[EN] January, the month after Christmas, the New Year. But just not my favorite month. It's cold and the month drags on forever and is actually just waiting longingly for spring or, like me, for his Thailand vacation in February. The stock market didn't get off to a good start on the trading day, but then moved up significantly again over the course of the month. There was a small brake on the last trading day from the FED and dwindling prospects of falling interest rates as early as March. A lot happened in my portfolio in January and I now have a very large cash rate and am ready to buy larger drops on the market. If this doesn't come, I'll continue with my savings plan strategy and collect the interest on the daily money. My portfolio looks like this at the end of January:

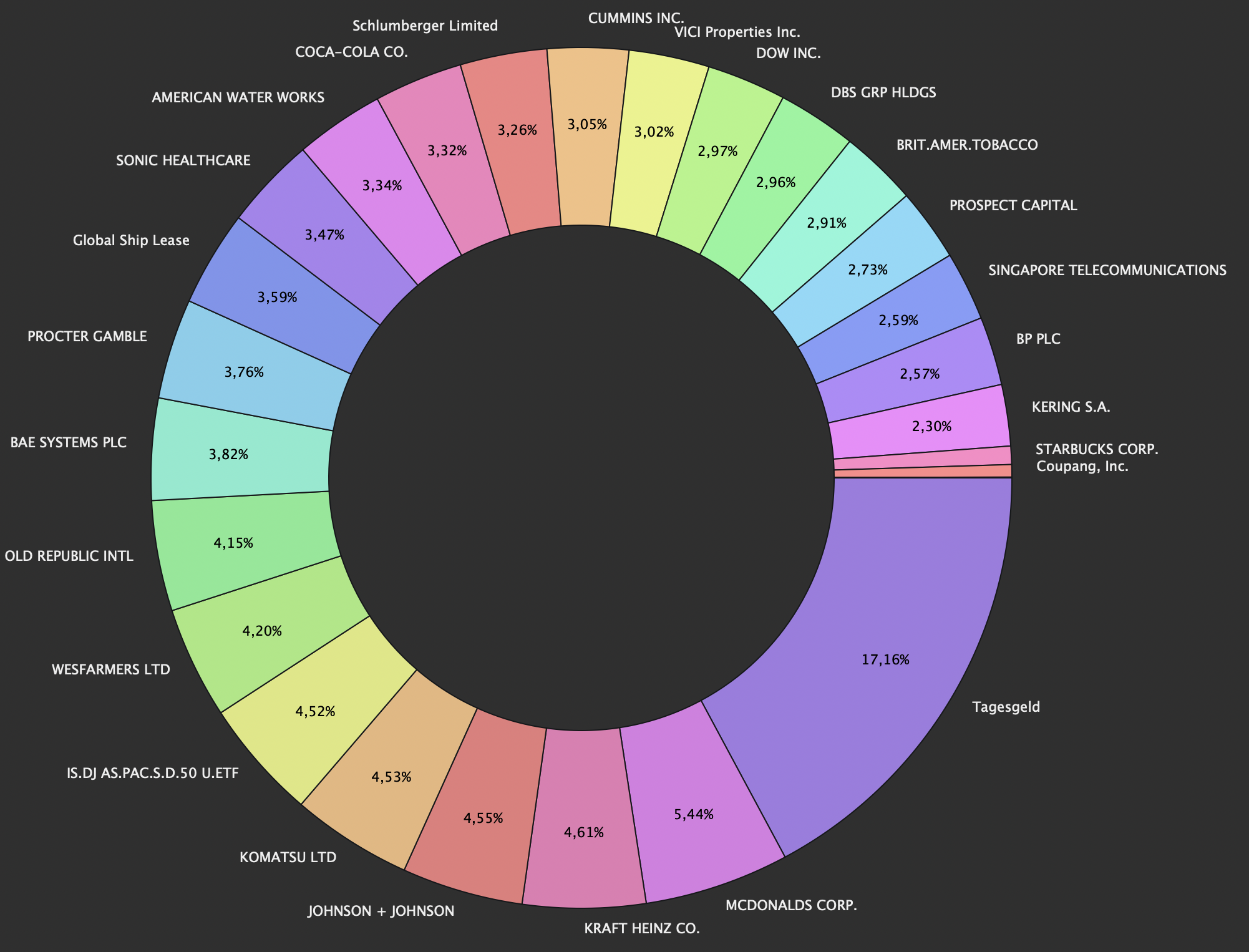

At the end of January, the portfolio currently consists of 27 different components, including 25 individual stocks, 1 ETF and the daily money account. The five largest positions at the end of December are:

- (new) Overnight money

- (3.) McDonald's

- (5.) Kraft Heinz

- (9.) Johnson & Johnson

- (7.) Komatsu

By selling the first two positions (S&P500 ETF and Global X Nasdaq Covered Call), the top 5 was thoroughly mixed up. The largest position by a significant margin is now overnight money with 3.5% interest p.a., followed by McDonalds and Kraft Heinz. New to the top 5 is Johnson and Johnson and Komatsu. The latter rose significantly due to strong quarterly figures on the last trading day in January.

Performance

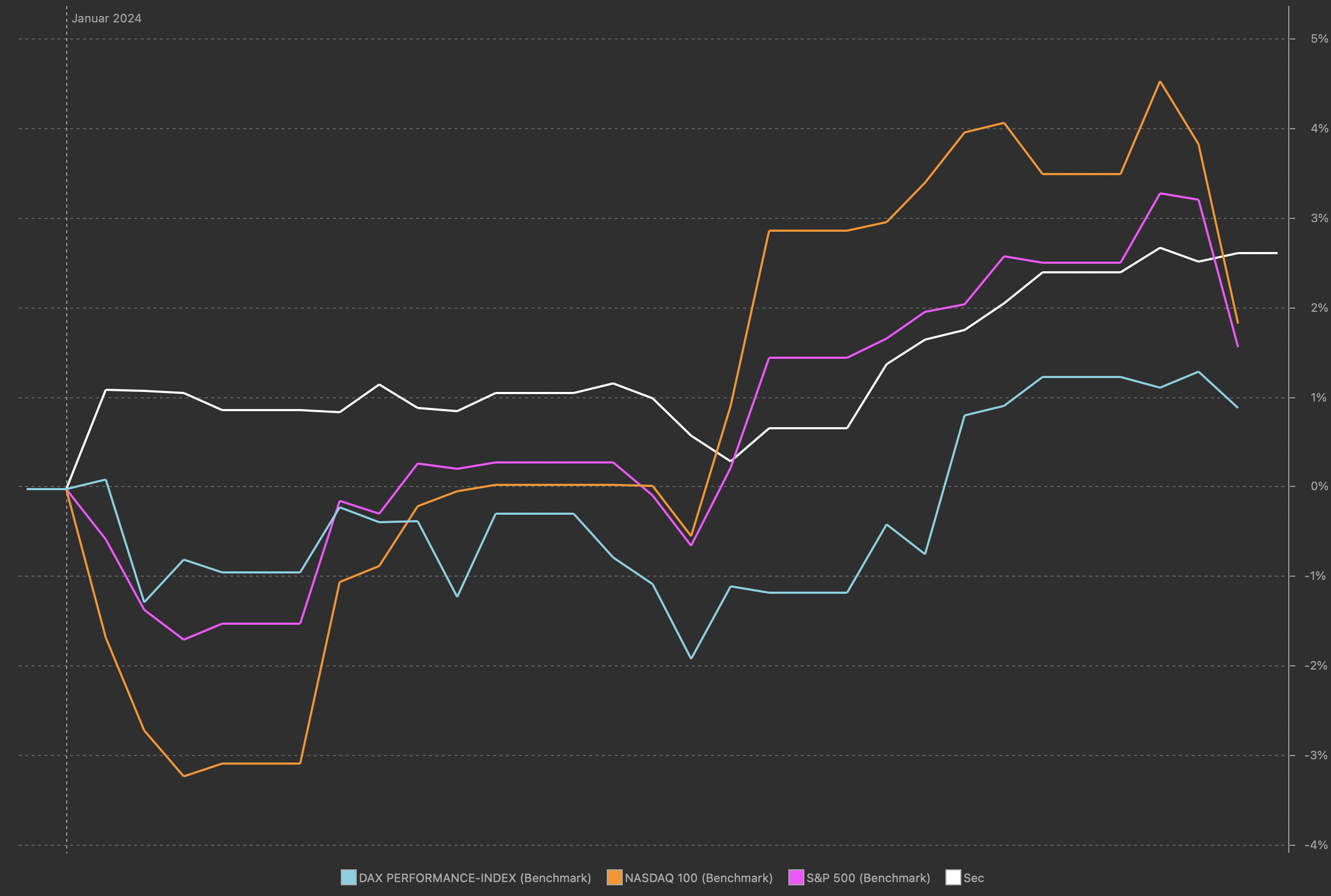

As already mentioned, the start of the year was overall very positive for the stock market. This also had an impact on my portfolio and we were able to achieve a book profit of +2.6% YTD or for the month of January. My portfolio is shown by the white curve and is titled Sec.

