Last night I felt like I contradicted myself only to later find out I was right lol. I posted on InLeo Threads in which before I went to bed it felt like we where in for a crash. Come the next morning my portfolio was up nearly 5% in a single day. That's pretty wild and showed that things where still on the up and up.

But then it happened...

That sell off I had figured would happen. Mainly because of a lot of passion and emotion goes into crypto trading over any real fundamentals and I would even say that's more and more true of the general stock market as well.

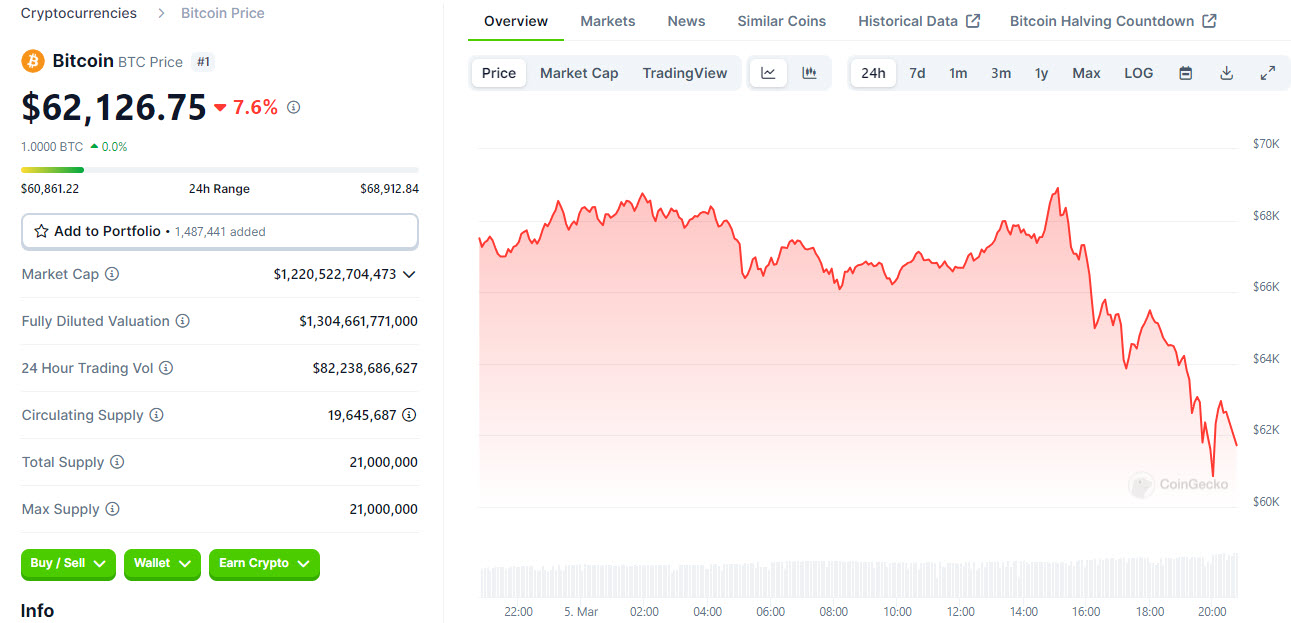

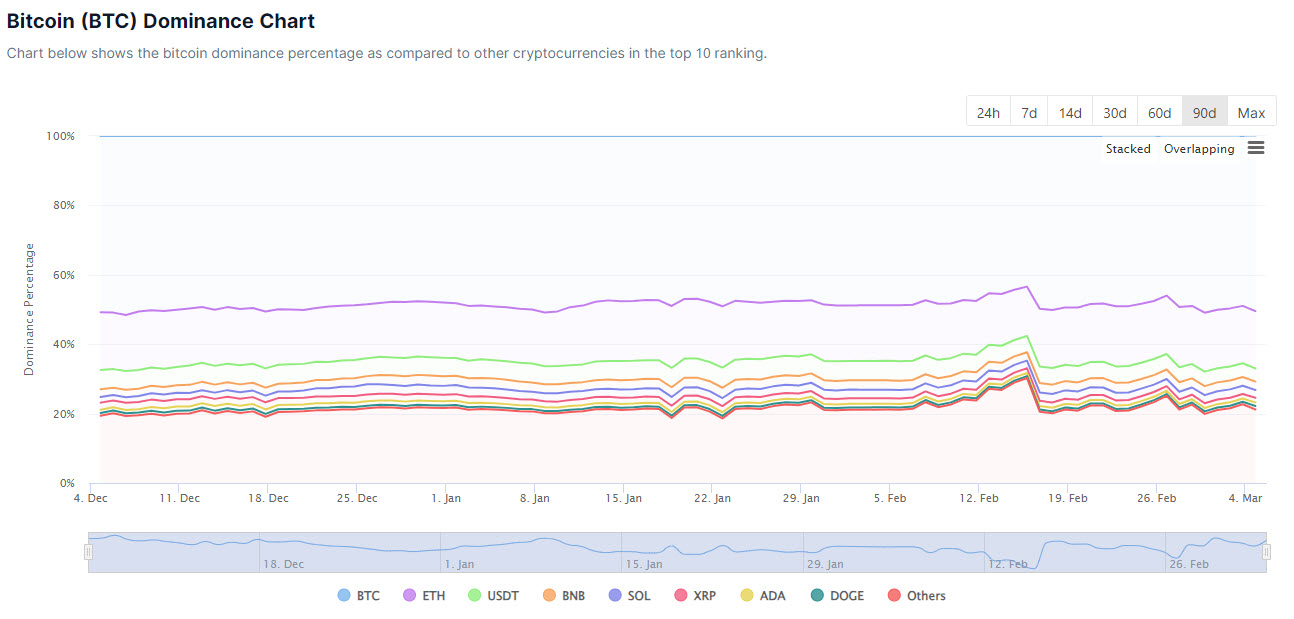

Bitcoin just flat out tanked and with it exited a massive amount of value in the crypto markets. Now currently down 7.8% of the 2.4 trillion dollar market cap what it showed us was just how much dominance bitcoin has again in the markets and just how fast things can happen in these markets.

We also have to understand that a lot of press was on to hit a new ATH (All Time High) which does seem like it happened and right then is when profit taking started. To be fair I don't blame them, I'd do the same thing if I was investing into a new ETF asset or just buying up bitcoin was within a week or two I was up some 20% - 30% those are gains you lock in!

But here's something history and markets have shown us in the past. When a new ATH is reached it's at some point hits a new ATH and continues to cycle on it's way upwards. This is why I feel a lot of people sell out when that mind trigger of a new ATH is hit and then most likely buy in again. With crypto this happens even faster then the stock market. Being that it's a 24/7 traded asset (unless you're in a ETF rip those people) unless that's not the case if it's not please let me know and the source info.

Another quick note on Altcoins. While I don't feel like they will get left behind an alt coin season really only ever comes if bitcoin continues a upward trend but that trend starts to stagnate.

This stagnation but slow hold on increasing value in bitcoin often sends people packing up and looking to the alt coins as a way to start building gains. So until we see that altcoins are going to struggle and it might be best to take your gains where you can.

For example one of the more recent ones #PEPE which as crazy as it sounds is one I feel will be a key performer. Not because the altcoin does anything special but simply because pretty much everyone in the world knows PEPE and it's so damn meme heavy.

I called this and bought in on PEPE when it was just $0.00000019 It's value now... $0.000006 it's hard to see but that's one less zero and a rather massive rally with a massive trading volume to support it. This is another key factor to look into is the volume of the token. Without it, it's worthless as no one wants it in that case.

So what's your play? A good time to make sure you dollar cost average in again? Personally for me I like to wait for these drastic dips and buy for a long term hold. That's normally when I so call "dollar cost average in" Which over time has performed very well. However I would also say never try and time the market because you'll 99 out of 100 times be wrong.

*This article is for entertainment purposes only and is not finance advice.

Posted Using InLeo Alpha