Weekly Recap

Passive Investing is Gambling

“Ignorance is bliss” goes the saying. The average person that puts money into the stock market doesn’t know where that money is being put to work and what it does for them or for the economy at large. To boot, this is a feature of the current system, not a bug. The intent is to artificially prop up the entire market and create massive opportunities for insiders to rob folks of future profits.

How Big is Passive Investing?

Investopedia defines Passive Investing as such:

Passive investing is an investment strategy to maximize returns by minimizing buying and selling. Index investing is one common passive investing strategy whereby investors purchase a representative benchmark, such as the S&P 500 index, and hold it over a long time. Passive investing can be contrasted with active investing.

Investopedia

I would contend that the first line in the definition is a complete lie. Yes, individual investors who buy and sell in the Wall Street casino typically underperform the market and/or lose money. However, it assumes that the only game in town is the Casino and that the market will be higher when you need to cash out your investments than it is over the period of time that you’re routinely putting money into it. Anyone who thought they would retire during the Great Financial Crisis understands how much BS this concept is.

Passive investing is also bolstered, if not outright mandated, via tax incentives. Corporate retirement plans give participants the ability to defer the cost of taxation. However, they also limit what your plan can offer as “responsible” investments. Most plans are structured with a handful of ‘diversified’ mutual funds and a couple other options like a money market savings fund and maybe even the ability to buy your own company’s stock. Note that most mutual funds are only allowed to be long the market and have a maximum amount of cash that they can hold at any one time so that they’re always invested heavily in the market.

The set it and forget it nature, corporate incentives like matching, and favorable tax treatments have made passive investing the biggest single source of the money in the equities markets. This article from CNBC looking back at all of 2023 found that over half of all the money held in the equities markets is now in passive investment mutual funds and etfs.

In essence, half the money in the equities markets is complacent. Like a huge heard of lambs completely unaware of the wolves circling.

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Or better yet…Become a paid subscriber to get access to:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

Do You Know What is In Your 401k?

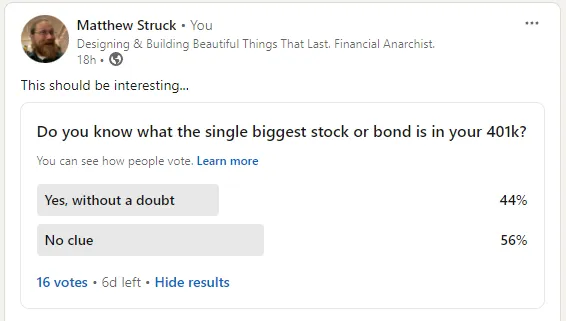

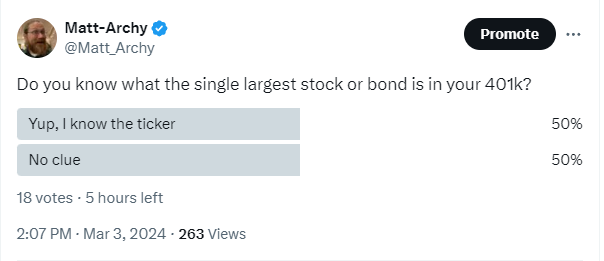

This is one of the biggest issues with passive investing. Most folks have no clue what they’re invested in. A very rudimentary but effective example of this is a couple of polls I put out on my social media accounts. My followings on LinkedIn and X are vastly different. LinkedIn is where a lot of my legacy Insurance, Risk Management, and Financial sector professional contacts reside. X is where I shitpost, troll, and meme about things like politics so my following is more Libertarians, Anarchists, and a little dash of conservatives thrown in. Not surprising to me, but perhaps surprising to you, at least half of the respondents in these small sample sizes in both populations said they had no clue what the single largest investment in their 401k was!

This means out of 34 people who have responded so far, at least 18 of them don’t know what their money has gone into.

Something to also note is that I’m not certain of the financial state of the X respondents but I have a very reasonable expectation that the respondents on my LinkedIn poll have significant amounts of money in their 401k and corporate retirement accounts!

How Does Ignorance Result in Theft?

