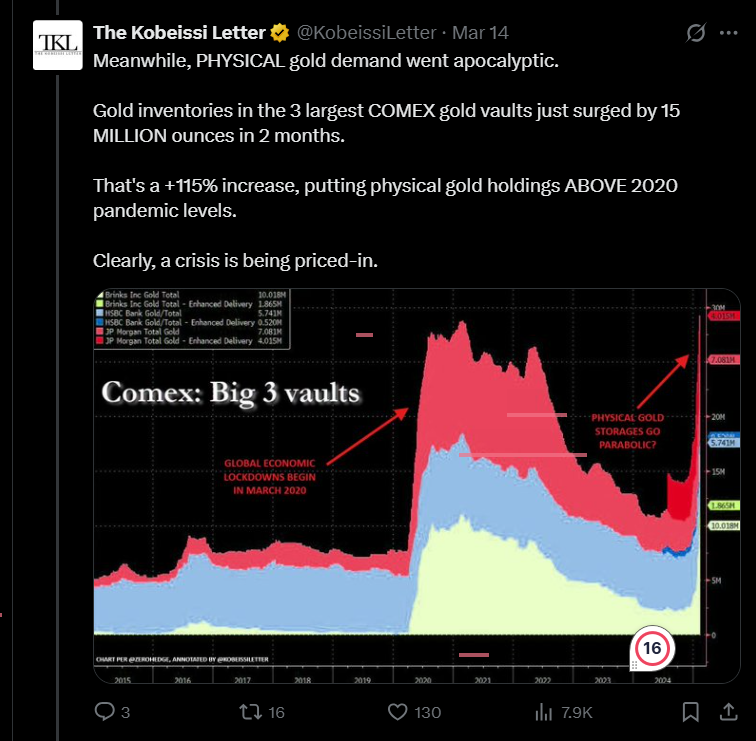

Behold the Extent of Robust Demand for Physical Gold These Recent Months!

There has been tremendous demand for Gold in recent months, with Gold inventories in the three largest COMEX gold vaults increasing by 15 million ounces, a rise of +115%.

Gold price rise analysis thread by The Kobeissi Letter>>

Gold is Precious, and the Gold Held at Fort Knox is Even More So!

It’s likely that people feared President Trump would announce tariff hikes on Gold, prompting them to purchase significant amounts of the precious metal in recent months. As of now, we know Trump is not interested in imposing tariffs on Gold.

However, the President's close aide, Elon Musk, tried to stir up news by tweeting on his X platform that he suspects the Gold bullion reserves held by the US government treasury and other federal departments at Fort Knox Bullion Depository might have been stolen!

The Fort Knox facility safeguards 147.3 million ounces of Gold bullion. It remains closed for visitors.

The facility’s Treasury Secretary Scott Bessent has assured that all gold in the facility is audited and accounted for, and is open for President Trump or his aid to verify.

The value of the Gold reserves at Fort Knox is $770 billion and it will still not be sufficient to repay US debt burden of $36 trillion!.

Conclusion

Gold, become great again for sure, and smart money has been stockpiling on the precious metal keeping them to leverage on their capacity to serve as a safe haven asset. This only reflects, the prevailing Market uncertainty in current economic landscape.

The Trump factor, has amplified this Market uncertainty with investors fearing the onset of inflation, and global recession. Add to this there are ongoing wars, prolonging the geo-political tensions in the World.

Good old gold with its 400 years has proved to be the World Economy's No.1 safehaven asset. It has in these recent years surely made Gold Bug Peter Schiff proud!

That's all folks thanks for reading!

Posted Using INLEO