Week after options expiry was all about raising capital to cover margin exercise risk and using down days for more uranium. Did write the covered calls for the next cycle but no new credit spreads.

Portfolio News

In a week where S&P 500 dropped 0.24% and Europe dropped 0.43%, my pension portfolio rose 0.29%. Heavy lifting done by De Grey Mining (DEG.AX), Japan and SMR stocks on the big movers list below. Drags - solar power and uranium (a few dropping more than 10% - e.g., IsoEnergy (ISO.V) down 13.2%) and lithium. Now there may be a case of tax loss selling in Canada and Australia with June 30 tax year ending.

Big movers of the week were NANO Nuclear Energy (NNE) (49%), Lightbridge Corporation (LTBR) (39.8%), Lanthanein Resources (LNR.AX) (33.3%), Myer Holdings (MYR.AX) (27.9%), Heavy Minerals (HVY.AX) (25.9%), Titan Minerals (TTM.AX) (17.1%), NuScale Power Corporation (SMR) (16.7%), Fission Uranium (FCU.TO) (16.5%), Global Atomic Corporation (GLO.TO) (15.7%), Starr Peak Mining (STE.V) (12.7%), Sif Holding (SIFG.AS) (11.2%), Stuhini Exploration (STU.V) (10.3%), Hercules Metals Corp. (BIG.V) (10.2%)

13 stocks in the big movers list is a bit stronger than the last few weeks. Star of the week was nuclear technology (3 stocks) driving gains in a soft week for uranium. One other uranium stock making a move on improving news flow from Niger. Two acquisition stocks in the list - one in uranium and one in Australian fashion retail. And the silver miners are showing some life after a pull back with 3 stocks. One (Hercules Metals (BIG.V) gets a bit of a push with a name change reflecting its positioning as a silver and copper miner.

Headlines for the week tell a story of market nerves ahead of inflation and jobs data. Markets are also clearly diverging with only a few tech stocks driving Nasdaq and S&P 500 higher and the Dow Jones lagging. Friday moves sees funds starting to move back to the more traditional economy.

Crypto Recovers

Bitcoin price had a wild week dropping hard in the first day and then recovering almost all of that ending just 0.4% lower for the week with a trough to peak range of 8.9%.

Ethereum price did much the same but recovered more strongly ending the week 3.5% higher with a trough to peak range of 8.5%. Talk of the ETF approval did help the mood.

Quite a few altcoins showing strength especially against US Dollar. Example - Aave - the lending protocol (AAVE) up 30% from the weeks lows

Avax (AVAXBTC) up 27% against Bitcoin

Polkadot (DOT) chart is a little different - popping 19% and dropping back and then recovering most of the drop

Solana (SOLUSD) chart looks much the same with 23% pop

Litecoin (LTCUSD) found buyers at a low level not seen since early 2024 and rose 13% almost in a straight line

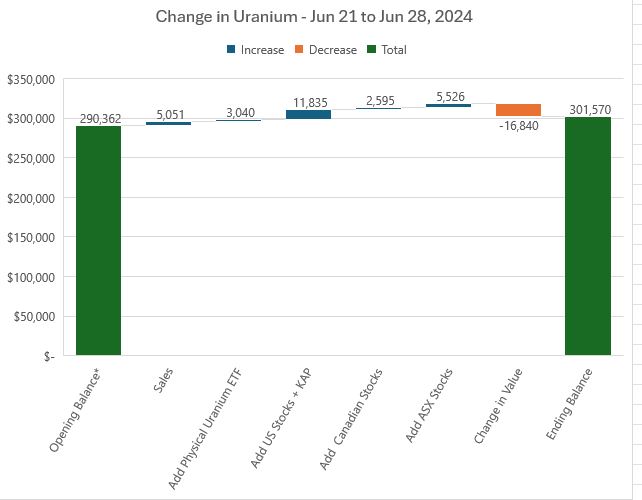

Uranium Holdings

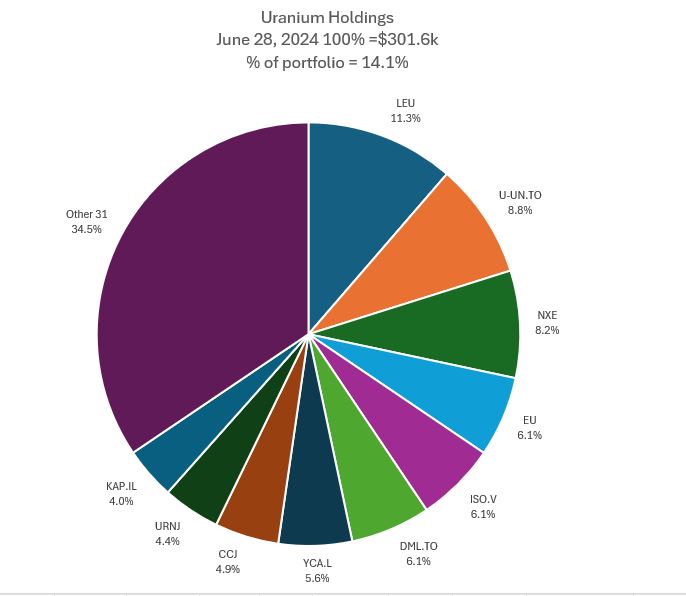

Changes in the week come from additions in physical uranium and some bottom feeding in all 3 jurisdictions. The US number is matched by the sale - an in and out transaction (see URNM below). Overall value saw a 5.8% drop - note the opening balance does not match previous reports - had missed out two trades in the period before.