The theft we are talking about here has to do with the potential, future value of these investments. It’s what makes this so easy to ignore if you’re the half of respondents to my polls who don’t know what you’re invested in. In fact, even if you do know what you’re invested in, you probably have no clue how much is being stolen from you over time.

Fees

401k administration is very lucrative. The firms are managing trillions and they get management fees each year that your assets are under management. Typically fees range between 0.5% and 2.0% per year and go to the management firm and/or the mutual fund managers. I won’t bore you with the whole run down but you can read about it in this Investopedia article breaking down the entire scheme.

These fees reduce the earning potential of the money locked up in the plans. And keep in mind that the earning potential is compounding. So 1% lost today could result in 20-30% of lost returns over a lifetime in the plan.

Misallocation

The mutual fund offerings within a 401k typically hold dozens or even hundreds of investments. However, they are typically weighted toward a handful of individual companies or investments at the top. Quite often, different mutual funds within the same 401k will have an oversized position in the same exact companies. At present, only a handful of stocks are accounting for the bulk of the stock market gains. Mutual funds most certainly are overweight those handful of names so their performance doesn’t lag their competitors (they can get replaced within these huge investment plans if they underperform). This means a handful or maybe even one or two equities could be the primary investment within someone’s 401k.

Folks in their 50’s and 60’s have between $250,000 and $500,000 in their 401k on average (source: Empower). 100’s of thousands can be invested in a couple names on an index. What makes this worse is that mutual funds are very slow to reallocate investment money. It goes quarter by quarter. Nimble is not the name of the game for them. They are literally the Titanic of the investment world. Because of this, the crash of one or two stocks could result in massive losses for 401k holders. This then results in panicked liquidations when they look at their quarterly statements and creates a stock market exodus.

MSFT 2007-2009

Over a period of 21 months from late 2007 to August of 2009, Microsoft lost 60% of its’ value. Now imagine your 401k is over leveraged into MSFT stock. The mutual fund might actually buy some more in the first quarter or two of the drop assuming that the fall will be temporary and it’s on sale. The grave reality finally sinks in and the fund manager sells a bunch but remains invested in some of it because the fund requires a large percentage of the cash in it stay in the stock market. The stock market and MSFT finally rebound but the mutual fund manager isn’t going to immediately start buying Microsoft again. They wait a couple months to make sure the smoke has cleared. Meanwhile, Microsoft rebounds 20-30% in that time period. The fund manager has effectively bought high, sold low, and bought high again. Even if you stuck around for the whole round trip without getting spooked out of the market, you’ve been cheated out of thousands in the near term and potentially tens of thousands in the long term because of the lost compounding potential.

Right now, the Magnificent 7 stocks make up more than 30% of the major stock market indexes. This means the dollar-cost-average into S&P index etf’s crowd has the same problem that the 401k crowd has. And there’s typically a lot of crossover. So folks are also putting their “dumb” money into the market outside of a 401k as well.

This equates to putting a large percentage of your net worth (say 30%) on a cluster of 4 numbers on the roulette wheel and feeling completely comfortable that nothing bad will happen.

***Also note that a bulk of your 401k could be supporting a company you despise or works against the principles you strive to live by

Artificial Support for Markets

All of this passive money that stays in and flows into the market regularly creates a foundation off of which active money managers and hedge funds can nimbly move their money around and garner outsized profits. They amplify these profits using leverage that the average investor doesn’t benefit from. In fact, the abuse of leverage is most of the reason the Great Financial Crisis happened and continues to damage markets to this day. Passive investing skews the risk reward dynamic in the favor of these active managers. They can take more and more risk than if there wasn’t a dependable safety net made up of suckers’ money to help them get out of a bad bet or lessen the losses of that bet.

The benefit that the average investor garners from passive investing is paltry compared to the risk they’re taking on. This means that a sure thing in their mind is actually just another situation where wealthy and politically connected people have leveraged the game in their own favor and the bulk of the risk of catastrophe is passed off to the average joe or jane that doesn’t know any better.

Should I Cash Out My 401K?

