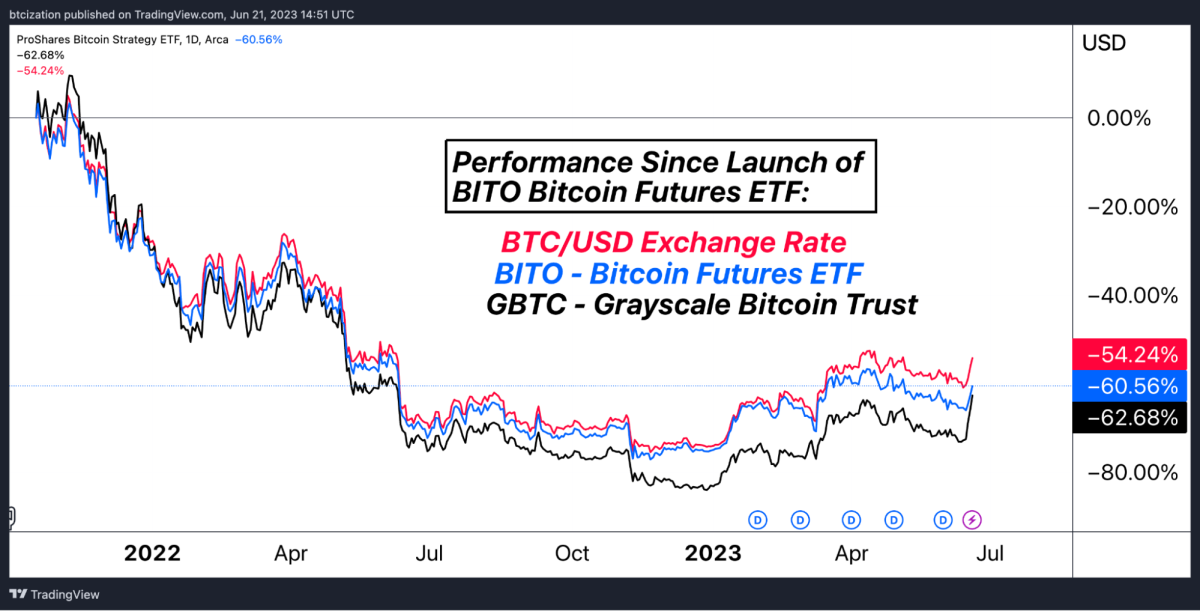

The total assets in Bitcoin Exchange-Traded Funds (ETFs) have experienced significant fluctuations. After peaking at $62 billion in June, the assets plunged to $46 billion, but have since rebounded by 30%. According to Bloomberg analyst Eric Balchunas, institutional participation in Bitcoin ETFs could double within a year, signaling growing confidence in these products.

Initial Optimism Followed by Mixed Reactions

The approval of Spot Bitcoin ETFs in the U.S. in January was hailed as a landmark moment for Bitcoin, offering mainstream financial access to the cryptocurrency. However, eight months later, opinions are divided. Some analysts argue that the ETFs have not yet attracted significant institutional capital, while others point to the recent recovery in assets as proof that institutional adoption is underway.

Jim Bianco, founder of Bianco Research, sparked controversy by suggesting that Spot Bitcoin ETFs have not become the gateway for traditional finance (“boomer adoption”) as many had hoped. In early September, Bianco remarked that these ETFs have merely become "tourist vehicles" rather than tools driving mainstream adoption. Bianco’s data indicated that the total assets across all 10 Bitcoin ETFs dropped to $46 billion by September 9, marking the lowest point since February, after initially starting at $30 billion in January.

Institutional Outflows and a Turning Point

Leading up to September 9, there were significant outflows from Bitcoin ETFs, amounting to roughly $1 billion in just eight days, largely driven by traditional finance players. Yet, following this drop, there was a notable shift. Eric Balchunas reported that, starting on September 10, Spot Bitcoin ETFs saw net inflows of over $568 million. By September 23, inflows averaged $4.63 million per day, totaling $17.7 billion in new capital since the beginning of the year. This trend signals renewed investor interest and hints at the gradual recovery of confidence in these products.

