The last bull run of 2021 brought us DeFi. It started small but then a ton of new apps and protocols emerged. A lot of them copycats with just small tweaks. The bear market has been especially brutal towards these protocols. A lot of them died. But a few remained and are still around. They provide vital services to the crypto industry that were not possible a few years ago. Lending, trading, staking etc, the basics of the financial industry.

Let’s take a look at the top DeFi protocols and compare them.

We will be looking into the following protocols:

- Uniswap

- Lido

- Curve

- AAVE

- MakerDAO

- PancakeSwap

- Compound

- etc

There are different types of applications above, like DEXs, lending protocols, staking protocols etc. It can be a challenge to find a common denominator for all of them to compare them to each other, but we will be looking at the following parameters:

- TVL

- Trading volume

- Users

- Top trading pair on each platform

- Fully Diluted Valuation / TVL Ratio

- Market cap

The data is extracted from multiple sources like Dune Analytics, DeFi Lama, protocols web pages etc.

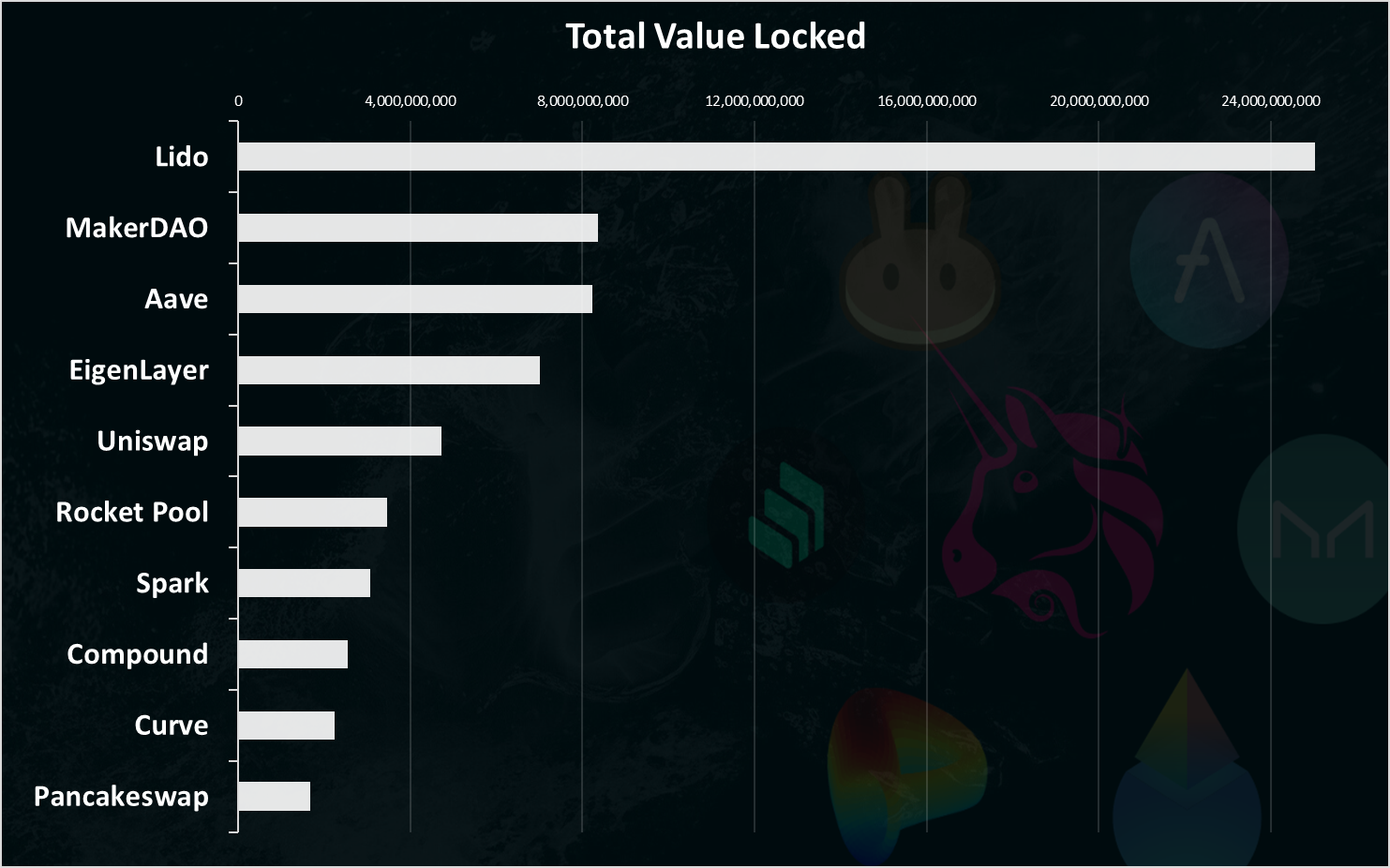

Total Value Locked TVL

One of the key metrics for the defi protocols is the total value locked TVL.

Here is the chart.

Lido comes on the top here with 27B. For those who don’t know it is a protocol for staking Ethereum. Lido has been a dominant protocol providing this service. Users stake any amount of Ethereum and get a return on it from the Ethereum staking rewards. There are multiple protocols that provide this service, but Lido is on the top.

After the first one, that has a special use case, MakerDAO with the DAI stablecoin comes on the second spot. It is a protocol that enables DAI creation by providing other tokens as collateral. Aave the lending protocol is on the third spot.

Interestingly, the EigneLayer protocol is now ranking high while being a relatively new protocol. Again it is a staking ETH protocol, or to be more precise restaking.