It would be no exaggeration to say that the FED gave me victory against the comparative indices NASDAQ, S&P500 and the DAX in January. Thanks Jerome! And finally, let's look at the performance since recording, i.e. since September 1st, 2020.

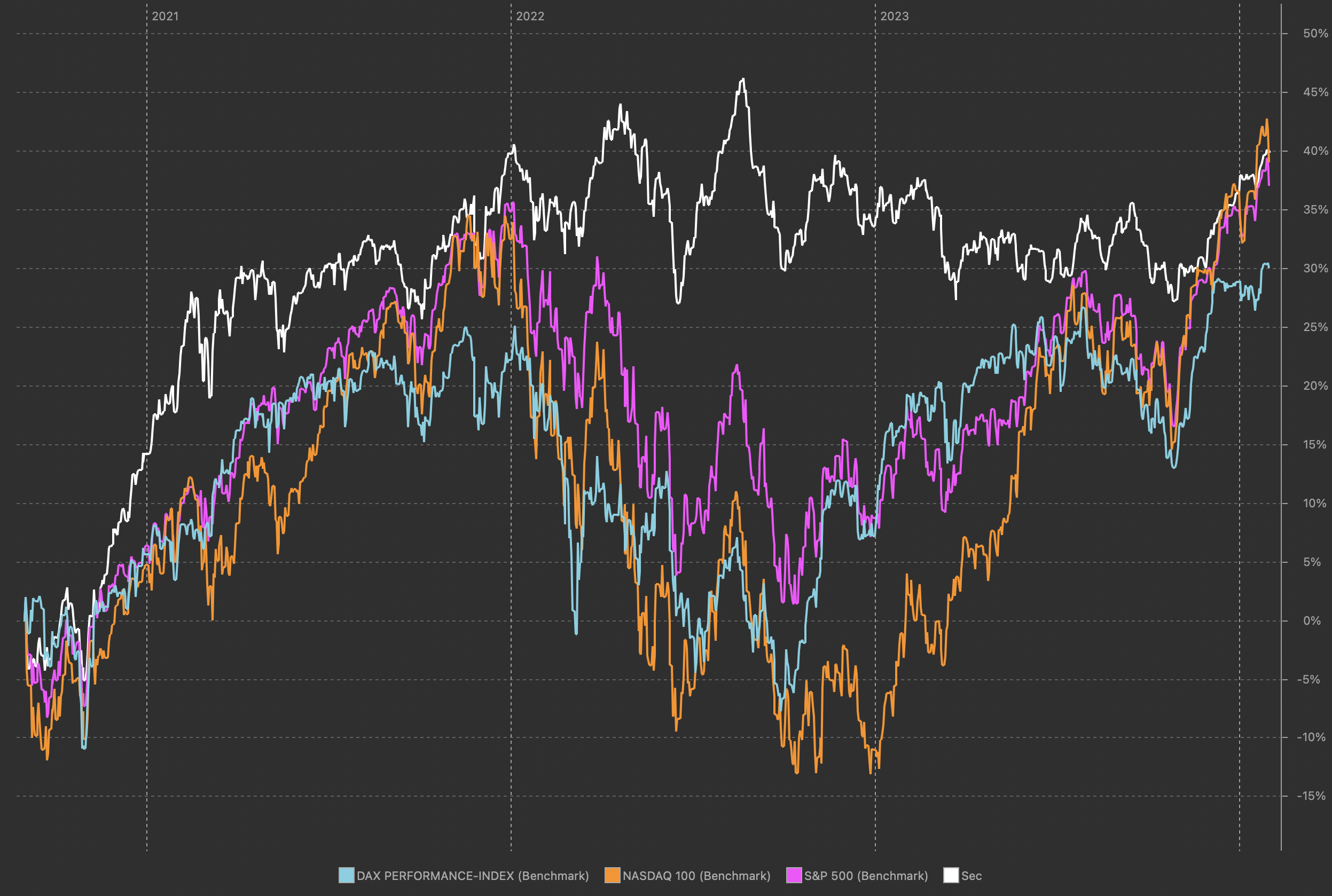

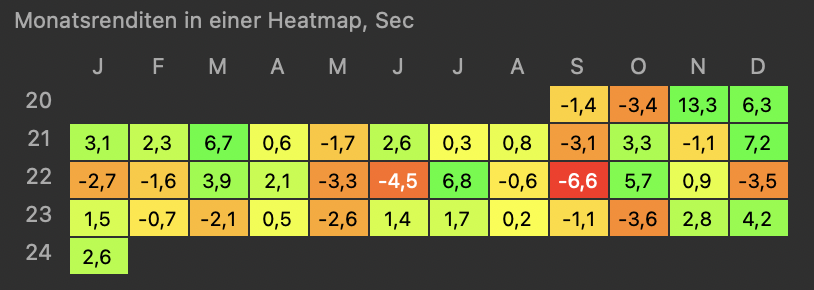

Here we are at a good level at +40% and are just ahead of the above-mentioned indices. But you can also see that my portfolio and the comparative indices now have a very similar trend. Here is the updated heatmap for the month of January.

And so the first month of the year is behind us again. Overall, I am satisfied and the effort required for portfolio management was limited.

Buy/Sell

There was already a lot of action in the depot at the start of the year. Individual investments were made, sales were carried out and savings plans were implemented. For me, the savings plans were carried out on the classic days at the beginning and in the middle of the month.

02.01:

- Cummins

- Kering

- Coke

- Singapore Telecommunications

- Starbucks

15.01:

- Procter Gamble

- BP

Let’s first look at the savings plans. There was only one change here and Komatsu was replaced by Coca Cola. Here I wanted to once again take advantage of Coca Cola's price weakness and get more shares of this wonderful company in my portfolio. The first buy/sell action started on January 10th. I sold MacFarlane for a profit of 15% and added Schlumberger to my portfolio. Macfarlane is trading at its annual high, and I wanted to take the profits here, as this stock, which is not particularly well capitalized, can