No, I am not advocating for that. There are huge penalties and taxes associated with such a move. Plus you can’t as long as you’re still at the job where your plan is sponsored. Here is a short list of best practices:

Think about only contributing enough to maximize your employer match

Invest in the funds with the lowest fees

Make sure you’re invested in a combination of stock & bond funds (not just one or the other)

Pay attention to the top holdings of each fund you’re invested in and make sure there isn’t much crossover

Keep your mind open to investments outside of the Wall Street Casino for cash you’re investing outside of a retirement plan (buying gold within an IRA is also an option)

Regularly check up on the above items (at least quarterly is a good starting place)

Keep an eye on building a hustle/business where you can get away from these traps for good and invest in yourself and control your own destiny

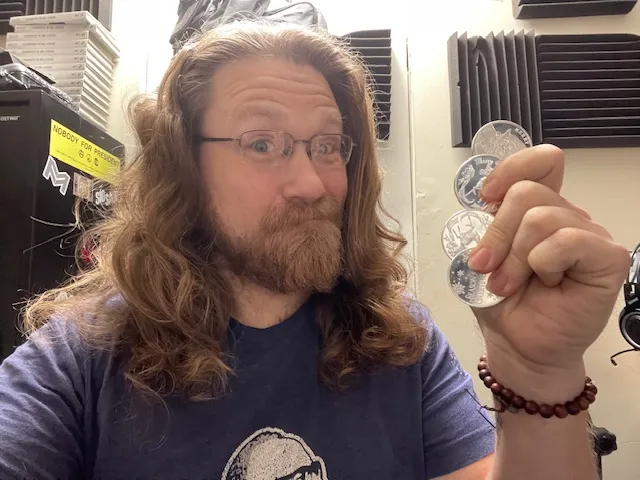

I am Giving Away Silver!

You heard that right! I’m giving away silver rounds to my subscribers. On April 1st, 2024 I will be giving away silver rounds on The Anarchist Investor LIVE! at 12 pm EST. The show takes place on the Ungovernable YouTube channel and will be released on the podcast platforms afterward as well. Interested? Read on!

What Am I Giving Away?

I will be giving away at least one, one ounce silver round, no matter what, to my current subscribers. So if you’re getting this automatically, you’re already in the game. But wait, there’s more! inserts Ron Popeil gif

For every additional 50 free subscribers that I get, I’ll add a silver round to the giveaway and an additional subscriber gets a chance to get one. For example, if 50 new free subscribers join between now and 4/1, I’ll be giving away 1 silver round separately to each of 2 lucky subscribers. This goes up to 4 subscribers receiving a silver round if 150 new free subscribers join. This means it’s in your best interest to share this post, future posts, my live casts, and any of my social media posts publicizing the giveaway because the more subscribers that join, the bigger the giveaway gets.

I will be doing future giveaways of precious metals, bitcoin, and other anarchist approved investments for free to the subscriber base. And as the subscriber base grows, so do the giveaways!

How Do I Make Sure I’m Eligible?

You gotta be in it to win it. Just make sure you’re subscribed to The Anarchist Investor. That’s it. If you’re automatically receiving my daily newsletter in your inbox, you’re in the game! If you aren’t, hit the subscribe button below and let’s get some silver in people’s hands. It is the people’s money after all. 😉

Subscribe to the Anarchist Investor

So with that, I wish you all good luck and I’m also looking forward to sharing my work with you here at The Anarchist Investor!

I've Been Sleeping on This Investment

And it has cost me thousands!

While everyone watches the stock market, Bitcoin and gold challenge all-time highs, there is a sleeper investment opportunity that most folks are missing. It requires a little bit of up front investment and setup time but promises to provide passive income for years. The kicker? You can also earn much more through capital appreciation!

Passive Crypto Mining

Ever look into the price of running just a single Bitcoin miner? The ones that promise a reasonable monthly profitability cost thousands to purchase and require that you upgrade them every couple years to keep up with the computational power requirements of the network. It presents a huge barrier to entry for the average individual. Yes, there are small stick drives and things that mine bitcoin but I’m not interested in 1 Satoshi every couple months. I want to be able to put together a profitable setup in the present that includes the opportunity for price appreciation in the future. This is where decentralized crypto really starts to shine.

