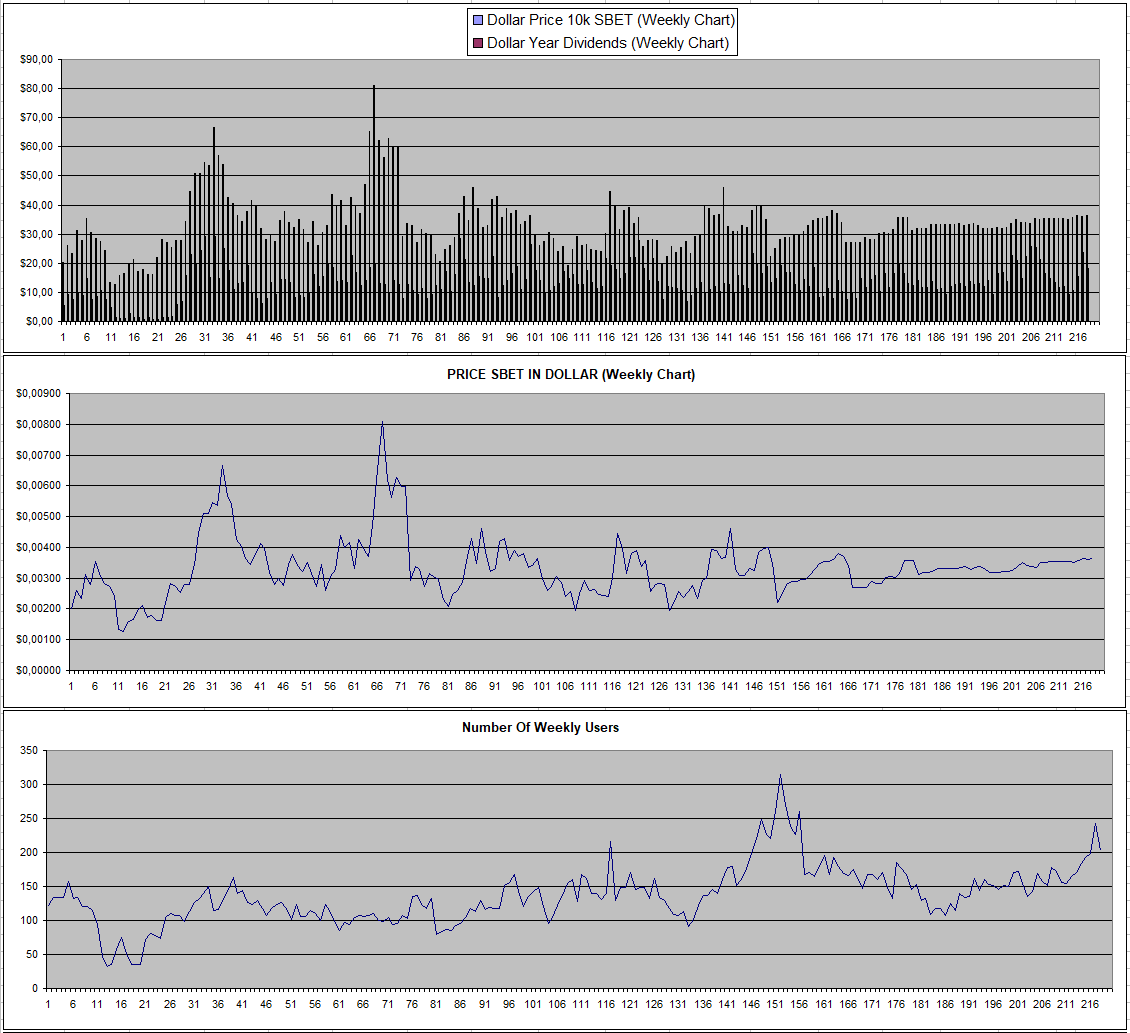

Sportbet.one (SBET)

EOS pumped last week +36% last week along with the entire crypto market which usually means that gamblers don't move up in stakes equally and bet less crypto. This makes GambleFi coins (that are not valued on hype) underperform in the bull market but they do continue to give earnings to reinvest. Last week was excellent and there was a decrease landing on dividends that were hive compared to the 8 weeks before. The price if SBET still isn't making any moves and returns first need to get higher in order to make that happen.

