Hm that's not good...

As if a hurricane, floods, and escalation in the middle east weren't big enough downers...

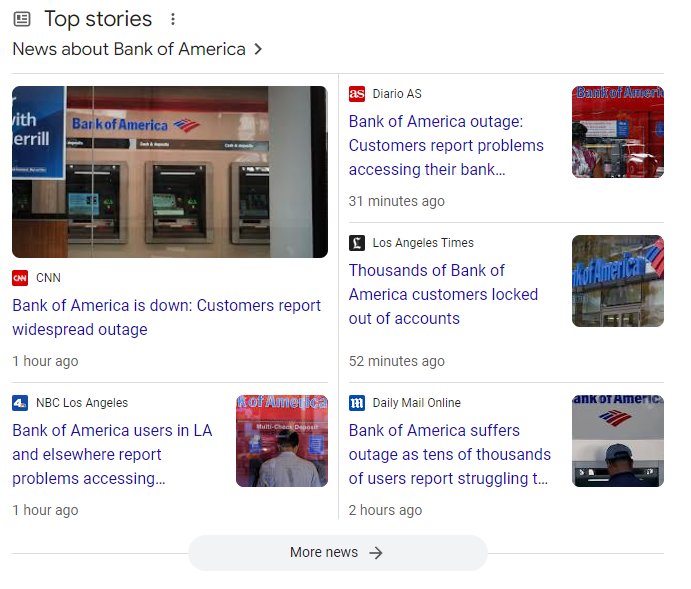

Off the heels of Chase Bank members thinking that stealing is an "infinite money glitch", Bank of America now reports that tens of thousands of customers are locked out of their accounts.

Many customers complained they could not see their account balances.

Some who could access their accounts were startled to see zero balances.

The account anxiety is real!

Everyone in crypto knows how stressful it is to log into a frontend only for it to tell you you've got $0 in your account or that it simply won't load. Transferring a lot of money at once comes with the same or even more aggravation. We know that if we mess up there's nothing anyone can do about it and the funds are lost.

Obviously with the banks it's a little different in that users know if they make a mistake it likely can be reversed, but at the same time they're at the mercy of whatever the bank tells them. Such is the custodial nature of unsecured debt. If the bank can justify freezing your account and stealing your money there's really nothing the individual can do about it. Better luck next time, friend.

There's also a big difference between banking in USA or another country who's financial institutions aren't nearly as trusted as ours. Americans still fully believe that the money in their account is theirs to spend because the illusion has been maintained for generations. It only takes a single banking crisis that FDIC insurance can't cover for people to realize that the entire sector is a complete fraud floating on thin air.

“Five accounts show zero balance, over 20K,” one Bank of America customer on Downdetector wrote.

“Shows my debt just fine tho,” another user said.

Now obviously we shouldn't read into such things too much, and I fully expect that these customers haven't lost any money, but still it is pretty funny that the debt owed to the bank works just fine while the debt owned the the customer (unsecured liability pinky promise) doesn't. Of course if it was the other way around this wouldn't even be news and no one would report on it... because people are selfish and only care about #1. A credit card glitch isn't going to resonate with anyone. Thems the rules, so there may be some survivorship-bias going on here.

Imagine this guy in crypto.

This is who you're trading against.

Speaking of crypto...

Monthly Performance into Uptober

Bitcoin printed a record-breaking gain of 7.75% for the monthly candle last month. Pretty funny that this is the all time record isn't it? There's a reason why people like me are always talking about September being bearish and buying the dip. We started October at $64k. Where will we be in four weeks?

October has only printed red on two different occasions: 2014 and 2018. Notice that those are both bear market years and really do not apply to the current situation. Keeping this in mind it may be reasonable to expect something like a 15%-30% gain... which doesn't sound like a very big gap but when you realize the dollar terms the psychology is wildly different. A +12.5% gain would be retesting $72k into all time highs, while a 30% god-candle would pump us above $83k. Obviously the $83k ATH price point is going to generate exponentially more excitement than a retest.

All that being said I lean more toward retesting $72k at the end of the month. It's just the safest and most reasonable assessment at this point. At the same time we can all see that the world is in turmoil and anything is possible in the short term. All I can say is that a flash-crash at this juncture is an absolutely screaming buy signal. Doesn't matter if we are at $50k or $40k. I'll be all in and then some if real panic enters the market. I'm more than comfortable buying when there's blood in the streets at this point, even when the blood is my own because my current long position would get hard-busted in that event.

Conclusion

We should all be hypersensitive to bank glitches such as this one. This one probably doesn't mean anything but it is suspect that the biggest banks are having issues like this while also being heavy in the red in terms of unrealized losses. I fully believe that a potentially worldwide banking crisis is coming to a future near you.

The only question is: wen?

Posted Using InLeo Alpha