Decentralized networks are being built all over the world. In basic terms, decentralized networks utilize the willingness of people to band together and create data or information networks that used to only be available to mega investors pumping billions into development and build out. The networks grow by enticing individuals to front a little bit of money to purchase a miner, node, or beacon and then reward those folks with crypto every hour, day, or month. The networks have an incredible range of uses such as cellular phone service, weather measuring, street mapping, IoT device coordination, etc. The best part is that the individuals are invested in the success of the project and they profit right along with the success of that use case.

Don’t Miss Your Chance At Free Silver!!!

I’m giving away pure silver to up to 4 free subscribers on April 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe to the Anarchist Investor

Or better yet…Become a paid subscriber to get access to:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

But You Can’t Earn Much!

This was my original thought too. How could earning crypto in small amounts daily result in any kind of actual return? And how are crypto tokens worth fractions of a penny every going to be a good investment of time, energy, and money? In short, it all adds up. Those fractions of a penny become pennies, nickels, quarters, and dollars. And depending on the success and profitability of the project, those coins/tokens can become much more valuable over time.

Take for an example Helium (HNT). The life time chart above is down from its’ original price. However, mining IOT and MOBILE on the HNT network would’ve been done over those first few months while the price was dropping. Effectively, this is a form of dollar cost averaging. HNT also sits on a base layer called Solana (SOL) which has seen a huge amount of growth in project development over the past couple years. Over its’ lifetime Solana (SOL) has gone up by almost 30X. And this value appreciation should continue into the future as more projects like Helium get built off of that base layer.

What Projects Are You Looking At?

I’m currently mining IOT with my Bobcat300 miner. I will look into adding CRNK mining on the same device (this is going to be more than a plug and play move so I’ll have to bumble through it). In addition, I’m looking at purchasing miners for FRY, DIMO, GEOD, MOBILE, and HONEY. Note that i’ll be doing a more in-depth review of these projects as I get them each on line. My back of the napkin math looks like a $2,100 up front investment that should result in roughly $1,500 per month in passive income at current prices.

FRY - weather/sky mapping

DIMO - road & gps location mapping

GEOD - weather/sky mapping

MOBILE - cellular servicing

HONEY - road mapping

The best part is that you can afford to get each of these projects online for under $500 each with the exception of the GEOD miner that costs just over $600. If you’re investing $500 per month in other areas, you can pick up a couple of these in certain months as an investment. It’s kind of like buying a dividend yielding stock that sits in your office and pumps out crypto every day.

Project Links

IOT/MOBILE: https://hellohelium.com/

Crankk: https://crankk.io/

DIMO: https://drivedimo.com/products/dimo-vehicle-smart-hub

GEOD: https://geodnet.com/

HONEY: https://bee.hivemapper.com/

The Bitcoin Rally May Already Be Over

Altcoins are telling the story everyone is missing.

By now it’s fairly common knowledge that Bitcoin rallies into but most definitely out of halving. In the last two months it has rallied approximately 50% depending on which point you’re measuring from. So almost certainly there’s more to go, right? Right?!?

Bitcoin Rally

Some part of me thinks about the Quarter Quell in Hunger Games every time I write about Bitcoin Halving. Perhaps one day I’ll need to dive into how they are similar and how they differ. However, that’s just a diversion from what is really important. Will we hit $100,000 BTC this bull run?

In the prior 3 Halvings, there have been slightly different behavior leading up to them and out of them. Something also to note is that Bitcoin has never gone through a sustained downturn in the US or Global economy. It has been in a perpetual bull run since 2012 and has only existed in the era of low interest rates and quantitative easing ad infinitum.

Don’t Miss Your Chance At Free Silver!!! 🥈🥈🥈🥈

I’m giving away pure silver to up to 4 free subscribers on April 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe to the Anarchist Investor

Or better yet…Become a paid subscriber to get access to:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

Halving #1 - November 8, 2012

There isn’t a ton of price data from this time period and quite frankly, the number of bitcoin outstanding was so small that I’m not sure it makes much sense to dig into this halving all that much. Any price rise or fall would’ve been subject to early adopter enthusiasm and growing pains. The Silk Road was also established in early 2011 which accounted for a lot of the Bitcoin demand outside of mining and trading at the time. Ross Ulbricht, it’s founder, was arrested and his laptop was seized on October 1, of 2013.

Halving #2 - July 9, 2016

This is the most dramatic (to date) of the halvings in terms of Bitcoin’s rally into it. The peak of the rally also happened a month prior to the actual halving. Conventional talking points say that the real rally happens after the halving. Well not necessarily in this case. I actually think that talking point is polluted by the circumstances surrounding 2020 and the lockdowns but we’ll get to that. Note that in 2016 the S&P 500 rallied 15% for the year. It was a risk on kind of year with lots of money going into risky assets.

Bitcoin rallied about 78% from the accumulation (sideways movement) that preceded it. The rally topped out a month before the actual halving. It then proceeded to correct 38% from the highs. It is my theory that the new Bitcoin ETF has moved up the timeframe for the peak in Bitcoin but also will exacerbate the fall. More on that later as well. The final behavioral note here is the prolonged period of consolidation following the rise and fall.

Halving #3 - May 11, 2020

The flash recession that was caused by the COVID lockdowns is still affecting us to this day. Bitcoin had a precipitous fall off in March of 2020 like any other risk asset as everyone ran for the safety of dollars, US Treasuries, and Gold/Silver. Halving fell right in the midst of the recovery from this craziness. I have only measured the rally from the pre-COVID period. In my opinion the fall and rebound isn’t a part of the normal behavior of Bitcoin (or any other risk asset for that matter). The peak happened a couple days prior to halving and I’m only giving the rally credit for 27%. Bitcoin then consolidated for a period of time following halving and resumed the rally. Of note is that most other risk assets also resumed their bounce/rally.

This is where I think a lot of Bitcoin evangelists get their talking point about Bitcoin rallying following Halving. It’s the most recent event and it didn’t coincide with a steep decline prior to the consolidation and subsequent rally. This recency bias may be driving a lot of the hoopla around Halving #4. That and the fact we might be in the midst of a ‘Crack Up Boom’ but more on that tomorrow.

Halving #4 - April 19, 2024 (anticipated)

Here we are in the present day. Bitcoin has rallied about 65% from the previous period of consolidation leading into Halving. We are still about 40 days out from the anticipated Halving #4. Note that in Halving #2 when risk assets were rallying without a huge correction that preceded it, Bitcoin topped out a month prior to the date. Inflation-sensitive assets continue to rally in the present day as well which may be adding fuel to the continued rise in Bitcoin. Add the demand now filtering through the ETF from normies and it’s FOMO’mageddon. But with all of these tail winds, could we be closer to the top of this run than everyone thinks?

Bitcoin Dominance is Falling

What is Bitcoin Dominance other than a catchy name for a crypto-loving synth-rock band? It is the share of the total market cap of crypto attributed to Bitcoin. In the beginning, there was only one (I’ll spare you the Highlander meme). Bitcoin dominance was 100%. Let’s look at it now.

Just kidding!

Now on to the actual chart!

Over the past 8 years, a huge number of crypto currencies have come online. These represent base layers with dapps built on top of them, meme coins like DOGE, shitcoins, the ultimate shit coins MAGAcoin, TRUMPcoin, etc. There is a lot of competition for the money flowing into the crypto space. Notice how the dominance of Bitcoin has rallied into halving but those rallies are peaking lower and lower? The overall investment in the space is moving toward other projects/coins.

A point I’ve been trying to make to the Bitcoin Maxi’s around me is that Bitcoin doesn’t necessarily have a huge competitive advantage as a first mover. In most technological breakthroughs, it’s highly unlikely to see the first mover still be the dominant force in the space a decade or two out. This may be occurring here with Bitcoin. It doesn’t mean the value is going back down to pennies again. Bitcoin has built a brand name which can stand for a long time. It does however mean that expectations need to be realistic. If Bitcoin had a monopoly on the cryptocurrency space, then the sky is the limit. But in the Wild West of blockchain development, Bitcoin isn’t going to be the Big Kahuna forever. One or several crypto may already exist that will overtake Bitcoin. The hope of maxi’s is that when that happens, the value of Bitcoin will remain in tact. I’m not totally sold on that.

Altcoins Rallying Early

The conventional timeline of Halving is a consolidation of Bitcoin, a rally into or just immediately after halving, Bitcoin pulls back or consolidates while alt coins rally BIG. Well, that timeline may be mashed together this go around. Since the beginning of the year, coins like SOL (+45%), CRO (+65%), and even HIVE (+25%) have been moving up in tandem with BTC. Normies are buying Bitcoin via Coinbase, Swan Bitcoin, and ETF’s. This is being sold as the driver of Bitcoin prices to incredible heights. I see it as a different story. It is the maturation of Bitcoin. The transition into an asset that everyone knows about and gets integrated into many more portfolios. Unfortunately, that doesn’t necessarily translate into higher prices for hodl’ers. It does translate into a more robust marketplace that can achieve price discovery easier. This means the huge swings get smoothed out. There will be some growing pains yet to come however.

How Does Bitcoin Behave in a Recession?

I don’t think anyone knows the answer to this yet. With the inclusion of so many normie buyers and a paper market for Bitcoin via the ETF, it’s entirely possible that the behavior in March of 2020 is going to play out again when the proverbial shit hits the fan economically. A cascade of selling may create an incredible buying opportunity. It may also be truncated by large investors and Wall Street types snapping up coins when they are depressed in value. Or it may become a safehaven asset. Only time will tell. My hope is that this helps you see a different angle than the polar view points that are out in the world right now.

I continue to hold and stack Bitcoin. I’m not taking much off the table with the present price action because my stack isn’t big enough to be reallocating a chunk. However, I will get to a price in other coins such as SOL and HIVE where I will start moving portions of my holdings into stable coins or other assets like cash, gold, silver, oil and uranium.

Will the US Dollar Collapse?

Is the US in a Crack Up Boom?

Predictions abound about the fate of the US dollar as the world reserve currency and even the domestic currency within the United States. Predictions are swirling about $1,000,000 Bitcoin and $3,000 Silver as a result. Many of these predictions come from folks that think we are in an economic phenomenon known as a Crack Up Boom. Let’s take a look at what that is and whether it makes sense that we’re in it or not.

