Inflation is undermining fiat currencies, prompting investors to seek alternative assets, with Bitcoin emerging as a potential solution. But can Bitcoin truly offer protection against inflation? This article explores the dynamics of inflation, the role of Bitcoin in this context, and its actual effectiveness as a hedge.

Understanding Inflation

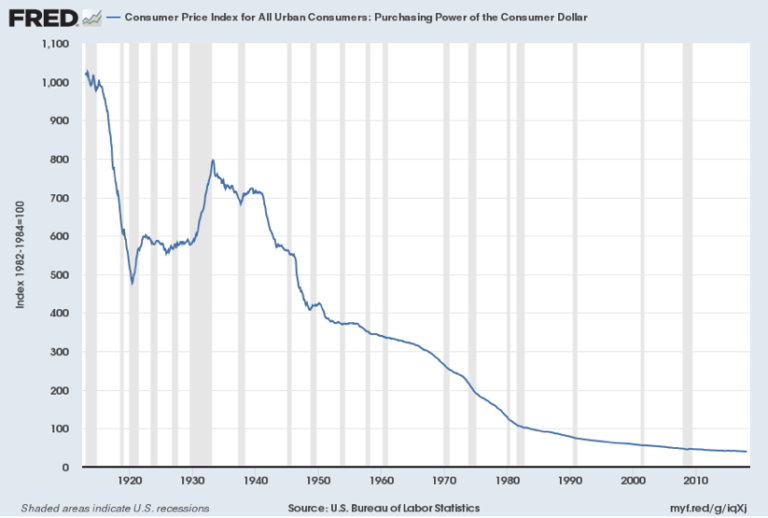

Inflation is the increase in prices of goods and services, leading to a decrease in purchasing power over time. It is tracked using two primary indicators: the Consumer Price Index (CPI) and the Producer Price Index (PPI).

- CPI measures changes in the prices of goods and services regularly purchased by consumers.

- PPI tracks the prices of goods and services sold by producers, indicating how production costs might influence final product prices.

Several factors trigger inflation:

- Monetary Policy: Central banks, like the Federal Reserve in the U.S. or the ECB in the Eurozone, manage inflation through tools like interest rates and money supply. Increasing the money supply can lead to inflation as more money chases the same amount of goods and services.

- Demand-Pull Inflation: Occurs when overall demand exceeds supply, often during economic booms or excessive government spending.

- Cost-Push Inflation: Results from rising production costs, such as wages or raw materials, leading to higher prices for goods and services.

What is Bitcoin?

Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, operates on a decentralized network using blockchain technology, ensuring transparency, security, and immutability of transactions. Unlike fiat currencies, Bitcoin has a fixed supply of 21 million tokens, making it inherently deflationary.

Evaluating Bitcoin as an Inflation Hedge

To assess Bitcoin's potential as an inflation hedge, consider its key properties:

- Limited Supply: With only 21 million BTC available, Bitcoin is immune to inflation caused by excessive money printing.

- Decentralization: Bitcoin's decentralized nature makes it resistant to manipulation or interference that can lead to inflation.

- Store of Value: Proponents see Bitcoin’s digital scarcity and growing adoption as making it a viable store of value, akin to gold, which has historically hedged against inflation.

- Volatility: Bitcoin is known for its high volatility. While this can deter some investors seeking stability, others view it as an opportunity for significant gains during inflationary periods.

Comparing Bitcoin with Traditional Assets

To understand Bitcoin’s potential as an inflation hedge, compare it with traditional assets like gold and government bonds:

| Attribute | Bitcoin | Gold | Government Bonds |

|---|---|---|---|

| Supply | Limited | Limited | Unlimited |

| Decentralization | Decentralized | Decentralized | Centralized |

| History as Store of Value | Emerging | Established | Established |

| Volatility | High | Low | Low to Moderate |

Inflation Rates: Gold vs. Bitcoin

Gold’s inflation rate is driven by annual increases in mined supply, typically ranging from 1.5% to 2%. Bitcoin's inflation rate is controlled by its protocol through halving events, which occur approximately every four years, reducing the issuance of new BTC.

Pros and Cons of Bitcoin as an Inflation Hedge

Pros:

- Limited Supply: Protects against inflationary pressures.

- Decentralization: Shields from government manipulation.

- Potential for High Gains: Volatility can lead to significant profits during inflationary periods.

Cons:

- Volatility: May deter investors seeking stability.

- Regulatory Uncertainty: Potential changes or restrictions could impact Bitcoin’s value.

- Adoption Challenges: Despite growing interest, mainstream adoption and acceptance as an inflation hedge remain hurdles.

Conclusion

Bitcoin has several attributes that could make it a hedge against inflation, but its effectiveness is still debated. Its limited supply and decentralized structure offer natural protection against inflation, yet its volatility and regulatory uncertainties pose challenges.

Thus, Bitcoin's role as an inflation hedge depends on its adoption as a store of value, regulatory developments, and broader macroeconomic conditions. Investors should carefully consider their risk tolerance and investment goals before committing to Bitcoin.