I was thinking about stacking a few coins into stables over the next few years and I got to wondering what I'd need to convert into stables every month to reach a $50K target over the next five years.

That 5 year date and amount is meaningful to me as it's around the time I kill the mortgage and then I've got just under 5 years until my private pension kicks in, and $50K is a nice slush fund for just under 5 years to pile into, meaning I'd have to work extremely minimal hours.

This entirely hypothetical scenario is kind of a hopeful worst-case scenario which assumes current prices remain stable and there's no more upside.....

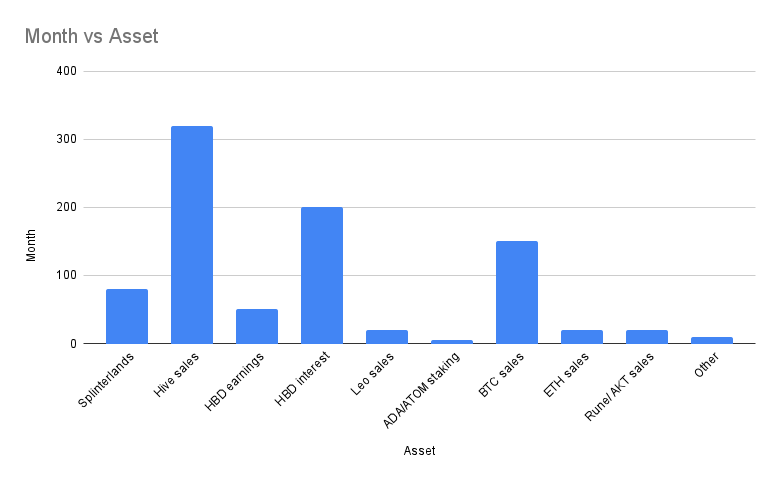

Here's one way one might achieve this $50K target over five years based on a monthly cash-out...

These are entirely hypothetical!

Over five years

Over five years this would mean sales of (at current prices, for example Hive at $0.40 and SPS at $0.02)

- Hive - 55K

- SPS - 300K

- LEO - 14K (@ 0.10)

- RUNE - 150 (@ 10)

- BTC - 1.5 (@ 75K)

- ETH - 50K including the fees.

Obvs the last one is a joke, like ETH itself.

Actually not too bad!

Given that the above is the WORST case scenario (I hope) it's fairly easy for someone to sell SOME tokens and stack $50K over 5 years.

And for tax purposes, this is manageable under UK tax regulations if yer on a low income because you'll only be paying 10% on yer gains every year.

In fact with Hive, this is pretty much just cashing out MOST of one's earnings, but not necessarily all.

The same goes for SPS too, especially as by SPS I also mean DEC. It's all the same after all. I have a sneaky feeling SL is just going to carry on drifting down, save maybe some interest if we have a massive crypto bull lifting everything.

Obvs not regular cashing out... probably not...

It's highly unlikely I'll cash out on a regular basis, much more likely is more intense conversions during up periods, and much less conversion during down periods.

The role of HBDs...

I got my $200 a month calculating a 10% return on an average of $20K HBD over the five year period, NOTE I'm not expecting that 20% yield to last!

Conclusion - I'm happy with this hypothetical...

What this shows me is that if you've got a few squid in crypto, it's relatively easy to stack a nice $50K chunk over 5 years without selling off too much of yer crypto-capital.

And of course one can always collateralise that BTC to keep that in the game!!!!

Posted Using InLeo Alpha