Hey folks, if you’ve been following me for awhile, you’ll know that I’m a big fan of Liquity, one of DeFi’s most battle-tested and long-standing lending protocols where you can overcollateralize your $ETH to mint and borrow $LUSD interest-free. One of the interesting announcements that came out in the past few weeks was with their adoption as a payment with Wirex — a crypto-friendly prepaid debit card that now allows you to use $LUSD for every purchases.

As I’ll break down in this article, I’ll dive into the reasons for why this integration is so significant, and also weight out the pros and cons for whether or not using your $LUSD on Wirex is a good option for you.

$LUSD now has a real world off-ramp

This first one is a given, but it certainly can’t be understated. Yes, there are stories of buying homes with Liquity, but this can be extremely difficult (or impossible) depending on where you live. Wirex, which serves 130 different countries, untaps the ability to pay for anything directly with your $LUSD, or in the case of Liquity CEO Michael Svoboda, lunch:

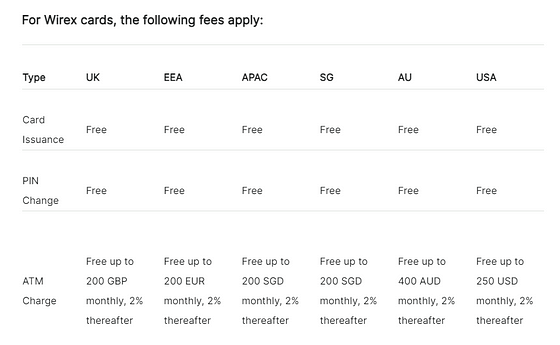

Although paying for a drink is pretty cool, personally, I think one of the most valuable use-cases is to use your $LUSD to withdraw fiat at any ATM that accepts Visa/Mastercard, and in most everyday cases, without any fees:

In other words, this means that if you’re living in the US or EEA, you can withdraw respectively up to 250 dollars or 200 euros worth of currency worldwide for free , with no foreign exchange or annual fees to worry about when you’re trying to withdraw local currency while travelling.

Freedom of Finance

Zooming out a bit, the very reason why cryptocurrencies were created in the first place was for the freedom of finance — a freedom that is deterred when banks can shut down your accounts and credit cards no a moments whim. Last fall we saw JPMorgan Chase effectively ban UK transfers to known cryptocurrency platforms, just one more domino in a string of banks that have imposed limitations on people’s access to their finances. Instead of a institutionalized lender, Liquity is the perfect example of how an immutable smart contract can provide the same service — without bias, without prejudice, and without politics.

In the same vein, Wirex is now allowing to take $LUSD one step further in bridging it to the outside world. Although Wirex does require KYC (depending on your jurisdiction) in order to open your account, Wirex has been used by millions of people with more than 20 billion reported crypto-transactions since 2014. Initially starting out as a $BTC debit card, Wirex has evolved over the last decade, now allowing the deposit/transfer/withdrawal for dozens of different types of cryptocurrencies — once again now including $LUSD.

How does it work?

Once you activate your $LUSD wallet and link it to your card, a customer will be able to pay directly with your $LUSD once your card is charged. Whenever you swipe your card, your $LUSD will now be used to settle that particular transaction.

Fees: In the world of DeFi, high gas fees (especially with Ethereum) can make everyday transactions pretty inefficient as one transaction’s gas fees can far outweigh the amount of $LUSD you’re trying to spend. Thankfully, when you’re paying with $LUSD (or any other stablecoin available on Wirex for that matter), the orders are essentially settled through large batches so that the end-user doesn’t get stuck with a large gas bill.

From what I’ve gathered, the only real crypto fees associated on Wirex are gas fees that are levied whenever you’re moving cryptocurrencies in and/or out of your wallet. Other fees, not particularly tied into cryptocurrencies but with general usage of the card include:

▹a 2% fee on ATM withdrawals if you go above your jurisdiction’s monthly limit

▹a physical card delivery fee (for US citizens it’s free, otherwise its also free to use a virtual card)

▹exchange rate fees — now this isn’t publicly listed as a fee, but I’ve seen quite a few people on reddit who have complained that the currency exchange rate that they use to process orders that aren’t in the card’s native currencies can be unfavorable. (To be fair, I’ve also read that this is a common complaint among all prepaid/credit/debit cards.)