quickly go in the other direction. Schlumberger is my personal bet on the need for oil as a commodity in the coming years. On January 17th I added the American water supplier American Water Works to my portfolio. For me, a basic investment in the utilities sector. On the same day I sold my largest position, the S&P 500 ETF, and realized a 9% profit. Let's be honest, such a large ETF position is just not for me. I also expect a correction and could then enter again with a smaller amount. A day later, on January 18th, I bought the Casino REIT VICI Properties. I find it exciting and the numbers looked good and the dividend is tasty, let's see. On January 26th I sold the Global X Nasdaq 100 Covered Call with a +3% return. Here I try to optimize returns and buy the paper again at a price <€14.90. With the profit realized, I received around 3 net dividends. Another sale took place on January 29th and hit the US railway company Union Pacific, where a profit of 12% was realized.

Dividends

Of course, there were also some dividends in January, which amounted to -55.8% compared to the same month last year.

- Orio Office REIT (0%)

- Kering (0%)

- Global X Nasdaq 100 Covered Call (+1.7%)

- Prospect Capital (0%)

In the brackets you will find the increase or decrease in the dividend compared to the previous payment. The information always refers to the currency in which the dividend is distributed. Due to my portfolio restructuring, I lost a few payers in January, so this is my worst month since February 2022. But thanks to the acquisitions of Schlumberger and VICI, I at least have new payers for the coming year.

