https://twitter.com/EricBalchunas/status/1772602019133423921

https://twitter.com/stackhodler/status/1777997420590153836

Hong Kong ETF goes live...

And sees net outflows on the first day.

Hilarious: SELL THE NEWS FAM.

Two major events happened today.

The the DTCC (Depository Trust and Clearing Corporation) declared Bitcoin ETF shares to have a collateral value of $0. The Honk Kong ETF also launched. The market is bleeding on these sell-the-news events which is to be expected.

UNDERSTANDING ETF LIQUIDITY AND TRADING

Remember that fundamental developments often take a year to materialize after the speculators try to "price it in". A lot of people made a big deal about the Hong Kong ETF because it was "in-kind" instead of "cash-creates". But what does that even mean?

In-Kind

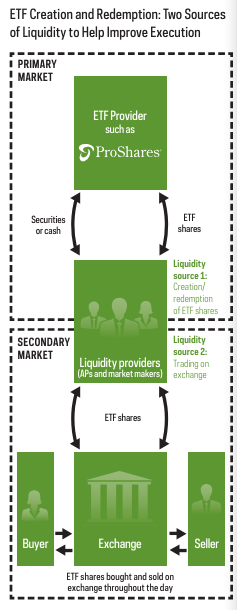

The Authorized Participant creates ETF shares in large increments--known as creation units--by acquiring the securities that make up the benchmark the fund tracts in their appropriate weightings... The AP then delivers those securities to the ETF in exchange for ETF shares.

Cash-Creates

APs create ETF shares by exchanging the appropriate amount of cash for ETF shares, for what's known as a cash create. Often ETF shares are created using a combination of securities and cash.

Wait... what?

Now the obvious question to ask here is pretty simple: if BTC ETF shares can be created with cash/bonds... then how is this not a naked short on BTC? How can the peg be maintained when the collateral is USD denominated? I read multiple articles on cash-creates ETFs and none of them seem to directly address this obvious concern.

Holding ETFs entails certain risks, which need to be hedged. Liquidity providers use a variety of financial instruments including futures, options, and other ETFs to hedge risk.

If I'm interpreting this correctly not only do market makers (Authorized Participants) need to hedge their risk, but also the ETF providers themselves.

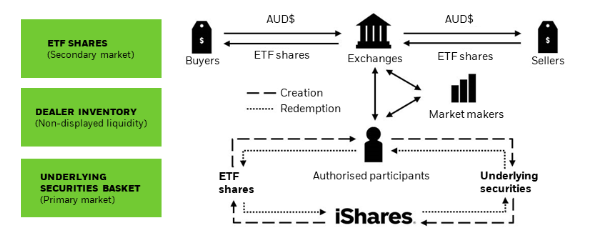

https://www.blackrock.com/au/intermediaries/ishares/authorized-participants-and-market-makers

Examples of APs include Merrill Lynch, J.P. Morgan and Citigroup.

lol @ J.P Morgan

iykyk

So it appears that anyone can be a market maker but only Authorized Participants can create or redeem the shares for their underlying value. This means that Blackrock needs to be making massive long bets on Bitcoin in order to hedge their position. After all, if Blackrock is going to accept cash/bonds to create these iBit shares and they are denominated in BTC, they are going to lose a ton of money if Bitcoin goes up and they aren't hedged.

This is where Blackrock's partnership with Coinbase comes in. Blackrock has to secure a lot of Bitcoin in order to hedge their position on the fiat denominated iShares. This is how an ETF can be denominated in USD but still track the underlying asset without incurring naked-short risk.

Conclusion

I still never figured out why the SEC demanded Bitcoin ETFs be cash-create. They say it's because of "manipulation" but also they are lairs that use that excuse for every illegitimate action they perform. Is an in-kind ETF somehow better than cash-creates? I honestly don't see why it would be now that I've done this cursory research.

At worst it looks like cash-creates gives Blackrock and Fidelity the ability to short the market if they decide they don't want to fully hedge their positions. However, we've all seen what happens to institutions that short BTC over the long term. They get wrecked. Something tells me the big boys are a little smarter than that, but maybe I give them too much credit. Either way it's a win.

Posted Using InLeo Alpha