Cryptoback ($WXT)

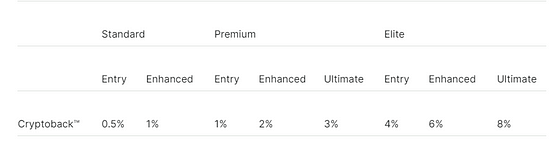

If you’re planning on using your Wirex card a lot, the fees potentially can be offset through Wirex’s Cryptoback program, which can earn you rewards in Wirex’s $WXT token as some pretty high rates depending on the tier:

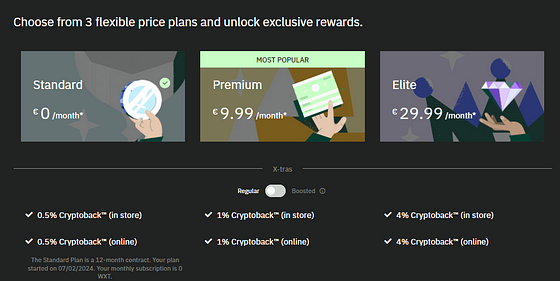

As you can see in the graphic above, each tier — Standard, Premium, Elite — has a different price plan, which can net you a different reward rate:

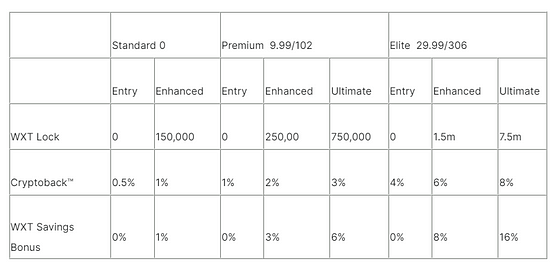

Within each tier, users can further increase their reward rate by locking $WXT for a minimum of 180 days:

In order to achieve the maximum cashback benefit of 8%, one would have to pay 29,99 euros plus have 7.5 million $WXT, or roughly $37k dollars worth at time of writing. Now personally I think that this is way too great of a sum to be locking up for that long, but the overall price action of $WXT over the past year actually hasn’t been that bad, or at least depending on when your entry point may have been:

Regardless, I’m still not a fan of locking up huge sums of money for that long, and I’d advise heavily to DYOR into the tokenomics of any altcoin you might be planning on aping that much money into.

Other things to consider

Because Wirex isn’t a bank, it can allows users more flexibility and access to their different fiats and cryptocurrencies. Yet this freedom also comes with its own set of considerations and risks…

Holding your funds (especially your $LUSD) isn’t FDIC insured: As with most prepaid debit cards, because they’re not run by a banking institution, there’s also no FDIC insurance to help bail you out if they go under. That being said, Wirex’s crypto is held on Fireblocks, which may offer users up to $30 million dollars worth of insurance if their claim is deemed eligible.

Not your keys, not your crypto: Perhaps the greatest lesson many (including myself) have learned from the last market cycle is that allowing any centralized entity to take custody of your crypto takes a certain level of trust. With that in mind, servicing millions of people since 2014, Wirex is probably one of the most highly-trusted and most long-standing crypto-debit solutions out there.

In the case for $LUSD, Wirex only accepts deposits via ERC-20 (Ethereum Mainnet): Due to the potentially high gas fees that Ethereum can incur, if you’re consider making a direct deposit of $LUSD, I’d advise weighing out your gas costs prior to sending any crypto over, because it may not be worth it if your gas fees outweigh what you’re transferring.

Conclusion:

Personally, I plan to only use my Wirex card when I’m travelling and when I need quick access to some cash. What I’m more excited about is for what’s in store for Wirex’s future, as they’re slated to release more details about Wirex Pay —( a dedicated payment L2) later this year (perhaps a future article on this later).

Regardless, $LUSD’s integration into Wirex’s suite of different cryptocurrencies seems to be a positive step forward for $LUSD’s growth, and I think it just offers increased testament to how resilient, trustworthy, and immutable Liquity’s stablecoin really is.

Have you used Wirex in the past? If so, I’d be curious to hear about your experiences in the comments below. Also, if you’re thinking about trying out Wirex yourself, feel free to use my referral link where we can both earn some cash back if you use it and decide to top up your card.

Also, if you’re curious to read more about Liquity’s mechanics, I recommend you check out my recent article in regards to how and why $LUSD keeps its peg.

And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: This is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!