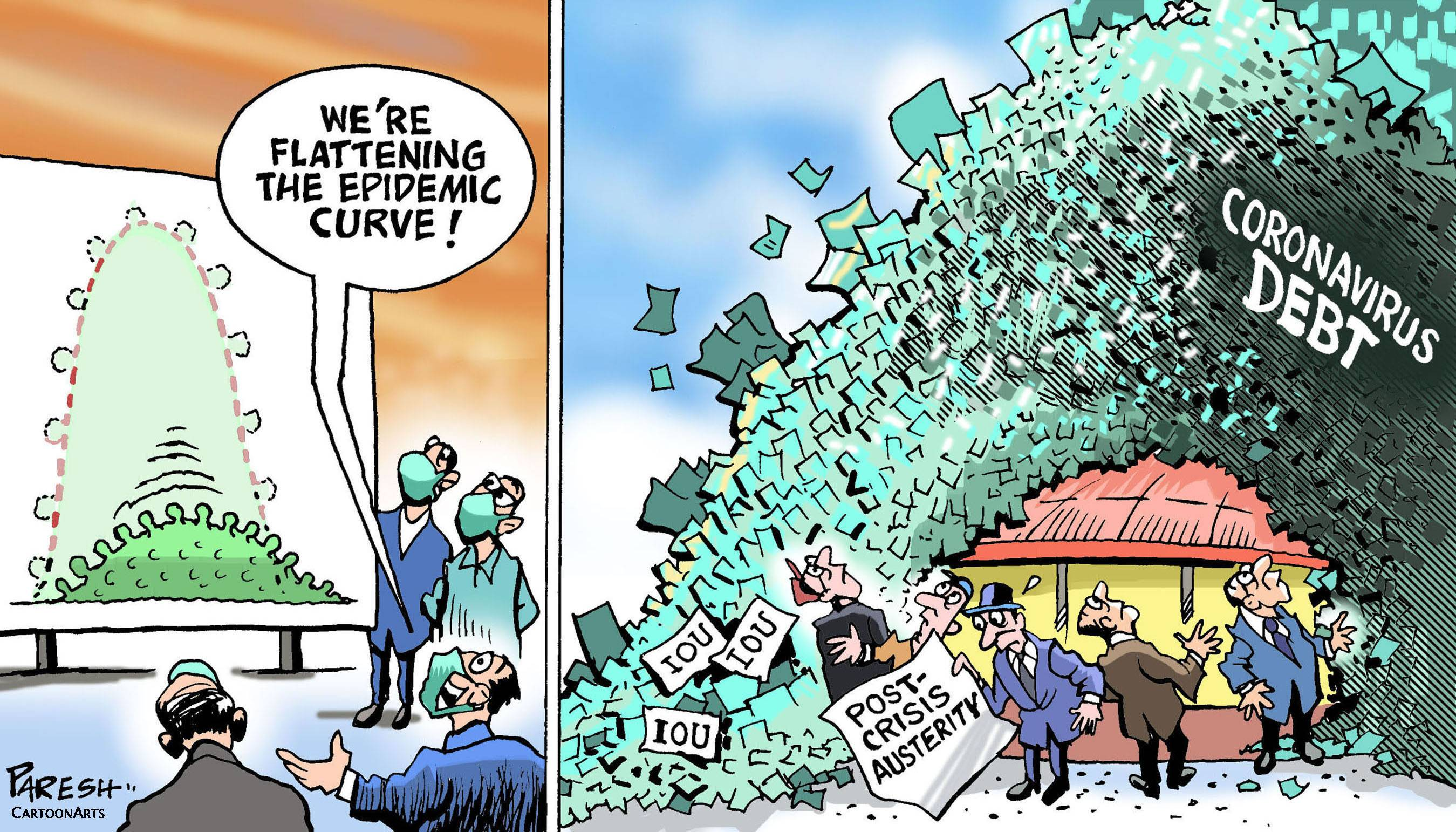

A debt deflation happens when the supply of credit in the economy shrinks, which makes existing loans harder to repay, which causes bankruptcies, which causes loans even harder to repay, etc. But here's the thing the Keynesians worshipping the state never tell you: Debt deflation wouldn't happen in the first place without debt inflation. If you don't have fractional-reserve banking, you wouldn't have a credit crunch to begin with. All loans and credit would be backed 1-1 with actual collateral instead of musical chairs.

The 19th century was one of generally falling prices. This encourages savings, both at an individual level and country level. Banks often went bankrupt because they still tried to run the typical fractional-reserve scam and there was no one to bail them out. Was this a bad thing? Depends on your perspective. If you worship centralized power and extremely large superbanks, then obviously a deflationary system isn't good. The ultimate solution to stopping banks from constantly going down is to get rid of fractional-reserve banking altogether, and not to prop it up with more and more inflation.

Irving Fisher was the clown that said the stock market reached a "permanently high plateau" right before the 1929 crash. To expect him to have the right analysis of the crash that he didn't see coming is retarded. In the meantime, Austrian economists like Henry Hazlitt and Ludwig von Mises did see the crash coming well ahead of time. Also actual dudes that had money on the line (not just talk, talk is cheap) also saw it coming, people like Roy Neuberger and Bernard Baruch.

Milton Friedman wasn't an Austrian economist. He was the mainstream "freemarket" guy that was still a cheerleader for the Fed. Ludwig von Mises correctly called him a socialist. So I don't care if Friedman thinks Irving was great. Irving was an idiot that didn't see the crash coming and made up an ex post facto explanation that enoucraged even more government power.

The "checkmate" that mainstream economists give is that loans wouldn't work under a deflationary system. But this is complete nonsense. You could have loans that are tied to a price index. In 2025, this isn't rocket engineering at all. Even if the price level declines by 50% per year, you could have a loan-able market where the interest rate is something like -48% per year (2% real interest). After all, all people care about is a REAL return. The idea that most people are too dumb to see past inflation (or deflation) is really moronic at this point.

And since a deflationary system encourages savings, you would expect the real rate of interest to be basically zero, since there would be a lot more capital that people could access.

Bottom line: The only real way to prevent debt deflation is to not have debt inflation in the first place. Papering it over is not a real solution.

Posted Using InLeo Alpha