Mix of holdings changes followings adds made in the week sees Sprott Physical Uranium (U-UN.TO) swap places with NexGen (NXE). EnCore Energy (EU) goes up 4 places pushing the 3 above it down. Adds to Cameco (CCJ) sees it climbing two places. The share of Others goes up 1.3 percentage points and up to 31 stocks. Overall share of portfolio climbs to 14.1% - getting a little higher than the original plans. Might cap it out at 15%

With one of the options trades coming to expiry in July, an update on status for Sprott Junior Uranium Miners ETF (URNJ). Have a few open options trades - the July expiry one is a 29/26 risk reversal (long 29 strike call and short 26 strike put. The September expiry is a 31/34 bull call spread.

The chart shows a sorry state of price collapsing from not long after trade entry time (the start of the rays) and falling through the sold put level (26). What is clear is neither of the price scenarios could follow through the way they started (the blue and green arrows together). There is a lot of support around the bottom of the cycles (say $23.50) going all the way back to Q4 2023. That is why there is a new green arrow on the chart starting sometime there. Get that price scenario and the September expiry bull call spread has a chance of going in-the-money but not enough to make the maximum. Trade management on the July expiry trade is to sell the bought call (29) if price improves a little to grab back some premium and be happy to buy the stock at $26 if price does not make it back above there.

Bought

A few placements to report

GTI Energy Ltd (GTR.AX): Uranium. Share placement was at a small discount to market at time of placement but price has drifted below. Not included in the uranium status charts - next week it will go in.

Evolution Energy Minerals (EV1.AX): Tanzania Graphite. Share placement at 2.4% discount to price ruling at placement time (price has since dropped lower)

With the Paladin (PDN.AX) acquisition announcement for Fission Uranium (FCU.TO) am fully expecting a jump in uranium acquisitions (esp. in the Athabasca Basin) and interest in the sector. Loaded up a few positions in the pension portfolio one day after making all the sales to release capital.

Cameco Corporation (CCJ): Uranium. Added a new parcel in pension portfolio. With the vertical integration this is not just a uranium play but a longer term view on new nuclear construction. Wrote covered call for 0.87% premium with 9.5% price coverage. A notable integration is 49% ownership of Global Laser Enrichment - expected to bid on the DOE RFP for enrichment services

Sprott Uranium Miners ETF (URNM): Uranium. Added a first position in the ETF to widen exposure right across the uranium miners - was a bit of a late night add as it overlaps Cameco by 17% and top 15 holdings held by 65%. Yield 3.10%. Closed out the position two days later for 1.9% profit - did not need the overlap.

Uranium Royalty Corp (UROY): Uranium. Getting more leverage to physical uranium.

Atha Energy Corp (SASK.V): Uranium. A possible Athabasca Basin acquisition

Glencore plc (GLEN.L): Base Metals. Commodity prices have taken a bit of a bashing - averaging down on the weakness. Wrote covered call for 0.38% premium with 7.9% price coverage. - low premium as covering average cost higher than the last purchase.

EnCore Energy (EU): Uranium. Average down entry price in personal portfolio. UI view is entry a bit lower would be better than this $3.70 entry. They like to enter when momentum indicator Relative Strength Index (RSI) drops below 30.

Lotus Resources Limited (LOT.AX): Uranium. Watched Uranium Insiders weekly video report - set out the buying parameters - watch the RSI when it reverses at the 30% percent mark. It did

Chart shows the RSI reversal in the lower pane. Of concern though is price has dropped below the 200 day moving average (green line) and has not confirmed the reversal yet. Support is lower down.

Boss Energy Limited (BOE.AX): Uranium. Added to holdings as Boss Energy has commenced production at its Honeymoon mine in South Australia and released information about increased resources at Gould's Dam.

The chart shows a few attempts for RSI (the lower panel) to break up. Also showing divergence with higher lows there at the time price was making lower lows.

Rolls-Royce Holdings plc (RR.L): Defense/Aerospace. Replaced portion of stock assigned in personal (3.5% premium) and managed (1.5% premium) portfolios. Keen to stay invested for the SMR potential - a few covered calls will recover that. Added to pension portfolio for first time.

Anagenics was Cellmid (AN1.AX): Biotechnology. Stock has been on big movers a few times in recent weeks. Scaled into holding in pension portfolio to get a reasonable size position - stock been hammered since first bought.

Standard Uranium Ltd (STND): Uranium. This has been a basket case - averaging down and looking at acquisition possibilities in Athabasca Basin.

Sprott Physical Uranium Trust Fund (U-UN.TO): Uranium. Averaged down entry cost in personal portfolio following UI idea to consider adding when discount to NAV gets close to 10%. The way markets opening suggested a green day for uranium - and so it was.

