About a week ago, Donald Trump announced he would order the US mint to stop producing the US penny (pictured at right). According to The US Mint, it costs 3.69 cents to mint a 1-cent coin. As of this post, according to coinflation.com, copper is $4.3443/lb and zinc $1.2895/lb, resulting in a melt value of $0.0075277 (about 75% of face value) per penny today. The rest of the cost is presumably other factors of production including dies, energy, labor, packaging, and distribution.

This isn't the first time the penny has been pressured by inflation. In the US, the 1909-1982 Cent was 95% copper, and those coins have a current melt value of $0.0287384 (287% of face value) resulting in the application of Gresham's Law. Both the 1909-1982 penny and the copper-plated zinc 1982-2025 penny have the same face value, but few knowingly spend the old ones. This isn't just because the "wheaties" from 1909-1958 (pictured below) have a neat wheat design on the reverse, but also because the coin is simply worth more than the government says it is.

How broken is our monetary system when the penny is even experiencing these effects? It was bad enough when dimes and quarters were switched from 90% silver to cupro-nickel after 1964. During World War II, there was also a period where 1-cent coins were minted in steel because copper was demanded by the war effort, although that is a slightly different circumstance. 5-cent coins were minted in 35% silver due to demand for nickel and copper as well, resulting in a melt value well above half that of a contemporary 10-cent dime.

On one hand, the arguments for deprecating the penny make a measure of sense. Canada dropped their version of coin entirely some years ago. It's expensive to produce and approaching obsolescence in commerce. On the other hand, it also requires the government to admit how much the dollar has been devalued since the Lincoln Cent was introduced. In 1909, there was no Federal Reserve system. the US dollar had been slightly deflationary, holding and often slightly even growing its value over time in spite of occasional "panics," Gilded Age shenanigans, and assorted wars. The biggest obstacle was the US Civil War with its ancillary monetary shenanigans.

Sound money was nonetheless a convenient scapegoat as people lobbied for more central control in response to real and perceived economic troubles, resulting in the Federal Reserve Act if 1913, and the US government gradually transitioned from defining money as a weight of commodity metals into pure fiat. At every stage from the Great Depression to today, apologists for central banking and government regulation insist blame should fall on free market failure for some reason, but I suspect a penny in 1909 has something approaching the buying power of a dollar today.

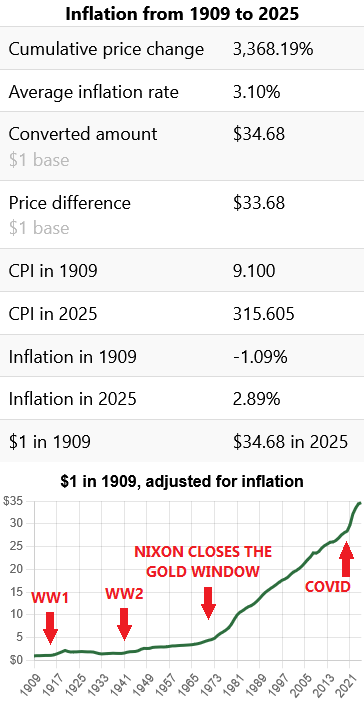

This kind of comparison is difficult to make precisely, because the past 116 years have seen technological advancements in every single aspect of economic production. Goods common when my grandfather and the Lincoln Penny were born are unknown today. The Ford Model T had only been launched a year prior. That was also before home electrification and indoor plumbing were common. Steam power ruled the rails and the waves. The official CPI calculator says a dollar in 1909 is worth $34.68 today, but I think this is overly optimistic for the government's own admitted mismanagement of our money. Even at that, if a penny then were only 35¢ in today's terms, there would be no reason to phase it out.

We need sound money. We won't get that from government no matter who is in charge. Even in a best-case scenario where someone like Ron Paul were appointed to audit and reform the Federal Reserve, we still have a government addicted to debt and reliant upon buying votes through profligate spending on State-monopolized services while rewarding corporate cronies through easy lending and blatant subsidies. Taxation and tariffs are not enough to feed this ravenous system eager for expropriated wealth. Trump may drop the penny, but in truth, has the penny dropped?