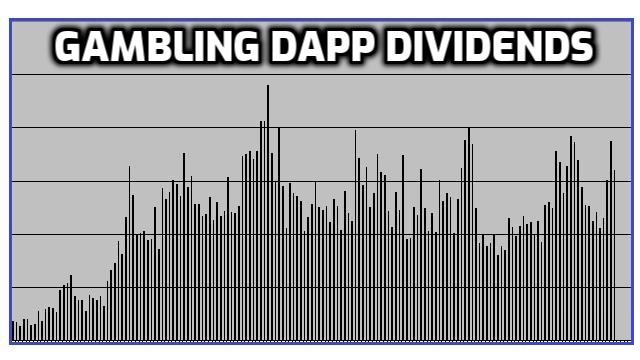

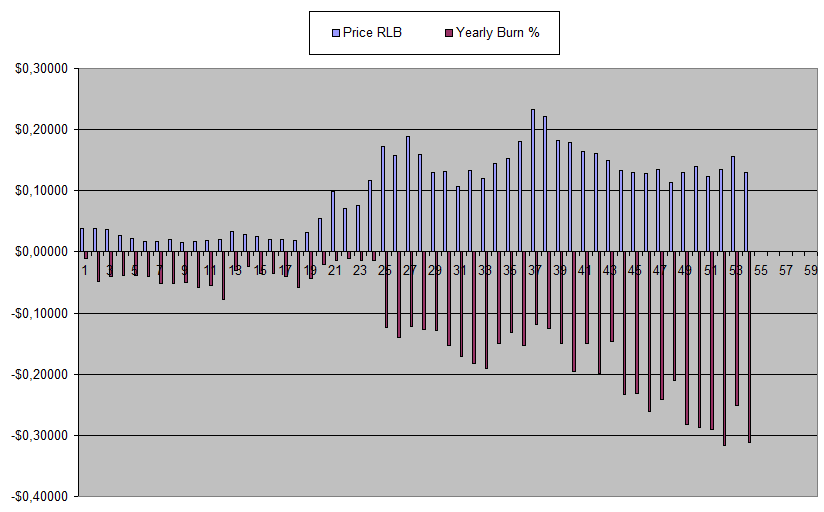

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

It remains somewhat a mystery to my why RLB isn't trading higher as the fundamentals look stupidly strong and the rate at which coins are bieng burned which can be confirmed on chain got back above 30% of the supply over a year. This means someone is heavily selling and it could very much be that Rollbit themselves are buying and burning some of their own holdings.

So either RLB will at some point go up a lot in price or they are faking a lot of the profit which someday might backfire. This centralization risk clearly is calctuated into the price thoughs

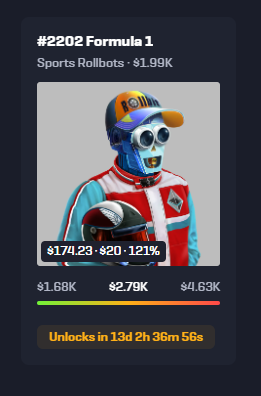

| Last Week | Now |

|---|---|

|  |

The Revenue share of my Sports Bot went up a bit again while it looked to be on the return back. the way I assume these work is that each time someone claims their revenue share, it is taken from the pool so the profit in the last 30 days is pretty much what it comes down to. So it's possible for it to go all the way up or all the way down again. So far I have been pleased to just hold on an claim it each 30 days and I likely will continue to do so at the risk of seeing the sell value go down going forward.

The price of RLB now seems to be in a sideways range and I do expect at some point that it will shoot up while the downside should be limited due to the heavy buy & burn. Purely on risk-reward, I'm quite comfortable to hold onto it.

This week printed another candle above 30% burn

The NFT revenue share also continues to be high and it will go up in 2 weeks after I claimed the next Sportsbot profit. There are many NFTs now also that trade in the green zone which makes it so that the returns are actually close to 50%+ off course with no guarantee that they won't come down again.

Overall, Rollbit just looks scarily strong with the price of RLB yet having to adjust to it.