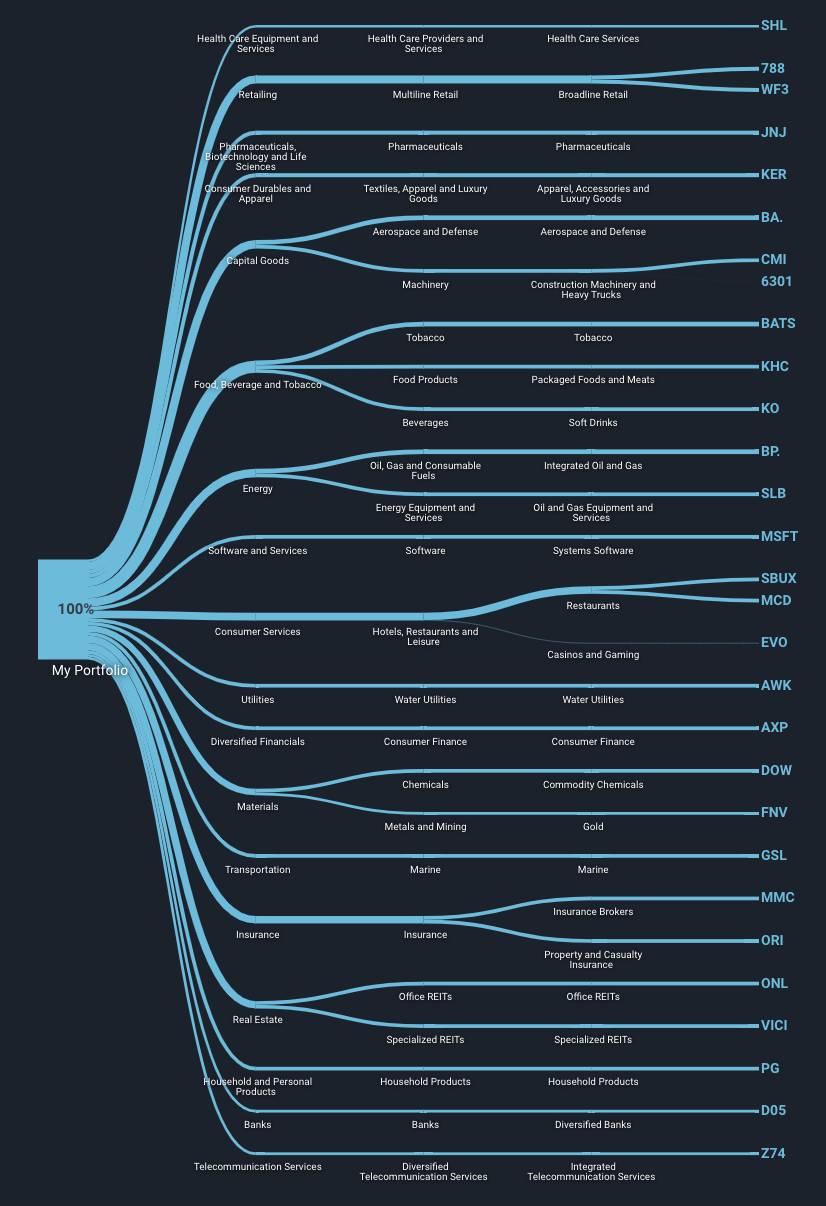

Diversification

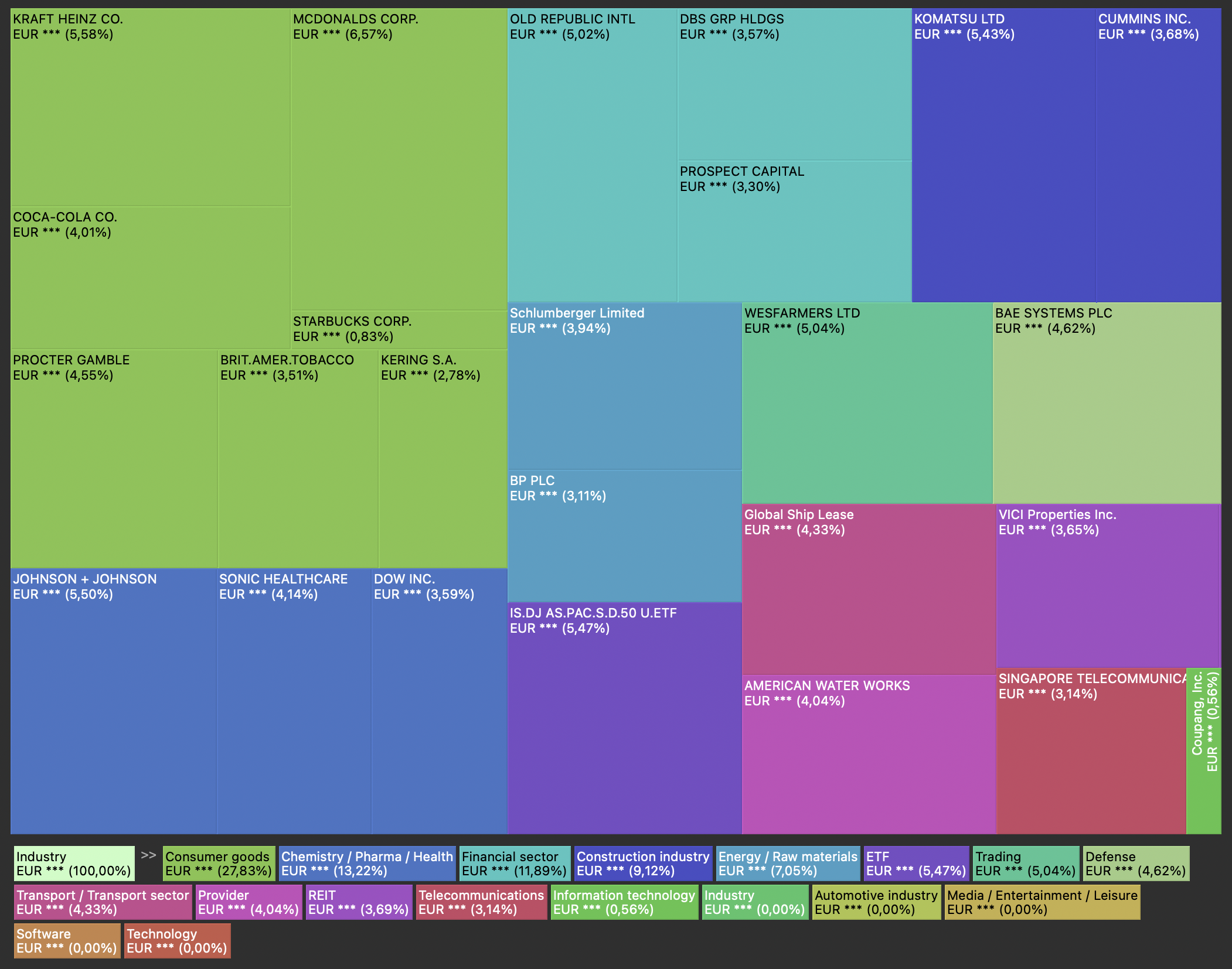

Here I show the diversification of my portfolio by industry and country. As already described in the Buy/Sell chapter, a lot has happened here and the diversification of the portfolio is being further advanced both in terms of countries and sectors. Apparently the focus of my portfolio is on everyday items that are needed regardless of the overall economic situation. It has been shown that strong brands can hold their own even in a bear market and are not slaughtered outright. Value is king.

The trained eye will notice that there are some values in the chart that I have not yet mentioned under buy/sell. That's also correct, as these stocks won't be added to my portfolio until February, so see this as a little foretaste of the monthly report for February. I have already achieved solid diversification across different industries. Here is another representation of the sectors from Portfolio Performance with the percentage distribution.

This representation shows that 28% of my portfolio is invested in consumer goods. The second strongest sector is now chemistry, pharmaceuticals and health with 13%. The financial sector with banks and insurance companies is also represented at 12%. Sectors that don't even occur to me: automotive, media and software. The telecommunications sector is now slowly starting to grow with the start of Singapore Telecommunications' savings plan and is now at over three percent of the portfolio share.

