Is that good enough clickbait?

After realizing that Blackrock is going to create a futures market atop their ETF and then doing some cursory research as to what that actually means... I'm starting to understand why the SEC constantly denied the applications under the guise of "market manipulation concerns". It's true that the SEC may have ulterior motives but also when one really dives into this stuff it gets a bit crazy. This is especially true while the market cap of BTC hangs at a relatively small number like $1.4T. Blackrock already owns controlling shares in companies that have a market cap higher than this. What's to stop them from flexing on BTC itself?

Was Bitcoin larping?

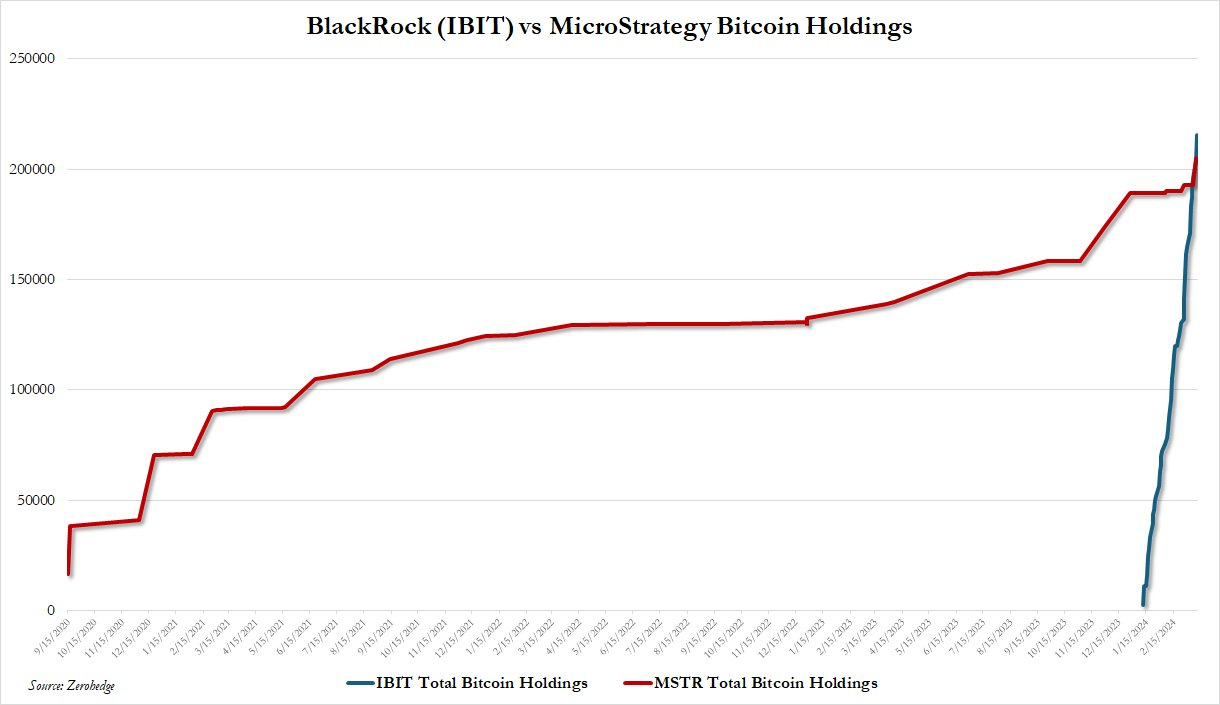

Judging by how much BTC institutions have been able to scoop up over a matter of weeks it becomes quite clear that there were a lot more liquid tokens out there than previously suspected. How else could they acquire so many in such a short time without even pushing the price up by x2? Lest not forget that when the ETF was actually approved the spot price was sitting at $44k.

Imagine being able to scoop up hundreds of thousands of Bitcoin off the market within a couple of months while only pushing the price up by 59%. If you had tried to tell me that before it happened there'd be no way I'd of believed it. It honestly should be mathematically impossible, especially considering how many diehard hodlers there are out there. And yet here we are: the record-breaking inflows continue and still we haven't seen any kind of supply shock. We all know it's coming... but wen? Wen will the non-believers and speculators finally run out of tokens to dump into the hungry-hungry-hippos mouth?