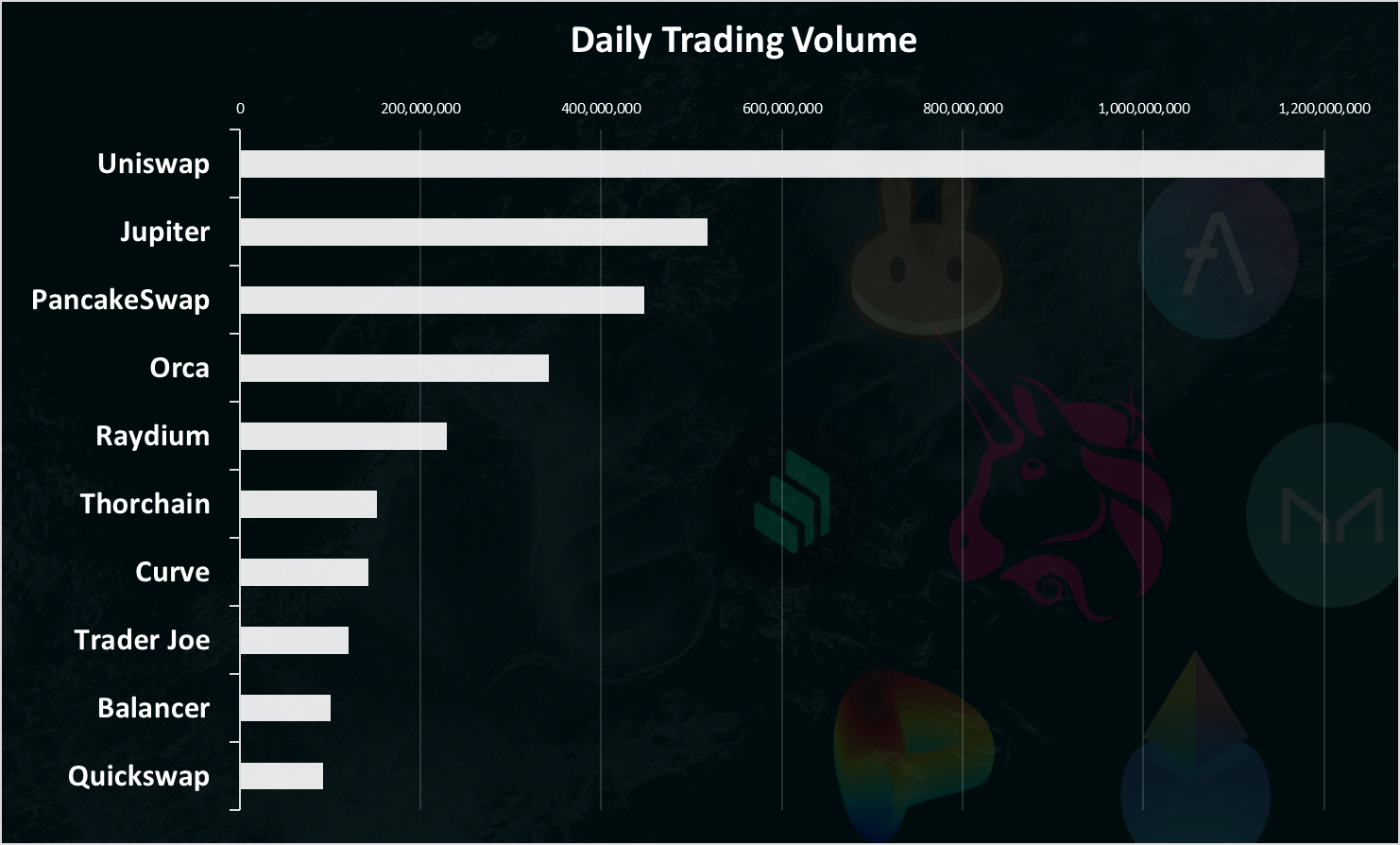

Trading Volume

The trading volume is not 100% applicable for all the apps above, as it is most a DEXs parameter, but we can have a look at the lending protocols as well, in terms of deposits and withdrawals of collateral.

Here is the chart.

Uniswap comes on the top here with 1.2B daily trading volume. Next is Jupiter, the newly launched protocol on Solana. Pancake now comes third. These three are DEXs, and as already mentioned these types of applications due to their nature have more volume than the lending protocols. The protocols with the highest trading volume are all DEXs.

