Before I start, I want to put a disclaimer that this post is related to trading strategies in the Indian Stock Market. I will be discussing one specific strategy. This is just a commentary on the strategy with some backtesting results. This will be a Technical Analysis post, my first at that. So, if I am doing something wrong, please feel free to point it out.

Strategy - Inside Bar Trading.

This is a very commonly used strategy where the trader places an order based on the price crossing a certain threshold.

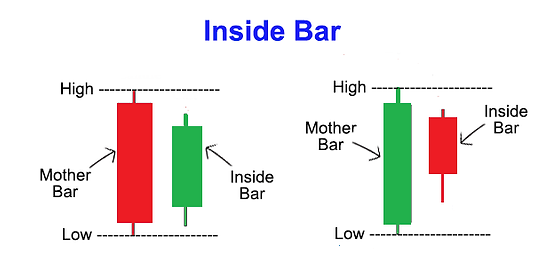

Identifying the Pattern is easy. If the following conditions are met the pattern can be considered as an Inside Bar Pattern.

- The high and Low of the previous candle shouldn't breached.* The body of the second candle should be smaller than the previous candle* The Opposite colour is preferred.

Source

The user enters into a long position when the 3rd candle closes on above the high of the first candle during a bull run.

Similarly, the user does a short selling when the 3rd candle breaches and closes below the First candle during a bearish setup.

The high and low of the first candle serve as STOPLOSS depending on the trade that the user is taking.

These may all seem very technical but it is quite a simple setup.

Now, I learned a golden rule in trading. Do a backtest of any strategy before using it yourself. So I did.

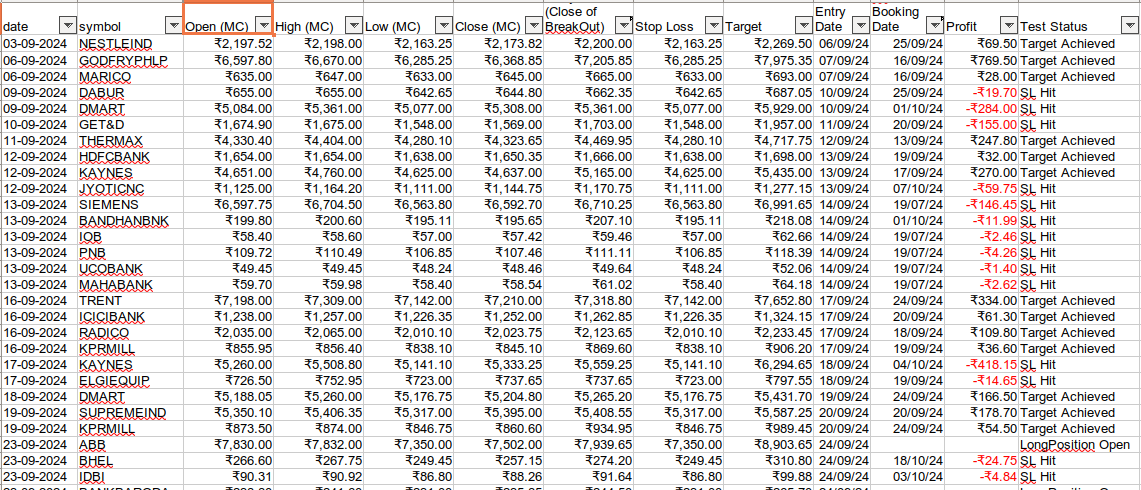

For my convenience, I considered the month of sept to run the test. To simplify it further, I filtered out the LargeCap Company and the FMCG and Bank Sector. And identified only the long positions aiming at risk to reward as 1:2

And here are my findings.

Total number of Trades Identified - 42

Target achieved -16 (Gained - INR 2590.70) (Win Rate - 38%)

Stop Loss Hits - 24 (Lost - INR 1551.79)

Open Trades - 2

While the basic math here shows that I am in sitting on a profit of INR 1038.91. The sheer number of SL hits is shaking my confidence in this strategy. Moreover, I have not taken the charges from the exchange and the broker into account. Assuming that they charge INR 20 per trade. I have to pay INR 840 that's approx 80% of my winning. Leaving me with INR 200 at the end of the Month. The numbers say it's not worth the effort.

Here's the twist, I have considered only two sectors while doing the backtesting. FMCG and Bank, FMCG, showed a net profit of INR 993. The banking sector couldn't keep up and deliver on INR 46. The same goes with the MarketCap. I have considered large-cap companies in this analysis. Maybe the strategy works better in the SmallCap or MidCap. The only way is to run the tests again.

I hope you enjoy the post. I know this is not like my regular post, where I joke about anything and everything. But at times I do stuff like this. Anyway, this was my first analysis. Maybe because of that I calculated something incorrectly or got some fundamental stuff wrong. Whatever the case your feedback is appreciated.

See Ya soon.

As always, I want to thank IndiaUnited and Beawesome for putting up with me.

Posted Using InLeo Alpha