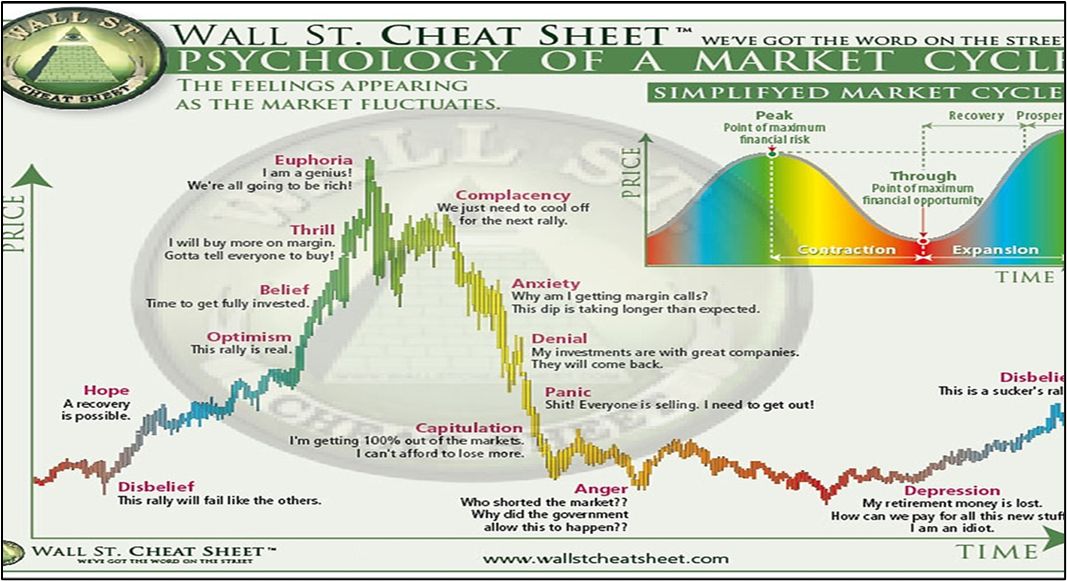

Disbelief regression

This truly signals that we have regressed back into the "disbelief" stage of the market cycle of emotions. "This rally will fail like all the others." That is EXACTLY how the market at large is reacting to the current price action. We got a big pump, meme coins and AI went batshit, and now everyone and their mother is calling out all the "top signals". Spoiler alert: when everyone is calling for the top it never is.

That's not to say that the market can't 20% dip at literally any time, because of course it can, but the overall trend still remains. Up only. A couple bumps in the way isn't going to stop that. In fact a 20% dip from here is $58k, and there is an entire maxi community called the "$58k Gang" just waiting for the chance to load up there. This would be a very unsurprising level to return to since we were only in that range for like an hour on the way up the ATH mountain.

But what of market manipulation?

Right so what I really wanted to discuss today was this whole concept of a futures market on top of BTC ETF shares. These contracts will allow anyone to bet on the direction of the market using the shares themselves as the collateral for this type of leverage. As the market maker, Blackrock should be placing the bets in advance to hedge their positions, but what if they decide not to?

Calls vs Puts

A call is an option to go long, and a put is an option to go short. The user pays a premium on these contracts in order to essentially borrow money in advance using a regulated market maker who offers the contract for sale. Why are they borrowing this money? To artificially freeze the price in place and give the user the option to place an order at a future date.

When a user buys a put contract the market maker should be hedging against that position by selling short. The opposite is true for a call order. In that case the market maker should be going long in real time, which allows the consumer to exercise that option at a later time in exchange for a small premium fee.

As a bookie.

Options have limited risk to the buyer and potentially unlimited risk to the seller. The buyer of an option contract can only lose the premium, while the seller can be exposed to extreme market volatility. This is why hedging the positions is so important. If Blackrock sells $100M worth of put contracts and $100M worth of call contracts at the same time then the position might look hedged at first glance, but it is not.

What would happen if Bitcoin dipped 10% below the strike-price and then 10% above the strike price before the expiration period? Then Blackrock could owe money to every single person they sold an option to. Not good! Or what would happen if Bitcoin spiked x2 and all the call options get a massive payout while all the put contracts only lost the premium? There are a lot of ways to lose when guaranteeing the price of an asset over an extended period of time.

It becomes obvious that these positions need to be hedged in real time based on the exact market conditions of the moment. The absolute best outcome for the market maker is that the price does nothing and crabwalks sideways so they can scoop the premium from both sides of the trade. As the price starts going up they have to go long to hedge against the calls. If the price goes back down they have to ditch those longs and start shorting. If done correctly it shouldn't be too difficult to come out on top. Although hopefully it's easy to see how shit could really hit the fan if somebody drops the ball, especially in a volatile or illiquid market.