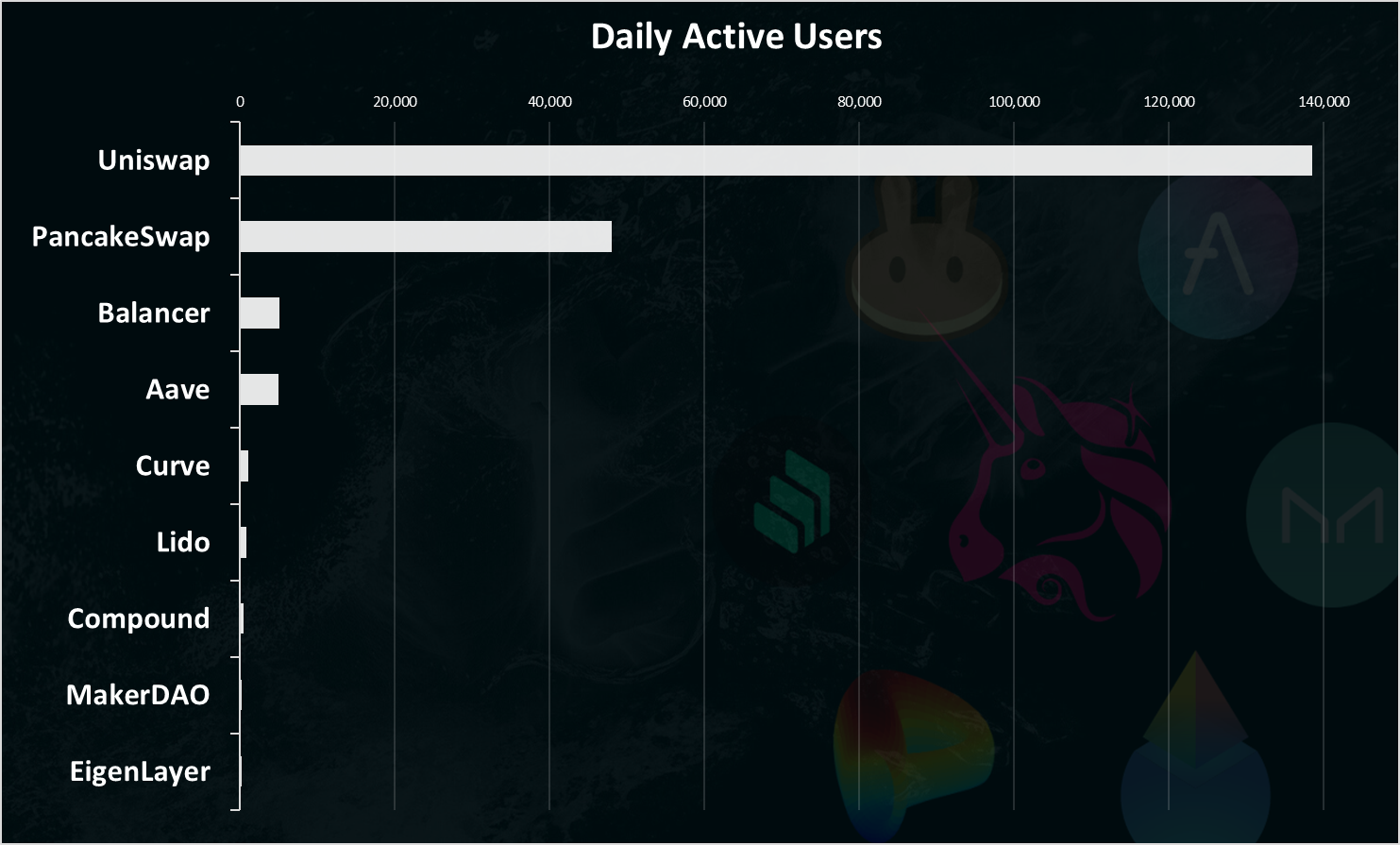

Numbers of Users

Here is the chart.

Uniswap is on the top here with 140k DAUs. Pancake follows with 50k. The other Defi apps have a significantly lower number of DAUs in the range of few hundreds. The lending apps usually have a smaller number than the DEXs.

What’s interesting here is that Uniswap has overtaken Pancake as the leading DEX in number of users. This is due to the expansion of Uniswap on other chains where the fees are lower and more users can afford to use the protocol.

Top Pairs

What tokens are traded/used the most on each platform? Here is the chart.

As we can see most of the platforms have Ethereum and staked Ethereum (stETH) as the most used/liquid tokens, followed by the stablecoins. This is of no surprise since Ethereum is the platform where most of them are built, and it is the second largest crypto.

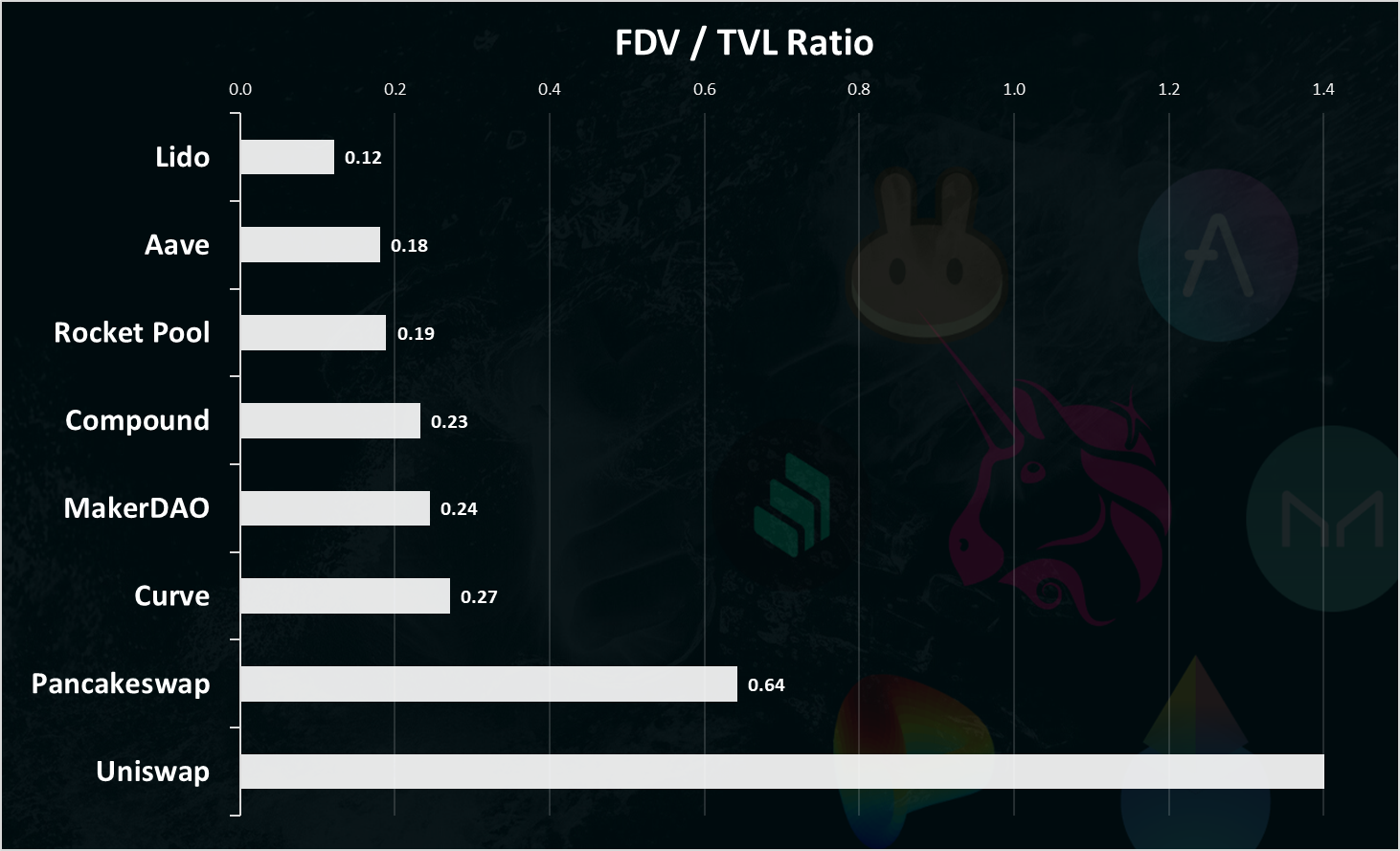

Fully Diluted Valuation / TVL Ratio

This is one of the most used metrics for DeFi apps. It shows the ratio between the value of the project and assets under management so to speak (TVL). When this ratio is small it could mean that the project is undervalued and the opposite. For example, if a project has a 1B valuation and is managing 10B in assets (TVL) the ratio will be 0.1, that is considered low.

Here is the chart.

Lido comes on the top here, since it has a lot of assets under management, but it also has a specific function for staked assets.

Aave, with a broader use case with lending, is on the second spot with its FDV / TVL ratio, followed by Rocket Pool. Uniswap has the highest ratio with market cap, with a 1.5 FDV to TVL ratio.

