The word inflation by now is not Alien to any of us. It is no longer a term that just Economists, and all related field of study are exposed to or familiar with because currently, everyone is experiencing it one way or the other.

Even the illiterate man and woman selling in the local Market are not spared from the ravaging effect of the phenomenon called inflation.

It doesn't matter how cheaply they source or purchase their items for sale, or if these said items are locally produced. All they knows is that they have to improve their income level by increasing their earnings, otherwise after the day's business they might not be able to purchase anything from the proceeds they realized from sales.

These are people that have no formal knowledge of basic Economics but by convention, they know how greatly the term inflation weighs on their finances. Hence, they will sort to cushion the effect of inflation and secure their own finance by increasing the prices of their commodities that are up for sale otherwise,

they will be out business in no and end up as destitute.

That is how deep inflation can sink a person.

Now what is this word termed inflation?

Simply put, it is the persistent increase in the prices of goods and services over a period of time. It has has the muscles and influence to cripple the value of money and make it even more difficult for one to attain financial freedom.

Talking about inflation and finance

I will use my country Nigeria as a case study. Before now, we use to have what is called substitute goods, these are goods that are almost like our preferred choice just slightly different in taste and they are usually cheaper and affordable. So if you do not have the required funds to purchase the brand that you want, you can always get a substitute in the form of generic.

Example of such generic products are powdered milk and chocolate, cereals etc that are measured in containers or scales.

Let me quickly chip in that there are even cheaper name brands like Cowbell, Bonvita, Twisco, Infinity cereal brand that can also serve as substitute in places of Peak, Milo, Kellogs, Good morning etc.

But today, we are seeing that various prices are now on equal levels for all commodities, leaving the consumer with little or no choice to choose from regarding purchase.

Gone are those days that the income inequality gap wasn't that wide and we still had what was called the middle class.

But today that class has fast gone extinct now. What we have currently is the rich and the poor with the poor existing on different levels of the poverty line.

It is also worthy to note that, the further our inflation rate grows, the more the purchasing power of individuals drop.

More so, the higher the cost of goods and services over time, the lower the value of money and the fewer goods and services it can purchase compared to before.

Thus, it becomes very challenging for individuals to maintain a certain standard of living, saving for a long term goal and planning for retirement.

With the inflation rate at 29.90% in Nigeria, we are currently experiencing one of the worst inflation pandemic (in the guise of hyperinflation) since I came of age.

This is evident everytime we go shopping, and meet at least a 5-10% increment in items previously purchased. So you find your self constantly reducing your consumption level so as to save cost and be able to afford a little of the basics especially when surviving on the same income level.

To further grasp how inflation affects the purchasing power of individuals, let us consider this illustration.

Assuming an individual has One hundred thousand Naira (#100,000) in a savings account, earning 5% interest annually. If the inflation rate is running at 8% per year. After one year, the individual's savings would have yielded Five thousand Naira (#5,000) in interest, bringing the balance to a Hundred and five thousand Naira (#105,000) only.

However, as a result of inflation, the cost of goods and services would have increased by 8%, meaning that you can now buy only 92% of what you could have conveniently bought a year ago.

In other words, the individual's One hundred and five thousand Naira (#105,000), can only buy what Ninety seven thousand Naira (#97,000) could have bought a year ago.

