KEY FACT: Crypto stablecoin Tether ($USDT) has hit and surpassed the $100B Market Cap, strengthening the stablecoin market for more commercial activities.

Designed on Corel Paint

Tether’s USDT Stablecoin hits $100B Market Cap

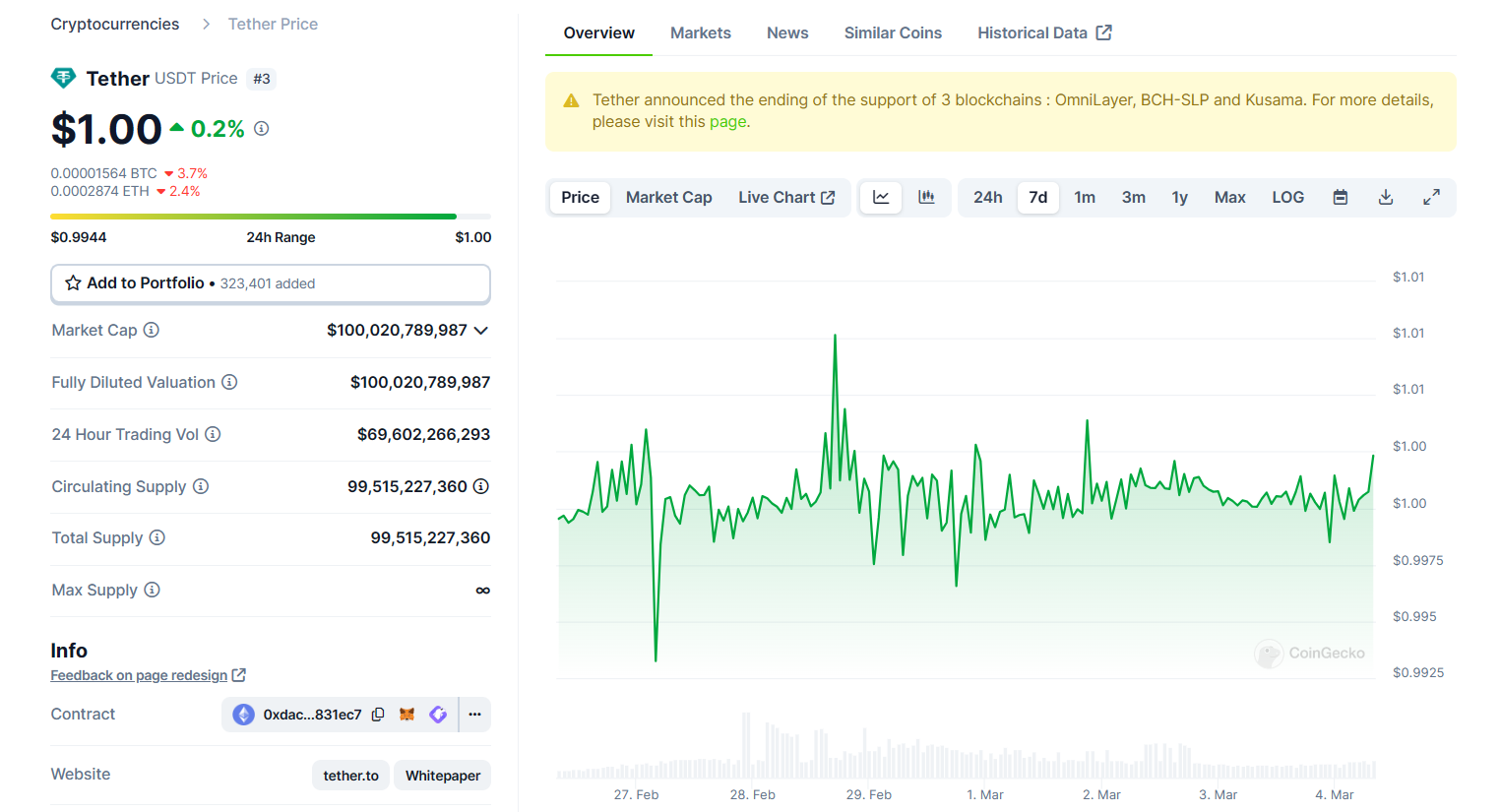

Crypto stablecoin Tether ($USDT) has crossed an all-time high market capitalization of $100 billion. This record, according to data from CoinGecko, was momentarily set on March 4 as the market capitalization fluctuates based on the current price and circulating supply.

Tether is a cryptocurrency pegged to the price of the United States dollar available on 14 blockchains and protocols, according to its website. It is the third-largest cryptocurrency by market capitalization behind $ETH and the largest stablecoin by market capitalization. The growth of USDT has been significant in the crypto sphere as it plays a key role as a blockchain-based option for crypto traders who need a stable asset.

Tether's USDT new market capitalization marks a 9% year-to-date growth and furthers the gap between its next-largest rival, USD Coin ($USDC), with over $71 billion. The new Tether’s market cap places it around par with the British oil and gas titan BP and a little above the e-commerce giant Shopify.

USDT chart showing market cap growth in the last seven days. Source: CoinGecko

With the crypto market springing back to a total market cap above $2 trillion, this milestone by Tether signals a strengthening stablecoin market which indicates that crypto can be utilized for daily human financial transactions without the fear of losing value.

Tether, the company that issues USDT claims that it backs each USDT token 1:1 with its independently audited reserves primarily made up of yield-bearing U.S. Treasury Bills (T-Bills) which is a short-term loan given to the U.S. government.

Tether’s Q4 2023 report showing $2.8 billion worth of Bitcoin holdings. Source: Tether

It is also reported that over half of Tether’s USDT is issued on the Tron blockchain, and the data earned a January United Nations report which says that “USDT has become a preferred choice” for Southeast Asia-based cyber fraud and money laundering. However, the company faulted the UN's claim by reiterating its (Tether's) law enforcement collaboration and the token’s traceability.

Besides Tether’s USDT, Hive Blockchain also issues the longest algo-stablecoin in the crypto sphere known as Hive Dollars (HBD). HBD is a native stablecoin on the Hive blockchain. $HBD is built to hold $1 USD value in the most decentralized ways. It benefits from the fee-less and fast transactions of the Hive blockchain. HBD can be saved onchain for an APY of 20% with a withdrawal window of 3.5 days.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha