Kris Marszalek, CEO of Crypto.com, has voiced concerns about "inflated" prices in the cryptocurrency sector. In a recent interview with Bloomberg, Marszalek expressed skepticism about the generous valuations being touted by teams of new projects amid a significant increase in funding rounds exceeding one billion dollars for early-stage cryptocurrency startups. These observations from the CEO of a leading global exchange primarily focus on the investment frenzy that accompanied the surge in token prices during the pandemic, which yielded mixed results for investors. While acknowledging the desire for financial returns, Marszalek emphasized the need for utmost caution in the current market context.

Crypto.com's venture capital arm, Crypto.com Capital, allocated $500 million for investments in cryptocurrency startups in January 2022. However, over the past 18 months, the fund has scaled back its investment activity. Publicly available information indicates that Crypto.com Capital has only made four investments since the beginning of 2023, compared to 35 investments in the previous two years. Despite the resurgence of enthusiasm in the cryptocurrency sector, Marszalek stated that the fund has sought to be reasonable and prudent in its investment approach. While not disclosing the exact figure, Marszalek mentioned that the unit has made approximately 70 investments to date, deploying a significant amount of capital.

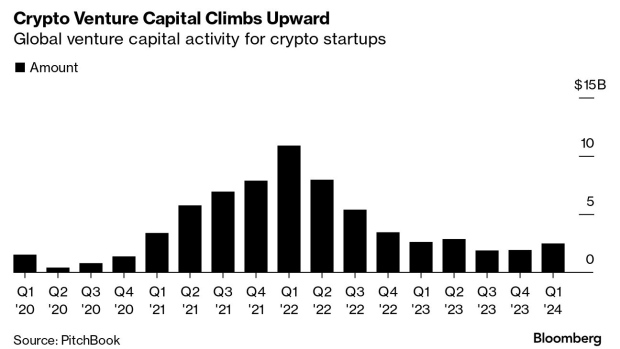

The cryptocurrency sector as a whole has recently witnessed venture capital deals highlighting skyrocketing valuations. For example, the blockchain platform Berachain, managed by pseudonymous founders with bear-themed avatars, secured $100 million with a valuation of at least $1 billion. Additionally, software company Merkle Manufactory, the creator of the decentralized social network Farcaster, and blockchain developer Monad Labs have achieved billion-dollar valuations in recent weeks. Crypto.com Capital has participated in some of these funding rounds, including Berachain's raise, as well as investments in staking company Kiln and gaming startup Arcade2Earn. The venture capital arm of Crypto.com primarily focuses on seed-stage and Series A rounds. However, Marszalek acknowledged that limited partners (LPs) providing capital to venture capital funds share his skepticism regarding the renewed excitement in the cryptocurrency sector. LPs are reluctant to invest further until venture capital funds demonstrate tangible returns.

Marszalek's outlook on Bitcoin is bullish. Regarding the leading cryptocurrency, Marszalek recently stated that Bitcoin may face some selling pressure leading up to the highly anticipated halving event, but its long-term prospects remain positive. While acknowledging the possibility of short-term selling pressure due to the "buy-the-rumor, sell-the-news" trading phenomenon, he emphasized that, in the long run, the halving event will have a positive and significant impact on the market. Marszalek stated, "Over a longer period, Bitcoin's halving will make a substantial difference and will be a positive development for the market." In particular, Marszalek expressed optimism for the six months following the halving event, predicting "quite decent action" in the Bitcoin market during that period. Despite short-term uncertainties, Marszalek remains optimistic about the future of the leading cryptocurrency and believes that Bitcoin's halving will propel the digital asset to new heights.