Hello everyone,

I wanted to share an update on the current state of Hive. 🚀

Source:

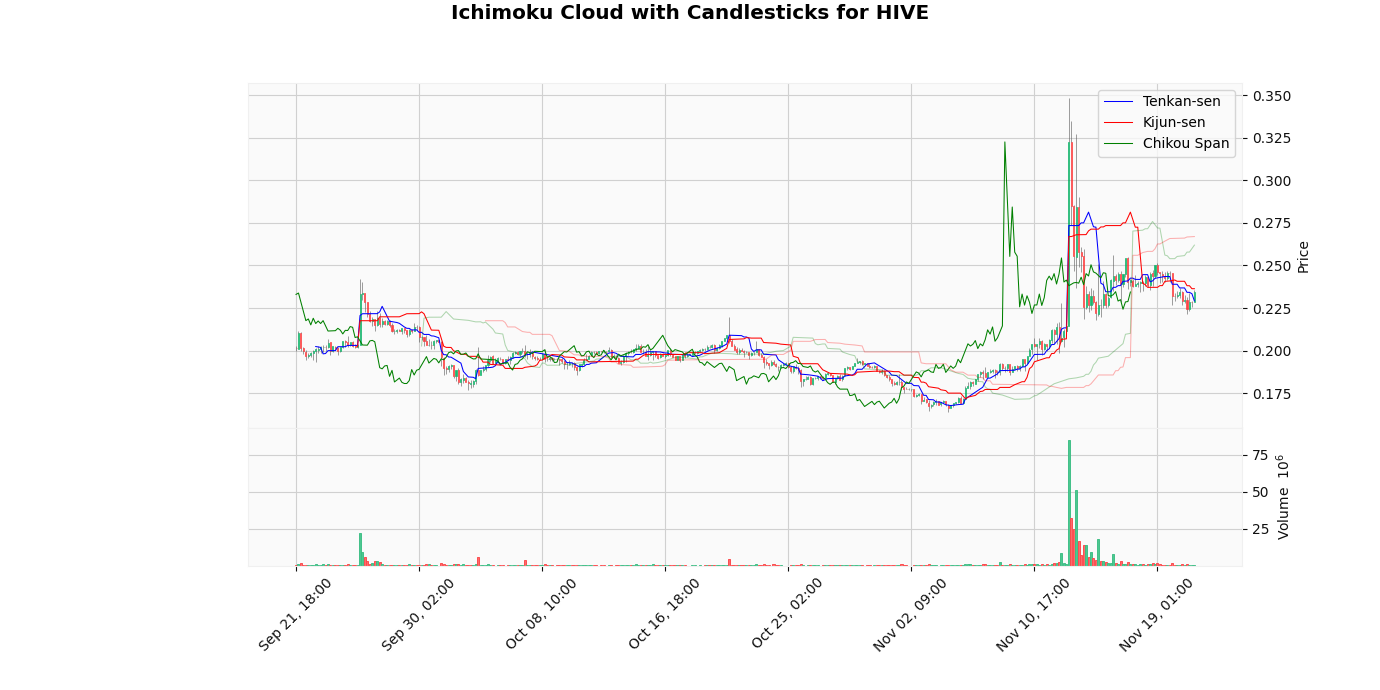

Graph data source 👉 binance.com "

Fear & index data source 👉 alternative.me

hive other data source 👉 coingecko.com

Data

🥇rank: 491

📈 Cap: 107828446 usd

📊Vol: 6061570 usd

24H -0.02197%🔴

7D 3.70525%🟢

30D 18.99261%🟢

For more information, you can visit the following links:

🔗 Hive

🔗 Hive Explorer

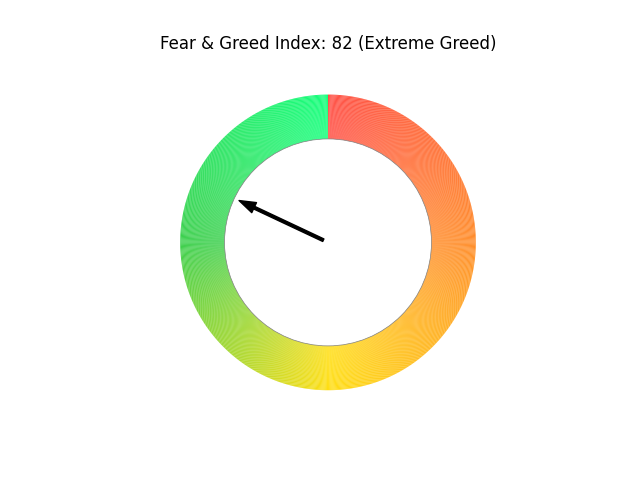

Actual Bitcoin fear & greed index:

HIVE/USD Market Analysis.

- Current Trend: Bearish (Cloud color: rosso)

- Tenkan-sen: $0.2292 (Price above)

- Kijun-sen: $0.2364 (Price below)

- Support Level: $0.26192499999999996

- Resistance Level: $0.2670

- ADX: 22.94 (indicando una forza del trend bassa)

- RSI: 37.41 (indicando neutro)

- MACD: -0.00, Signal Line: -0.00, Histogram: -0.00

- Volume Strength: -16.90%

Interpretation:

The current price of HIVE is located below the level of the Ichimoku cloud,

indicating a trend bearish. With a volatility of 52.85%, it is advisable to monitor the price levels around the

Tenkan-sen and Kijun-sen to detect signs of strengthening or possible reversal.

Personal Considerations:At the moment, the HIVE market looks weak, with the current price ($0.2344) below the Kijun-sen ($0.2364).

This indicates a potential bearish phase. In addition, the presence of the price below the Ichimoku cloud reinforces the

negative trend, suggesting that the bearish is still in control.

With a volatility of 52.85%, the risk of downward movement remains high. It is important to pay attention

to key support at $0.2619 and evaluate any signs of reversal.

For now, it is best to be cautious and watch if price can find support or if it will continue to lower levels.

Conclusions:

Given the current price of $0.2344, if it continues to respect the support level at $0.2619 and the resistance level at $0.2670, the trend could maintain its current direction.

However, should the price break below the Tenkan-sen ($0.2292) or the Kijun-sen ($0.2364), it could signal potential weakness in the market, leading to a possible bearish phase.

Conversely, if the price manages to break above the resistance level, it could indicate a strong bullish momentum, prompting further upward movement.

The ADX value of 22.94 suggests that the current trend is weak, which should be taken into account when making trading decisions. The RSI value of 37.41 indicates that the market is neutral, providing additional context for potential reversals.

The MACD line at -0.00 crossing above the signal line at -0.00 could indicate a bullish signal, while a cross below could suggest bearish momentum.

Thus, traders should remain vigilant and consider these levels as critical points for potential entry or exit strategies. Monitoring the volatility, currently at 52.85%, will also be essential, as increased volatility may lead to rapid price movements and changes in market sentiment.

Link of analisys: Bitcoin-Fear---Greed-Index---Historical-Data

Link of volume analysis: Hive-Volume-Analysis