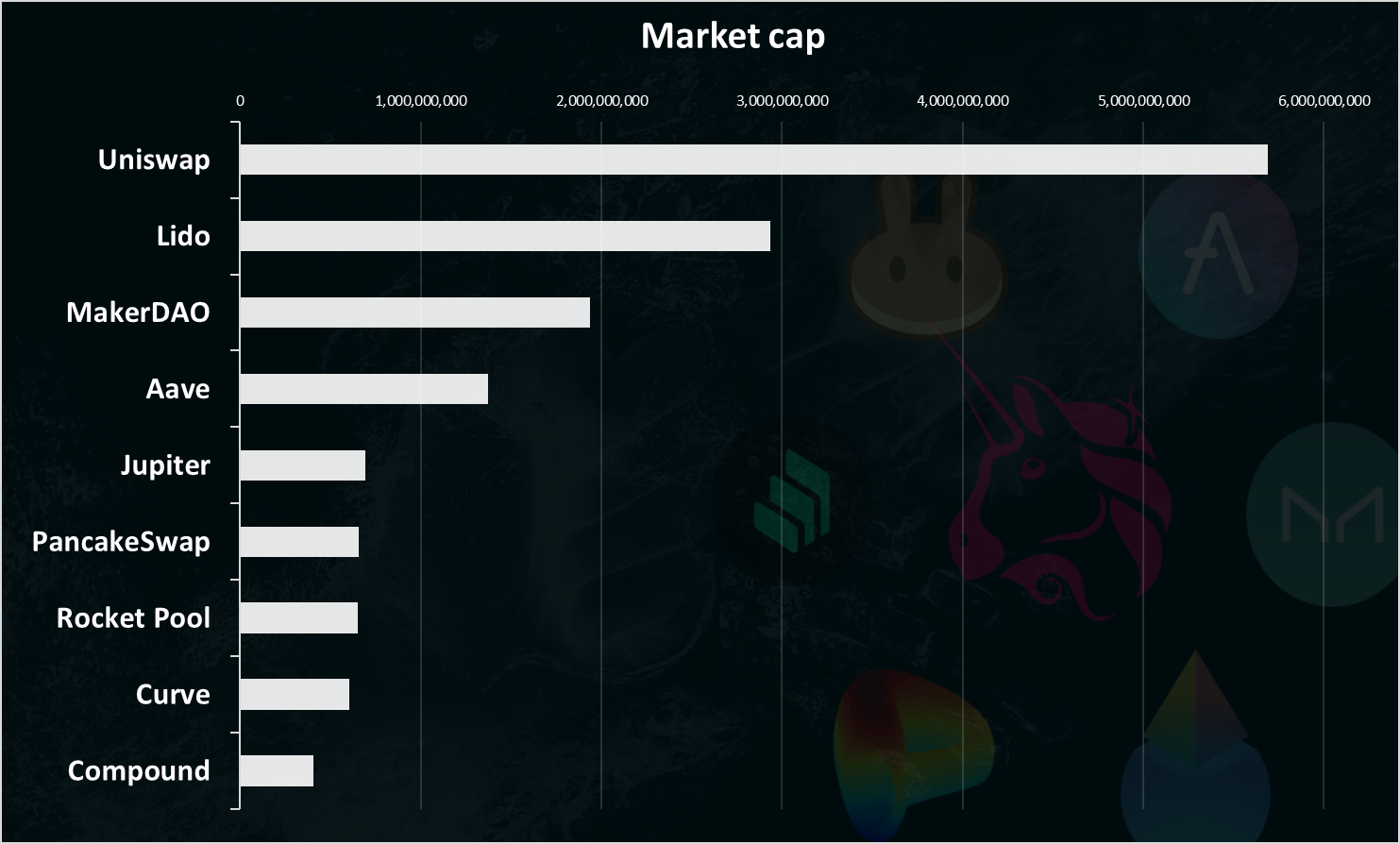

Market cap

At the end the market cap. Here is the chart.

Uniswap remains the strongest defi application in terms of market cap. It is now valued almost at 6B. Lido is in the second spot, followed by MakerDAO and Aave. These are all with more than one billion valuation.

All the best

@dalz