Hello everyone,

I wanted to share an update on the current state of Hive. 🚀

Source:

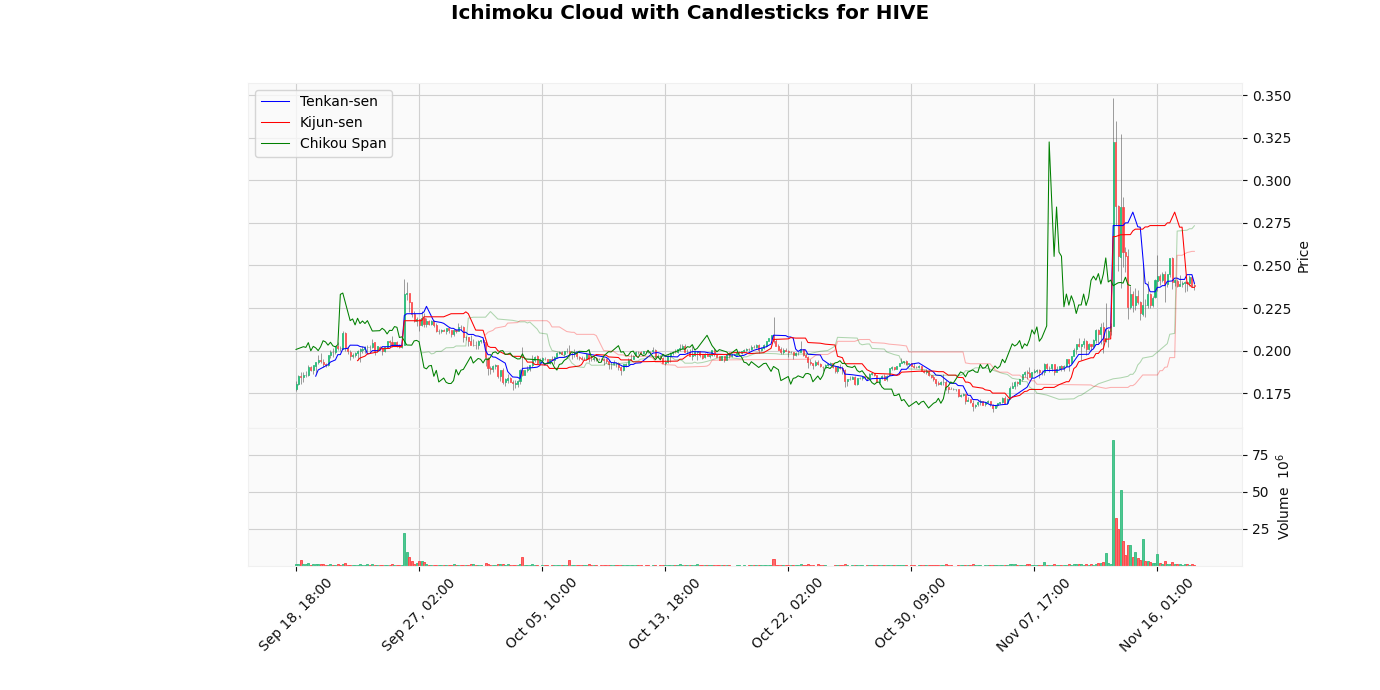

Graph data source 👉 binance.com "

Fear & index data source 👉 alternative.me

hive other data source 👉 coingecko.com

Data

🥇rank: 489

📈 Cap: 109882856 usd

📊Vol: 8770561 usd

24H -1.19664%🔴

7D 18.10181%🟢

30D 18.53761%🟢

For more information, you can visit the following links:

🔗 Hive

🔗 Hive Explorer

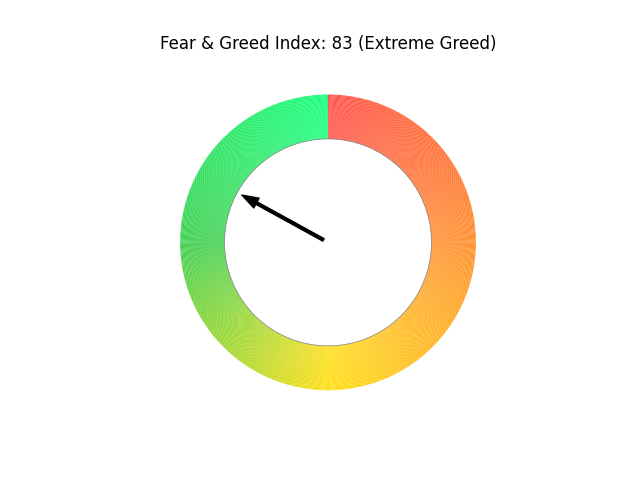

Actual Bitcoin fear & greed index:

HIVE/USD Market Analysis.

- Current Trend: Bullish (Cloud color: verde)

- Tenkan-sen: $0.2394 (Price below)

- Kijun-sen: $0.2371 (Price above)

- Support Level: $0.25825

- Resistance Level: $0.2733

- ADX: 41.72 (indicando una forza del trend alta)

- RSI: 47.06 (indicando neutro)

- MACD: 0.00, Signal Line: 0.00, Histogram: -0.00

- Volume Strength: -36.87%

Interpretation:

The current price of HIVE is located below the level of the Ichimoku cloud,

indicating a trend bullish. With a volatility of 52.59%, it is advisable to monitor the price levels around the

Tenkan-sen and Kijun-sen to detect signs of strengthening or possible reversal.

Personal Considerations:The HIVE market is showing positive signs, with the current price ($0.2382) above the Kijun-sen ($0.2371).

This may suggest a bullish trend, and with the Tenkan-sen supporting further upward movement, we may see

an uptrend in the coming days. However, with a volatility of 52.59%, it remains important to monitor any

sudden retracements. The current Ichimoku cloud (Kumo) shows a solid structure, with support in the area of

of $0.2582.

For now, the trend seems to be in favor of the bullish, but I will continue to follow closely to see if it will hold

above this support.

Conclusions:

Given the current price of $0.2382, if it continues to respect the support level at $0.2582 and the resistance level at $0.2733, the trend could maintain its current direction.

However, should the price break below the Tenkan-sen ($0.2394) or the Kijun-sen ($0.2371), it could signal potential weakness in the market, leading to a possible bearish phase.

Conversely, if the price manages to break above the resistance level, it could indicate a strong bullish momentum, prompting further upward movement.

The ADX value of 41.72 suggests that the current trend is strong, which should be taken into account when making trading decisions. The RSI value of 47.06 indicates that the market is neutral, providing additional context for potential reversals.

The MACD line at 0.00 crossing above the signal line at 0.00 could indicate a bullish signal, while a cross below could suggest bearish momentum.

Thus, traders should remain vigilant and consider these levels as critical points for potential entry or exit strategies. Monitoring the volatility, currently at 52.59%, will also be essential, as increased volatility may lead to rapid price movements and changes in market sentiment.

Link of analisys: Bitcoin-Fear---Greed-Index---Historical-Data

Link of volume analysis: Hive-Volume-Analysis