Before reading this, remember I suck at trading.

However, like all fools, this doesn't stop me from having a go. And last night, before going to bed at about 1 am, I saw that HIVE was looking spiky, so chose to stay up and see if my spidey senses were correct. This time, they were, and forty five minutes later, a green wick was quickly forming.

That is where I chose to stay awake.

As I was writing the other day, one of the challenges with spot trading is being "around" at the right time, because those right times might be pretty rare, and they might be at two in the morning. Because of this, I "set and forget" prices in the hope of catching a spike. However, this has challenges too, because it can trigger far below the peak, or it can be too far above the spike. If watching, it is possible to adjust, if not, too bad. Many, many times I have just missed out on sells (and buys), and many times I have sold well below the peaks.

Because of this conundrum though, what I end up doing is laddering my orders incrementally. This is especially useful if looking to sell larger quantities, because it can increase the sell average. For instance, if hoping to sell 10,000 HIVE (which is a large quantity for me) into a spike with the hope of buying back, you don't want it to sell at the bottom of the spike, rather the top.

But, that top is unknown, so like I had last night, my set sells were spread between 0.41 and 0.495. I wasn't expecting it to go as high as it has, but what this means is that my average sell price was around 0.44. If I had sold it all at where I thought it would go when it was sitting at around 0.33, I would have sold it all around 0.42. But, if I had waited and dropped the lot higher up last night, I could have averaged 47.

My buys didn't trigger.

And this is the next problem, because I was "hoping" that HIVE would fall far lower overnight than it did, and then it has spiked up even higher than last night, without me having bought any back to sell into the second run. Though, I still had a few of my higher sells in place, so despite not buying back, I was still able to increase my sell average a bit further. If it had fallen back, I would have ended up with more Hive, but would have "missed" the opportunity to sell and get even more.

For me at least, laddering has been a good way to manage buys and sells in these spikes, because while I miss the tops and the bottoms with the majority of my trades, the average is likely higher than if I relied on single trades hitting highs and lows. As said, I have missed many, many trades over the years by tine fractions. Like just the other week I missed a trade on HIVE/BTC where it went 0,00000452, and my sell was at 0,00000455 - The buy back would have been 30% lower, but instead, I traded nothing. I should have laddered around where I think it would go, or where I would be happy to sell.

I do the same on the internal market.

However, on the internal Hive market, there is an additional "problem" in that normally when HIVE spikes, HBD spikes along with it, albeit at a lower percentage. This means for instance, that while HIVE was trading at 47 cents on external markets, it was trading around 40 cents on the internal, because it is trading against HBD. So, I cancelled most of my internal orders in favour of external, and then will move back in at a later date. There are of course other reasons to trade on the internal market also.

When to buy back?

I have no idea. But my goal is to increase my stack of HIVE, so as long as I am able to do that, I am up. I would have loved to have stayed awake a bit longer and set some higher buybacks, because it became clear there was going to be a second run, but I missed them by a long way. I lowballed because if it did drop like a rock, I wanted to buy lower. Either way, it is not the end of the world, but if BTC does do a significant pullback in the coming few weeks, what will the low on HIVE be? And since I don't know, I will ladder my buys back in, starting at the most I am willing to pay, and working backwards.

Willingness is a big part of this, so when laddering buys for the future, consider what is the lowest you are willing to sell for, and when buying, consider the highest you are willing to pay. Greed often comes into play here, because it is pretty obvious that we want to sell for the highest, and buy for the lowest, but it is good to remember that at the tips of those peaks and the depths of those troughs, only very, very few trades actually catch them. Close enough is good enough - unless they are untriggered misses.

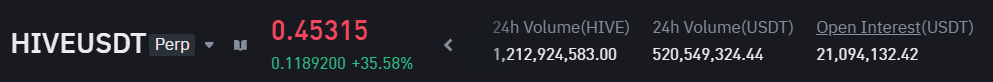

And on an end note, the HIVEUSDT Futures market is looking healthy.

That volume is over 2x the total amount of HIVE in circulation, and half a billion dollars in volume is nothing to scoff at. I still haven't dipped a toe into this yet, but it seems some are willing.

Taraz

[ Gen1: Hive ]

Posted Using InLeo Alpha