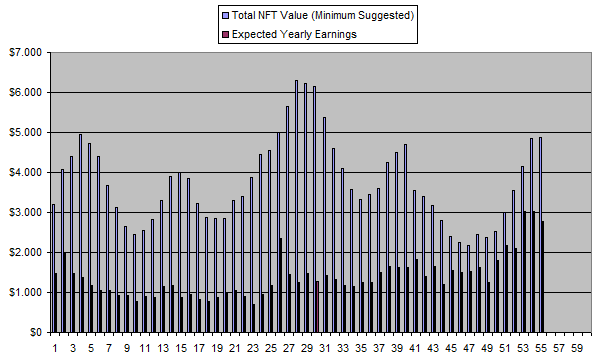

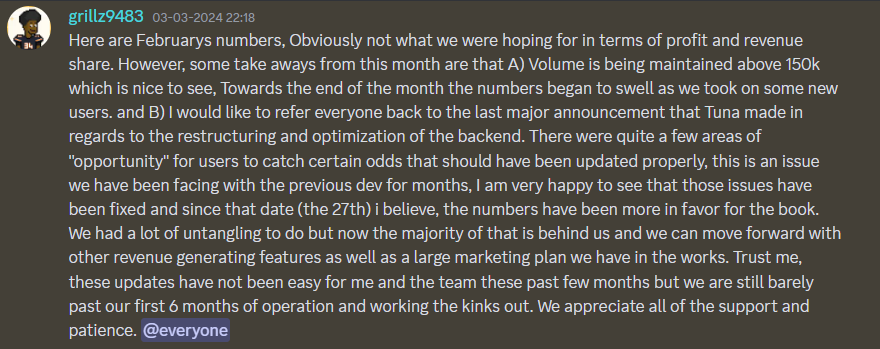

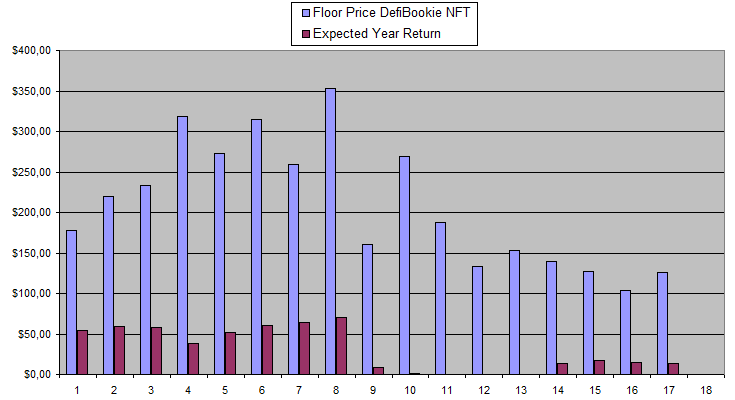

Defibookie (NFTs)

Some good and some bad news for Defibookie as the revenue share numbers were released and it turned out to be a slight losing month with no real volume growth. The reason for this was one of my major concerns with the entire platform as odds were being adjusted too late which made it easy to sharp players to exploit and win. The good news is that they acknowledge this and they claim they now have this issue fixed ready to move forward. In the end they are still a new platform that is being developed and they say that they do have a marketing plan going forward.

My main hope now is that with no revenue share next month, owners are going to be willing to sell their NFTs at dumping prices where I would start picking up some more. Right now the last one sold for 0.95 SOL (125$) which is still above the minting price (not counting golden foils). I it gets to 80$ or so I will start buying and might even put in some orders already. Last week still had 3.32$ in earnings.

These NFTs and this project remain a very high-risk gamble that may or may not pay off.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