Paladin Resources (PDN.AX): Uranium. With market not liking the merger offer for Fission Uranium (FCU.TO), took the chance to buy in the managed portfolio at something of a discount. Gives an entry to a producing mine and one in the planning stages with one stake.

CanAlaska Uranium Ltd (CVV.V): Uranium. Added a small parcel to small managed portfolio - ignoring the warnings about: you do not have much cash in the account. Also added back to pension portfolio.

Premier American Uranium (PUR.V): Uranium. Added back to pension portfolio following completion of merger with American Future Fuel (AMPS.V)

Words from the press release

marks a pivotal step in executing our strategic vision to consolidate high-quality assets in the premier uranium districts of the US. We now have a strong foothold in three prominent districts known for their significant uranium endowment and potential: the Grants Mineral Belt in New Mexico, the Great Divide Basin in Wyoming and the Uravan Mineral Belt in Colorado

https://finance.yahoo.com/news/premier-american-uranium-completes-acquisition-165500118.html

Sold

A bunch of sales to raise capital in pension and managed portfolio to manage margin risk.

iShares MSCI Poland ETF (IBCJ.DE): Poland Index. 12.6% profit since August 2018. Ukraine war has dented overall profitability of the trade idea.

Wynn Resorts (WYNN): Gaming. Sold half the holding. While the stock sale made a 4.2% loss on FIFO basis, income and capital trades to date give a breakeven of $69.86, 21.9% discount to $89.50 close (Jun 28)

North Pacific Bank (8524.T): Japan Bank. Closed at profit target for 35.2% profit since December 2017 - stock screen idea. Japan stocks are all hedged against drop in value of Yen.

Pfizer (PFE): US Pharmaceuticals. Closed out long position for 3.6% loss on stock assigned on sold put in February 2024. Chosen to take this exit as have put in place more short trades the week nefore - looking to follow the court case risk some more.

Thesis from 2021 onwards was to be short Pfizer on the back of risk that court cases would mount for Covid vaccine injuries. One of the trade structures resulted in landing with a long position - rather than sell at the time at a loss chose to write covered calls until such time as stock got called away. To date the trade has been profitable with 182% profit on the bought put costs. This last trade ate 10.5% of the net profits and covered calls added 10.7%

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. 1.4% blended loss since November 2023/January 2024. Sold at a loss as there are naked puts in place below this exit point.

Latin Resources (LRS.AX): Lithium. Sold half holding to bank profits for 581% blended profit since March 2019/January 2020.

Chart goes back to first tranche (vertical green lines mark each tranche) - been quite a ride - disappointing to exit after a 58% drop from the 12 month ago highs.

Pilbara Minerals (PLS.AX): Lithium. 391% blended profit since May/November 2019. Retain just under half holding. Idea from my builder at the time.

Valaris Limited (VAL): Oil Services. Final fill on closing out November 2028 expiry call warrants for 528% profit since June 2021. With price closing at $72.18, some way to go to 138.88 strike. Call warrants have been a strong way to invest in fallen angels - takes patience.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Woolworths Group Ltd (WOW.AX): Retail. Dividend yield 2.77%. Back in the portfolio after closing out in Janaury 2024.

Chart shows price breaking the short term downtrend and forming an inverse head and shoulders reversal - a W shape.

Star Entertainment Group Ltd (SGR.AX): Gaming.

Chart shows a long downtrend going back 2022 with the Sydney casino facing increasing competition with a new Crown Casino built and close regulatory scrutiny around money laundering controls. Normally would stay away from stocks like this but there is a new CEO stating July 8 - ex Crown Casino CEO.

Top Ups

Tyro Payments Ltd (TYR.AX): Payments Services

Sold

Bendigo and Adelaide Bank Ltd (BEN.AX): Bank. Closed out around 52 week high for 25.9% blended profit since July/October/December 2023.

First tranche entered in July 2023 right in the middle of the consolidation range with one scale in and one top up entry after that. Chart does show the strength of a break when stocks choose to break out.

Hedging Trades

Wisdom Tree Physical Gold (PHGP.L): Gold. 35.8% profit since March 2020 - nice return for a hedging trade

Income Trades

58 covered calls written across 3 portfolios for the new cycle (UK 2 Europe 15 US 41)

Naked Puts

- Coeur Mining (CDE): Silver Mining. Return 2.4% Coverage 12.4%

- Pan American Silver (PAAS): Silver Mining. Return 2.26% Coverage 5.8%

- Cameco Corporation (CCJ): Uranium. Return 1.15% Coverage 9.2%

- The Trade Desk (TTD): Digital Marketing. Return 0.93% Coverage 6.7%

- Rolls-Royce Holdings (RR.L): Defense/Aerospace. Return 1.6% Coverage 1%

- Lightbridge Corporation (LTBR): Nuclear Technology. Return 6% Coverage 68%

- NuScale Power Corporation (SMR): Nuclear Technology. Return 1.25% Coverage 46%

Credit Spreads

With margin pressure facing all portfolios, no new spreads. Only one outsanding with July expiry on Global X Uranium ETF (URA) currently at risk of assignement.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

June 24-28, 2024