Balchunas also noted that Bitcoin Spot ETFs have been among the most successful in history, attributing their rising cumulative net inflows to growing institutional trust in Bitcoin. As a result, total assets under management (AUM) have surged by 30%, reaching $59.2 billion—a near-record figure, according to data from Dune Analytics. This represents about 4.6% of Bitcoin's total market value.

Criticism of Bitcoin ETFs as Niche Products

Despite the recovery, Jim Bianco remains critical of Bitcoin ETFs, describing them as "small tourist vehicles." He supported his claims by highlighting the average trading volume, which dropped to $12,000 per trade, the lowest since March. Bianco argued that these figures indicate that retail investors, not institutions, are the primary buyers of Bitcoin ETFs. To illustrate the gap, he compared the trading volume of Bitcoin ETFs to other popular ETFs, such as the gold-backed GLD ETF, which has an average trading volume of $70,000.

Bianco also highlighted the low institutional participation, noting that only 9% of Bitcoin ETFs are held by financial advisors, while 12% are held by hedge funds. This means that approximately 85% of Bitcoin ETF holdings do not come from traditional finance, according to Bianco’s data. Additionally, BlackRock revealed that 80% of inflows into its IBIT ETF come from self-directed online accounts, further supporting Bianco's view that institutional adoption remains limited.

Differing Perspectives on Institutional Demand

Several market analysts dispute Bianco's pessimistic outlook. Juan Pellicer, senior researcher at IntoTheBlock, argued that measuring demand for Bitcoin ETFs purely in dollar terms, as Bianco did, is not the most accurate approach. Instead, Pellicer emphasized that Bitcoin ETF holdings have remained relatively stable when measured in BTC, despite market fluctuations. From August to the present, on-chain holdings for all Spot Bitcoin ETFs increased from 921,000 BTC to over 933,000 BTC, reflecting a 9% increase in three months as investors continued to accumulate Bitcoin during price dips.

Pellicer also noted that while some major financial firms, like JP Morgan and Bank of America, have been hesitant to fully embrace crypto ETFs, Morgan Stanley now allows its advisors to recommend Bitcoin ETFs to clients. He expects institutional capital to increase under favorable market conditions and at attractive Bitcoin price levels.

Optimism from Other Analysts

Contrary to Bianco’s skepticism, Eric Balchunas and other analysts have expressed confidence in Bitcoin ETFs. Balchunas downplayed concerns over recent outflows, noting that outflows of $787 million in a week represent just 1.5% of total assets, with the vast majority of investors holding firm. Moreover, Balchunas revealed that roughly 1,000 institutions currently hold Bitcoin ETFs, a figure he described as "unprecedented."

Balchunas also pointed out that BlackRock's IBIT ETF alone boasts over 660 institutional holders, with 20% of its shares held by large financial advisors and institutions. He predicted that institutional participation in IBIT could double within 12 months. In his view, Bitcoin ETFs are "anomalies of the financial world," exceeding all expectations, even though market volatility may cause further outflows in the short term.

Institutional Adoption and Future Growth

Matt Hougan, Chief Investment Officer at Bitwise Investments, echoed Balchunas' optimism, highlighting the rapid adoption of Bitcoin ETFs by investment managers. Hougan reported that wealth advisors have already invested $1.45 billion in BlackRock’s IBIT ETF, demonstrating strong institutional interest. Even excluding inflows into other Bitcoin ETFs, this figure makes IBIT one of the fastest-growing ETFs launched this year.

Meanwhile, Nicky Maan, CEO of Spectrum Markets, emphasized the growing demand for regulated cryptocurrency exposure. He argued that, for the asset class to go mainstream, particularly among retail investors, a clear regulatory framework is essential to ensure market transparency and sustainability.

The Road Ahead for Institutional Adoption

While Jim Bianco remains cautious about Bitcoin ETF adoption, he predicts that the optimal time for wider "boomer" adoption will be in 2028, following Bitcoin’s fifth halving. He also emphasized the need for significant advancements in on-chain tools, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and on-chain payments, to drive institutional adoption further.