CME Futures end-of-month expiration

Before now I never really understood how these contracts operated so the idea of the Bitcoin market moving when contracts expired made little sense. Now it makes perfect sense. A contract expiring forces the market maker to deleverage the position and rebalance the books.

Say the market maker has to buy Bitcoin to hedge against an imbalance of call contracts being sold. When those contracts expire at the end of the month the market maker will have to sell Bitcoin to pay off those outstanding debts. So even though everyone was collectively betting on the price going up the price will go down when the contracts expire because it was all done on leverage and derivatives in advance.

5 ways to hedge options contracts:

- Set put & call options against each other to balance the position.

- Buy spot with fiat reserves to balance call options.

- Go long on leverage to balance call options.

- Sell spot with asset reserves to balance put options.

- Borrow the asset and go short with leverage to balance puts.

As we can see there are a couple different ways a regulated institution can manage these positions. It's also easy to see why these institutions are so heavily regulated in the first place. We wouldn't want SBF or other degenerates in charge of one of these things, that's for sure.

Even though it is possible to balance the books using leverage this is not always ideal. After all the entire point is to scrape a little off the top for the market maker, and borrowing assets comes with an interest rate that greatly cuts into any potential profits (turning the market maker into a middleman for another bigger market maker).

But what if they don't hedge on purpose?

Here is where the market manipulation can come into play. Bitcoin is still a very small asset and easily controlled by an entity like Blackrock. What if Blackrock, in all their infinite wisdom, just decided that the price of Bitcoin was not going down. Make no mistake, at this point in time, they absolutely do have the power to make this happen.

So if they know for a fact that Bitcoin can't go down because their greedy little goblins are buying it all up at the strike price... why the hell would they hedge their position on the put options that they're selling? They absolutely would not, that's a complete waste of money.

Instead what they are going to do is incentivize their clients to buy put options to hedge individual positions. Who's not going to take that deal? Imagine your retirement account is already up x2 because of the BTC ETF in a short period of time. Of course you're going to buy a put option to keep that wealth secured. Why wouldn't you? Ah well in reality if Blackrock is manipulating the market in this way with an invisible buy wall at the strike price... well then the put contracts are simply a donation into the Blackrock coffers... which in turn gives them more funds to manipulate the market even more. Or at least that's the theory.

Now Bitcoin is going up, and the call options are paying out to Blackrock clients, but Blackrock doesn't mind, as they've hedged more than enough BTC to allow their clients to wet their beaks on this action. Besides, now investors are overconfident and REALLY want to buy more calls. Blackrock can now charge more for this contract under the guise that they are taking a bigger risk, and people will pay it because everyone is making money hand over fist.

2026

At a certain point BTC will be trading at astronomically absurd values and Blackrock might control 10% of the total supply by then. Now they know they can push the price down and aint no way anyone else is gonna be able to prop it up at the current overblown valuation. So they can employ the opposite tactic and capitalize on the pure unhinged fomo and greed of the market to sell call options knowing that price is not going to go up. They short the market into the dirt and know the price is going down. Again they don't need to hedge these positions, they are simply free money, along with the 1% a year they'll be charging on the ETF Operating Expense Ratio.

But Blackrock isn't charging 1% a year...

Yeah, this is another obvious rugpull. Once Blackrock and Fidelity users get 10x unrealized gains on Bitcoin and they can't sell without incurring a huge tax event they'll jack up the fees. Because that tax is exponentially higher than the OER it essentially traps clients into the ETF that they initially picked. That why some of these ETF providers are offering 0% APR like a used car salesman. Anything to get customers in the door, even if it's a loss-leader. This is the attention economy.

Conclusion

Futures and derivatives can get very confusing when looking at how they're made, what needs to be done to hedge them, and how they interact with the financial instruments around them. The Blackrock futures market is going to make a gigantic splash within the pool that is Bitcoin. Slowly but surely Blackrock is gaining more power over this market just like they've done with all the biggest companies on the planet. Underestimating these guys is not an option.

Don't forget that Larry Fink is the guy that basically invented credit default swap derivatives. You know, the template that made real-estate degenerates filthy rich before completely decimating the housing market in 2008. What will he cook up next?

Posted Using InLeo Alpha