| Week 18 | 1421$ | 102$ | 1287$ | 3.850$ | 128.73$ | 9.06% | -5$ |

| Week 19 | 1421$ | 126$ | 1561$ | 3.320$ | 132.05$ | 9.30% | +272$ |

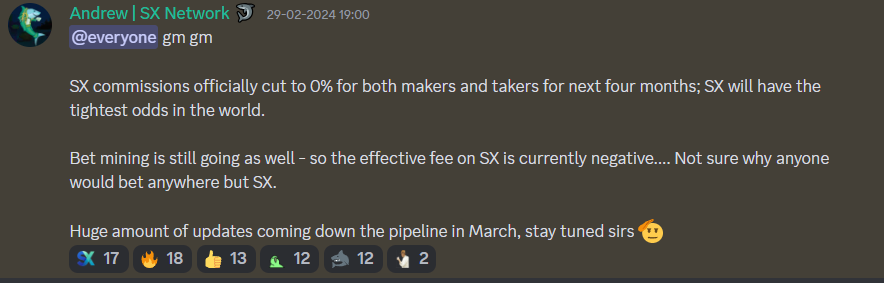

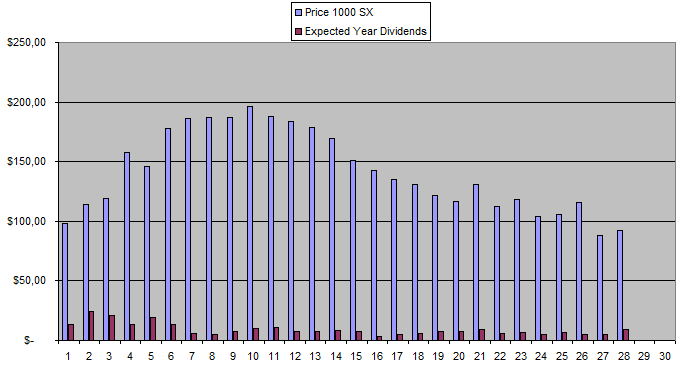

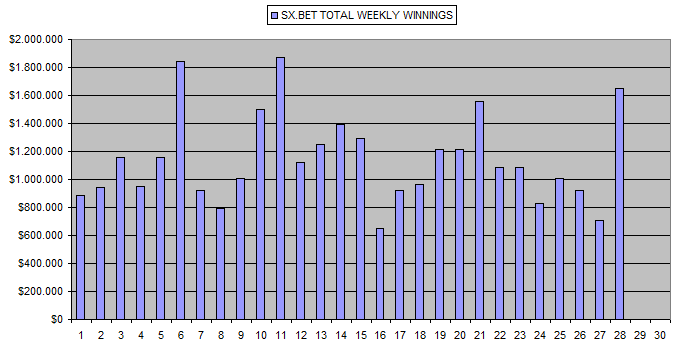

Sx.Bet (SX)

Some news for SX as the cut the commissions to 0% for makers and tajers the next 4 months probaly with an eye to boost adoption giving the platform the best odds available. I'm not quite sure how this works with a possible revenue share and where that comes from. I assume revenue share will be paid in SX from the stack of the devs based on the volume in the coming months.

Last week, the revenue share switched from mainly USDC to now SX and this seems to be 100% the case now 1 day later after claiming it. I will see if I can ask Andrew and explain next week. I do think SX is still good as a longer term hold so I don't mind.

The fee switch to 0% also pumped the volume and I expect it to go up more the coming weeks.

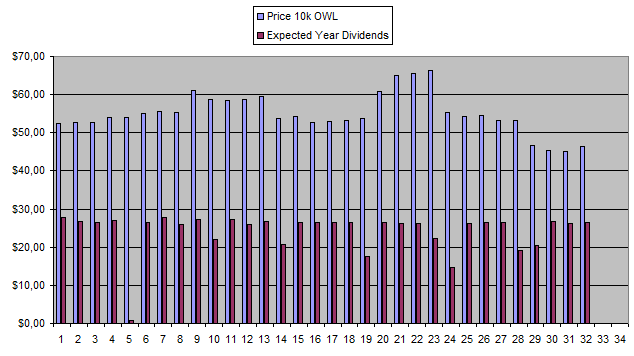

Owl.Games (OWL)

Another 30$ in earnings this week bringing me closer to earning back the investment but else not much seems to be moving on Owl.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 15/08/2023 | 400k | 2084$ | 1867$ | 20.40$ | 42.3$ | 2.03% | -171$ |

| 22/08/2023 | 400k | 2084$ | 1911$ | 20.80$ | 63.1$ | 3.03% | -106$ |

| 29/08/2023 | 400k | 2084$ | 1950$ | 0.55$ | 63.6$ | 3.05% | -67$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 12/09/2023 | 500k | 2636$ | 2454$ | 26.77$ | 110.67$ | 4.20% | -71$ |

| 19/09/2023 | 500k | 2636$ | 2449$ | 25.00$ | 135.67$ | 5.15% | -51$ |

| 26/29/2023 | 500k | 2636$ | 2699$ | 26.17$ | 161.84$ | 6.14% | +225$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 10/10/2023 | 500k | 2636$ | 2582$ | 26.1$ | 209.09$ | 7.96% | +155$ |