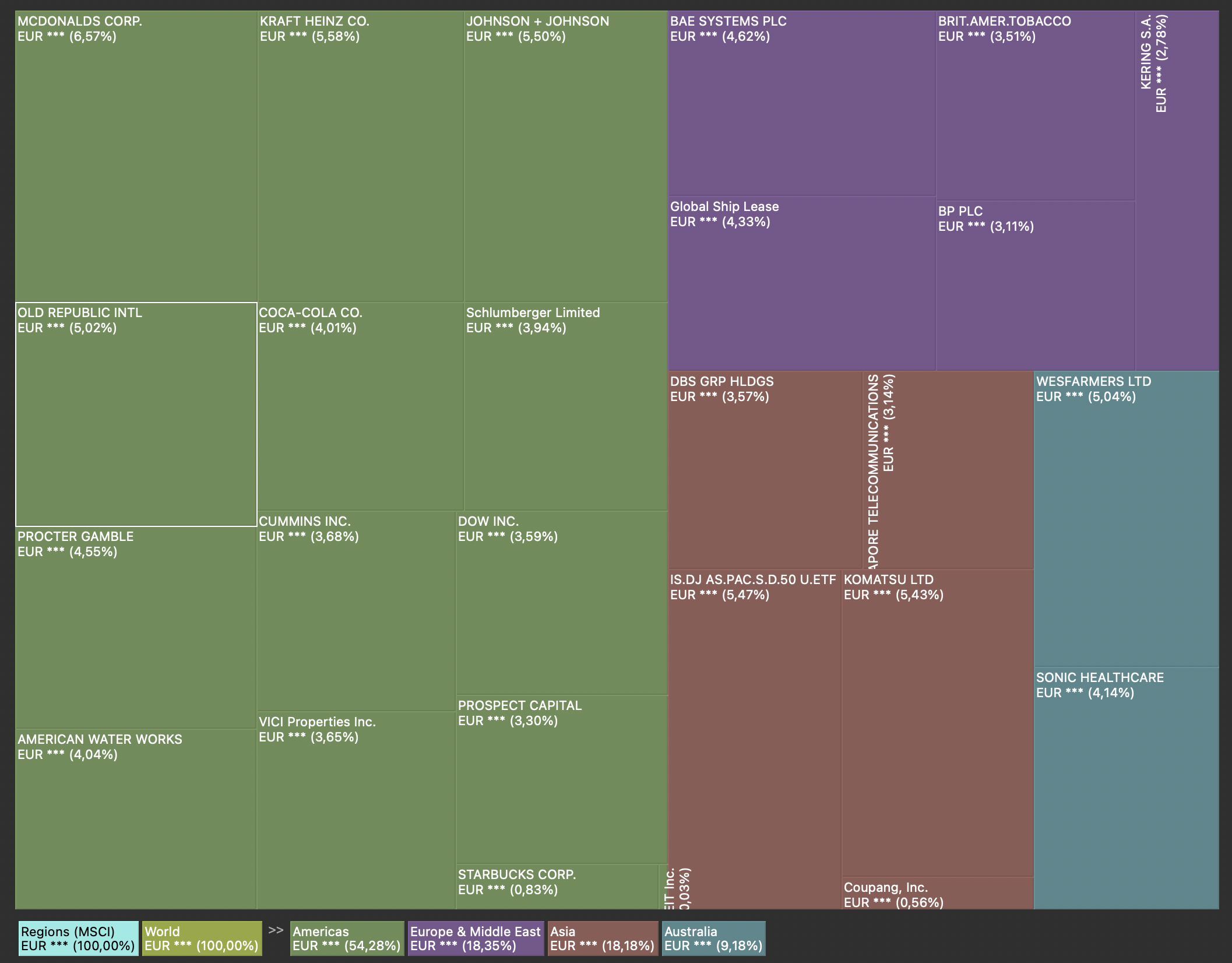

Not surprisingly, the focus of my portfolio is in the United States of America. The current savings plans are also expanding our commitment in Singapore and Europe. Here is the percentage distribution by continent:

- North American (USA): 55%

- Asia: 18%

- Australia: 9%

- Europe: 18%

North America is now only at 55%. Europe is now joining Asia. Asia also gained a little through the acquisition of Singtel. The topic of withholding tax, which I have highlighted on my blog, is particularly important for dividend investors.

Watchlist

I completely restructured the shopping list because I still found one or two titles that were interesting to me. I will introduce these titles in more detail in the next posts.

- Brambles (Australia)

- Cintas (USA)

- Dassault Systems (France)

- Fastenal (USA)

- Federal Agricultural Mortgage (USA)

- Iberdrola (Spain)

- Mainfreight (New Zealand)

- Main Street Capital (USA)

- MCGrath RentCorp (USA)

- Natural Grocers by Vitamin Cottage (USA)

- Orica (Australia)

- Rollins (USA)

- Taiyo Nippon Sanso (Japan)

- UPS (USA)

- Vossloh (Germany)

I've added a few new titles to my watchlist for the new year. I have also placed corresponding buy orders for the remaining titles on the watchlist, but these have not yet been executed.

Summary

- 27 components (25 stocks, 1 ETF, overnight money)

- Buys: $SLB, $AWK & $VIVI

- Sales: $IUSA, $QYLD

- Savings plans: $CMI, $KO, $KER.PA, $Z74.SI, $SBUX, $PG and $BP

- Performance YTD: +2.6%

- Performance January 2024: +2.6%

- Dividends: $ONL, $KER.PA, $QYLD & $PSEC

- Increase in dividend compared to the same month last year: -55.8%

- Cash rate: 17.2%

- Volatility: 19.5%

- Return (TTWOR annualized): +9%

- IRR: +5.4%

I have described my goals for 2024 in this article. Artikel. In any case, I wish you a great and greedy year 2024. Let's make ashes properly. There will only be a small report in February as we will be spending our family vacation in Thailand.

Disclaimer:

No investment advice, no purchase recommendation.