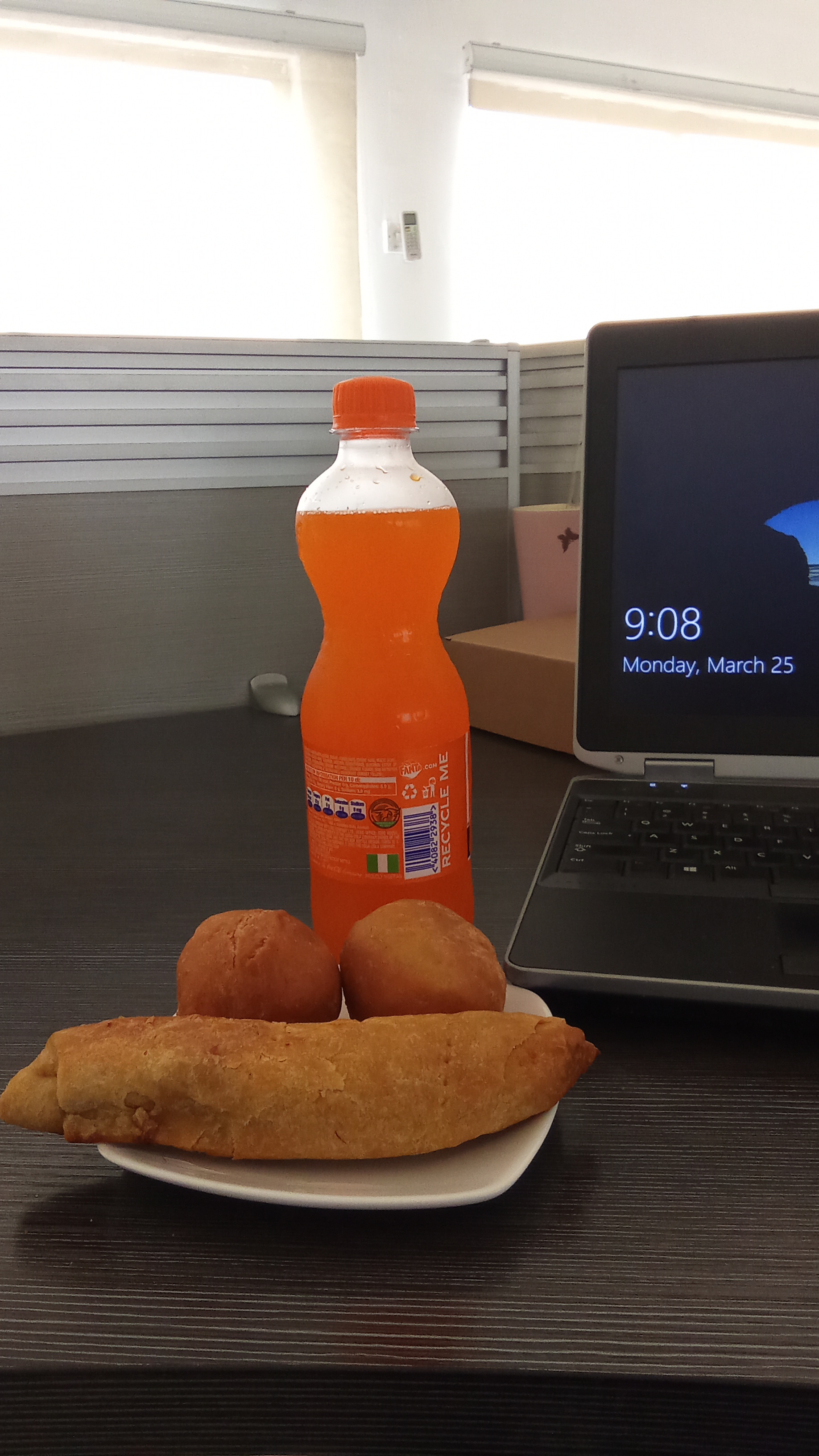

Image is mine

I was craving some sweets, so I decided to get some street snacks and a soda drink.

Usually say three years ago, Five hundred Naira (#500) can comfortably get you everything on that table (aside the laptop though lol) and like Two hundred (N200) change will come out.

Imagine my shock when I purchased these items and the total money spent was Eight hundred and fifty Naira (#850).

I felt robbed and that is exactly how inflation will make you feel, cheated!.

It basically cripples your purchasing power and it gets worse if your income level remains the same, because that will mean you ending up as a beggar, leaving on the marginalized side of life.

This post is a response to the daily prompt on the #inleo community and above is my response on to the #Marchinleo day, 25th prompt. Few days to go, click here to join

Posted Using InLeo Alpha