| 17/10/2023 | 500k | 2636$ | 2590$ | 25.05$ | 234.14$ | 8.88% | +188$ |

| 24/10/2023 | 500k | 2636$ | 2624$ | 25.62$ | 259.76$ | 9.85% | +248$ |

| 31/10/2023 | 600k | 3179$ | 2947$ | 19.95$ | 279.71$ | 8.80% | +48$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 14/11/2023 | 600k | 3179$ | 2796$ | 30.55$ | 340.69$ | 10.72% | -42 |

| 21/11/2023 | 600k | 3179$ | 2813$ | 30.65$ | 371.34$ | 11.68% | +5$ |

| 28/11/2023 | 600k | 3179$ | 2824$ | 30.53$ | 401.87$ | 12.64% | +47$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 12/12/2023 | 600k | 3179$ | 3221$ | 30.42$ | 452.46$ | 14.23% | +494$ |

| 19/12/2023 | 600k | 3179$ | 3445$ | 30.14$ | 482.60$ | 15.18% | +749$ |

| 26/12/2023 | 600k | 3179$ | 3475$ | 30.40$ | 513.00$ | 16.14% | +809$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

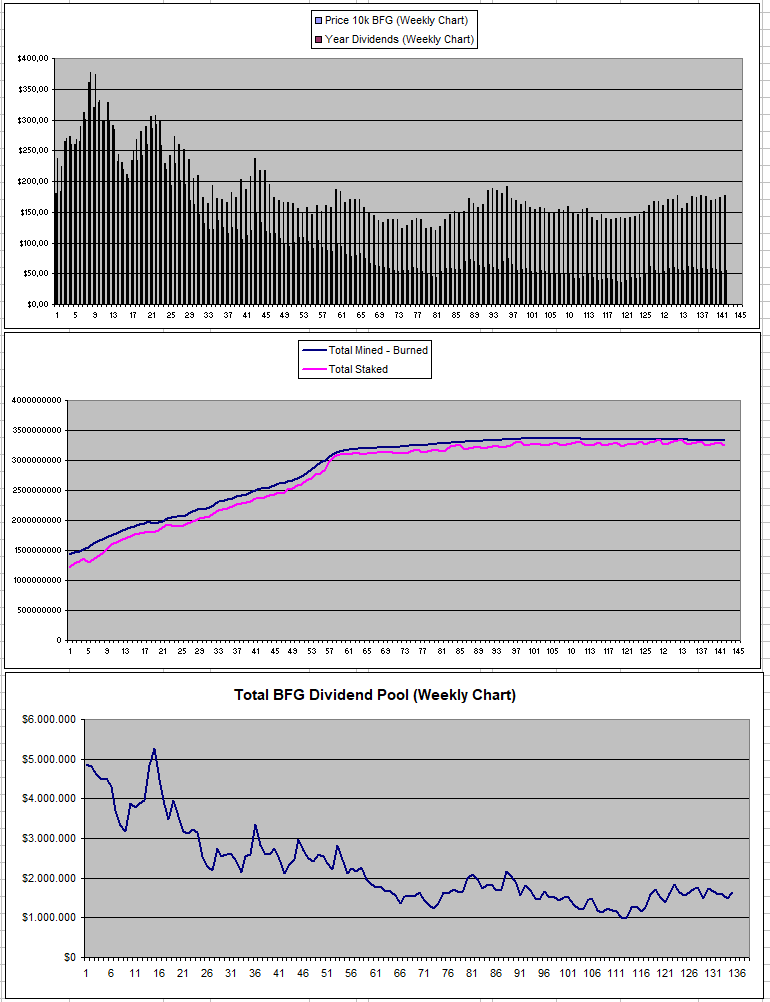

Betfury.io (BFG)

There is no update yet on the staking vote which passed and both the price of BFG and the revenue remains stable.

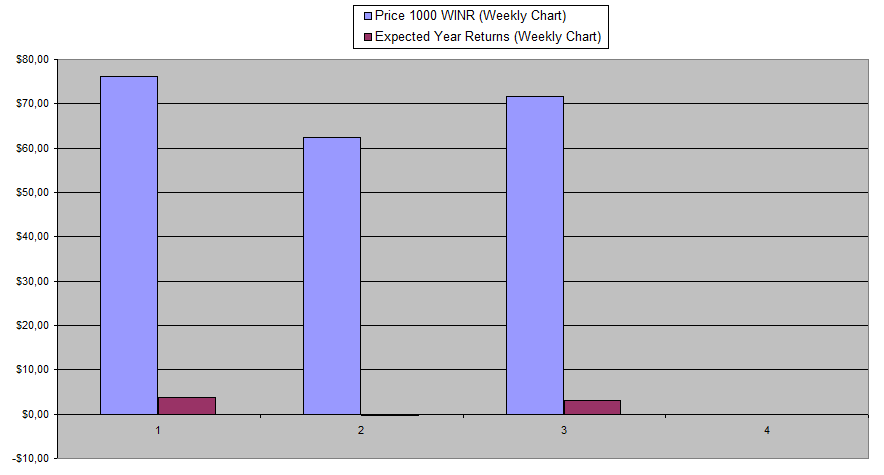

WINR Protocol

There was some profit on WINR again but with just a 700$ investment the gas cost to claim it is actually higher than the earnings. So for now I will let it just sit there. There is nothing at the moment that really makes me want to put more into it as everything is just a bit too confusing and unclear.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +49.76% APY |

| Betfury.io (BFG) | +30.92% APY |

| Rollbit.com (NFTs) | +57.05% APY* |

| Owl.Games (OWL) | +57.20% APY |

| Sx.Bet (SX) | +10.31% APY |

| Defibookie.io (NFTs) | +10.51% APY |

| WINR Protocol (WINR) | +4.39% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

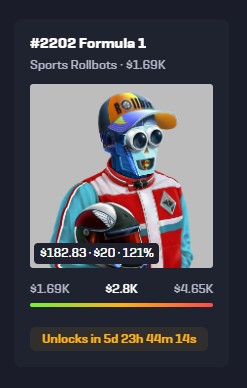

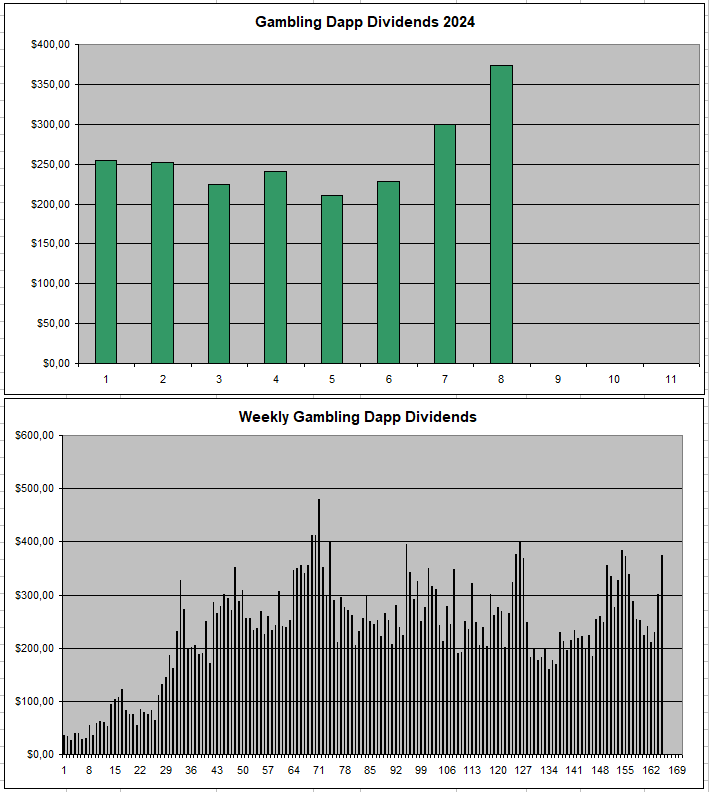

Personal Gambling Dapp Portfolio

It was another ok week above 300$ in earnings and I hope this trend continues as retail enters back in the cryoto space. I'm still holding 5M SBET | 500k BFG | 3 Rollbot NFTs | 600k OWL | 25k SX | 13 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using InLeo Alpha