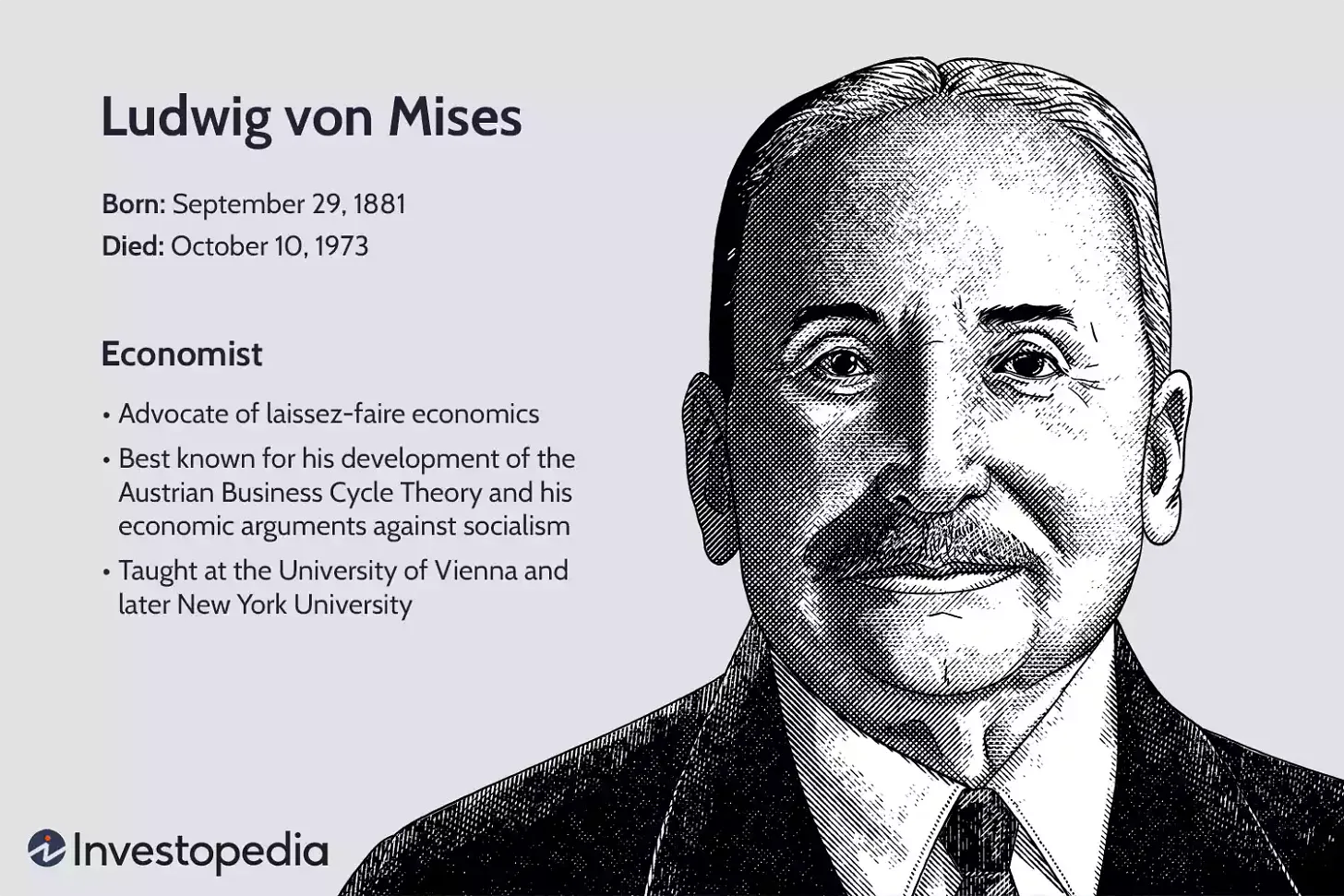

Austrian Economics

Before we dive into what a Crack Up Boom is, let’s take a quick look at the school of economic theory it comes from. Austrian economics began back in the middle of the 1800’s. It is composed of economic theory based on reasoning issues out without necessarily being a slave to economics numbers. It is the qualitative, laissez faire yin to the hyper statistically based Keynesian yang that we live under with the Federal Reserve today. The tenants of Austrian Economics view economics from the lens of absolute freedom of the individual to make decisions for themselves and how that plays out economically once there are interventions or disturbances. You can read more about it here: Austrian Economics on Investopedia.

Ludwig Von Mises (1881-1973)

“Mises concluded that the only viable economic policy for the human race was a policy of unrestricted laissez-faire, of free markets and the unhampered exercise of the right of private property, with government strictly limited to the defense of person and property within its territorial area.” - The Mises Institute

Mises was a champion of laissez faire governance (ie - no government interference in markets) and hard money via a gold standard. In 1920, Mises helped Austria to avoid the hyperinflation that its’ neighbor Germany suffered following World War I. Early on he identified that inflating their debts away would result in currency collapse. Something Germany learned the hard way just a year or so later.

Ludwig fled the Nazi’s to the United States in the 1930’s. He taught and wrote several books that are the cornerstone of Austrian Economics. His most accomplished student, F.A. Hayek won the Nobel Prize for Economics in 1973, a year after Ludwig’s death.

Don’t Miss Your Chance At Free Silver!!! 🥈🥈🥈🥈

I’m giving away pure silver to up to 4 free subscribers on April 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe to the Anarchist Investor

Or better yet…Become a paid subscriber to get access to:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

What is a Crack Up Boom?

Simply put, the real economy of a country falls apart while its’ currency hyperinflates. This results in the citizens shunning the local currency for other forms of payment such as barter, gold/silver, and perhaps crypto in the present day (in fact we have seen this in countries like Cuba already). The precursor to this calamity hinges on a central bank never letting the real economy fall into sustained contraction via currency printing. As the supply of currency increases, there is a reduction in the positive effects on the real economy. Mises outlined in his 1912 book The Theory of Money and Credit that the marginal utility of each new dollar printed drops. Eventually there is no stimulative effect to new credit issuance or money supply expansion. Purists of Austrian Economics will correct me here and say that there is never a stimulative affect for forced money and credit issuance. To that I say, you’re correct over a long enough timeline because all that does is cause inflation (eventually) and pulls future demand into the present. Public perception of this nuance is obviously a fickle thing.

Hallmarks of a crack up boom are ever increasing magnitudes of central bank and government intervention into markets, decreasing real economic activity, and the public’s inflation expectations detaching from central bank targets/projections. The process is one of momentum. At a certain point it begins to move like a freight train and the only two choices the central bank has is intentionally derail the train, or hit the accelerator. Eventually, even the printing press can’t keep up with the acceleration in prices and hyperinflation leads to the citizens rejecting the local currency for other forms of payment.

Read more about the Crack Up Boom here: Investopedia

Is the US in a Crack Up Boom?

Most recently Venezuela, Argentina, and a host of other countries have gone through this cycle. You actually see Javier Milei in Argentina turning to the US Dollar as a short term stop gap to halt it. My guess is he will call for a hard money system in the coming years once the ship stops sinking (he is after all a student of Austrian Economics). It certainly seems like the US is in the early stages of it. Something to note is that this process doesn’t have a definitive time frame, only a definitive result. The United States has certain characteristics that other countries in recent history that have experienced Crack Up Booms don’t. The biggest of which is the station as the world’s reserve currency. This creates an artificial floor of demand for US Dollars that slows this process. But I’m afraid it only delays the inevitable. On a long enough timeline, Economics is undefeated.

Recent interventions from the US Government and Federal Reserve Bank have ballooned. Hundreds of Billions in rescue and bailout packages in the Great Financial Crisis have turned into Trillion dollar ones during COVID (ie - the 2020 recession that was supposed to hit anyway). It’s not unreasonable to expect the next wave to look like 10’s or 100’s of Trillions.

Inflation had been under 2% for a decade leading up to a pop in 2021 that peaked at almost 10% if you believe the government’s estimates. If we look at the old formulas for CPI, that inflation rate is probably closer to 20%. Recent disinflation isn’t necessarily tied to central bank policy. It’s entirely possible that the supply chain bullwhip is providing a momentary relief from inflation before a second wave hits due to new supply shortages. As a side note, Mises would probably laugh at the idea of CPI as a measure of inflation. If you’re a working class family, you feel inflation without having to put a number on it. And when the central bank prints, you know your purchasing power is diminishing in short order. The net effect on the broader economy may be possible to obscure but what happens inside a household budget isn’t so easy to hide.

In addition, a subset of the population has been stacking gold and silver as an insurance policy for years. The recent popularity of Bitcoin and Crypto currencies has attracted a much larger portion to the idea of shunning fiat currencies for something that isn’t manipulated.

Conclusion

Typically, you can’t make the call that we are in any economic cycle until the effects of that cycle are being felt in full. This means you don’t know the moment it began until it has already passed. Kind of like Schrodinger’s cat. However, we can look at the hallmarks and make a prediction. The United States is on the path toward a Crack Up Boom. Because of its’ position as the world’s reserve currency it may not be too late. We may not have hit the event horizon just yet. However, the Federal Reserve’s intention to lower its’ key interest rate later this year points to a lack of understanding or worse yet, a lack of commitment to get us out of it. The full force of this economic cycle may not be felt for another few years or decades. But it is coming. Here’s how you can prepare:

Get out of ‘Bad Debt’

Collect actual assets - like precious metals and property

Stack alternative currencies like Bitcoin (use some risk management please)

Invest in yourself - a business or skills that you can run as an individual will pay dividends for your life and possibly generations to come

Educate your friends and family - don’t let them be snowed over by propaganda that changes the definitions of inflation, recession, or prosperity

Share this article and continue to read The Anarchist Investor 😁

Get something out of this article? Awesome! Please let me know in the comments, and feel free to share this post with your friends. It would help a lot!

JOIN ME LIVE! Monday Through Friday

The Anarchist Investor LIVE! is at 12 pm EST every Monday through Friday. Come join the conversation talking about contrarian investment, the economy, and markets. Plus a small dose of shitposting the trolling centralized authority.

https://www.youtube.com/channel/UCL0qwtU4SZhCgpz6f4EMgzw

Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation