I start with answering two questions then proceed to check for confirmations. Now I'm not selling myself as some trading guru or know where the price will eventually go in the future. If I did had that ability manifest at 100%, you'll never see me talking about the secret sauce because why would I?

You're better off watching some YouTube cryptoinfluencers or content creators here on Hive selling Hopium than spending your time in this post. Nothing is here is meant to be financial advise and do your own research than believe in some fool online telling you to gamble your money.

Post Objective:

Share how I arrived at my bias with some analysis. Enshrined in the blockchain this note so that I can comeback to it and review my thought process. If future me is reading this months or years from now, I hope you do better. I got the data from HiveHub.dev

What's my bias?

Hive will rally following BTC's movement but it's unlikely that things will go as high as it used to be.

Is there any data that may support this bias on chain?

Yes, at least I think so and below is my thought process.

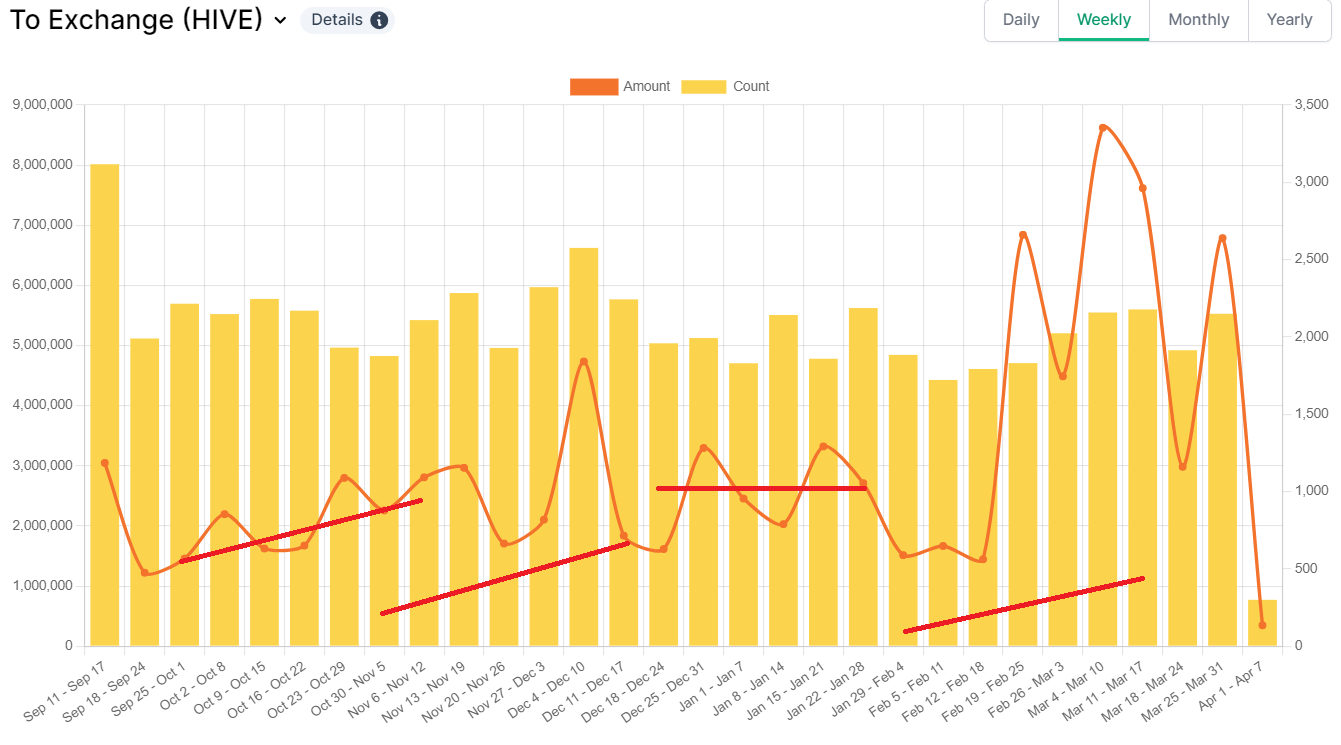

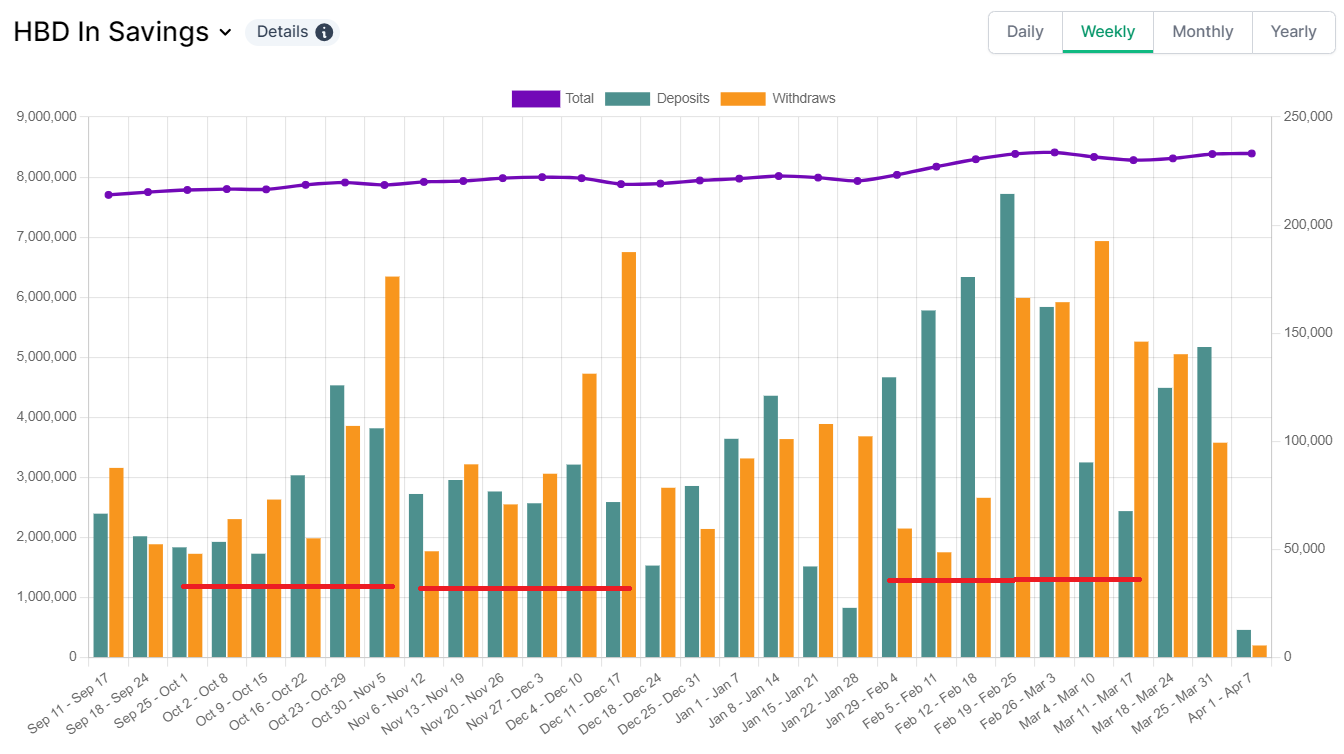

I noted February 5 to March 24 as the dates of interests because of the short term trend. These are important periods which will be brought up on succeeding graphs.

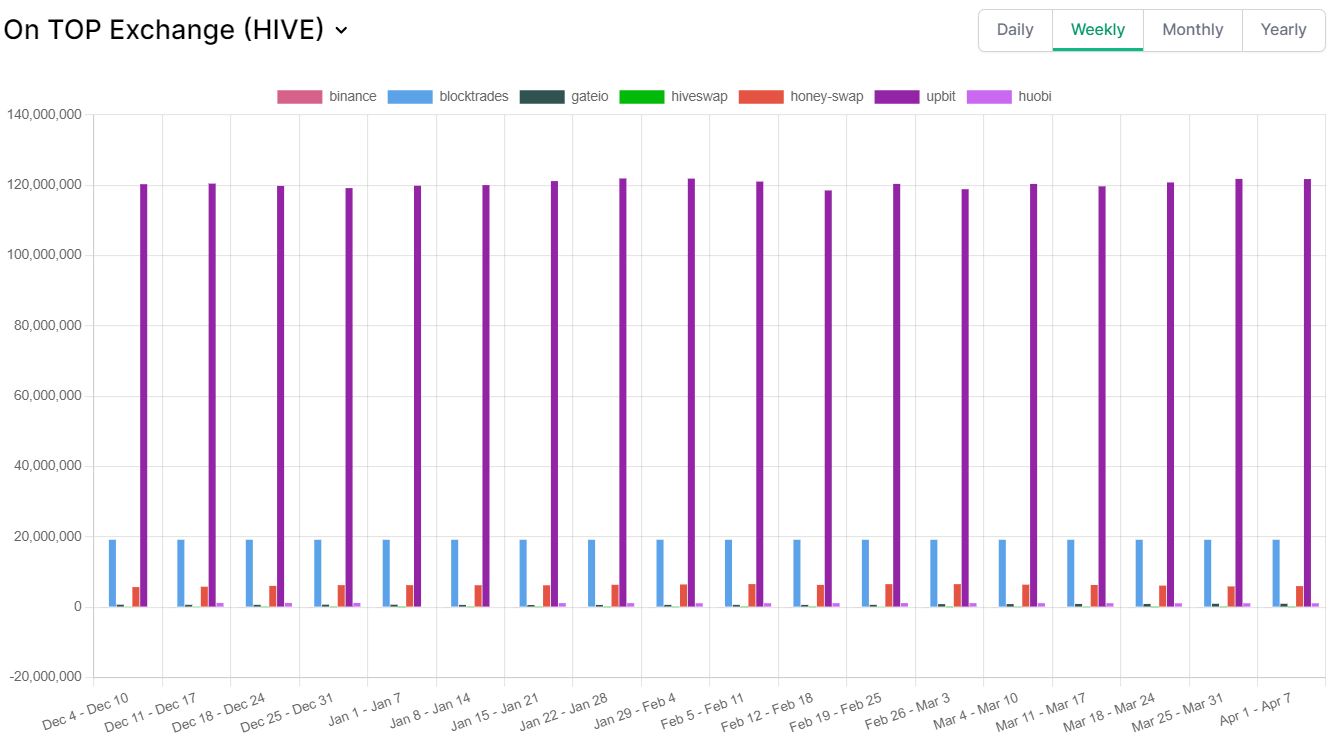

I first checked Coingecko Price Chart for HIVE/USDT then compared it HIVE/KRW chart from UpBit because it holds majority of the liquid Hive in accounts classified as exchanges.

What are the graphs I'm looking for? something that indicates there's going to be more buying pressure than selling pressure. Wait? didn't I say my biased was bearish earlier? so why would I be looking for bullish signs? It's a habit to dispel some confirmation bias, it's a phenomenon where you believe something to be true and your effort to look for things that support your idea is more than the effort to prove yourself wrong. This makes you prone to overlooking other facts that tell you you're wrong.

Does the activity on the blockchain reflect an overall underlying interest on Hive?

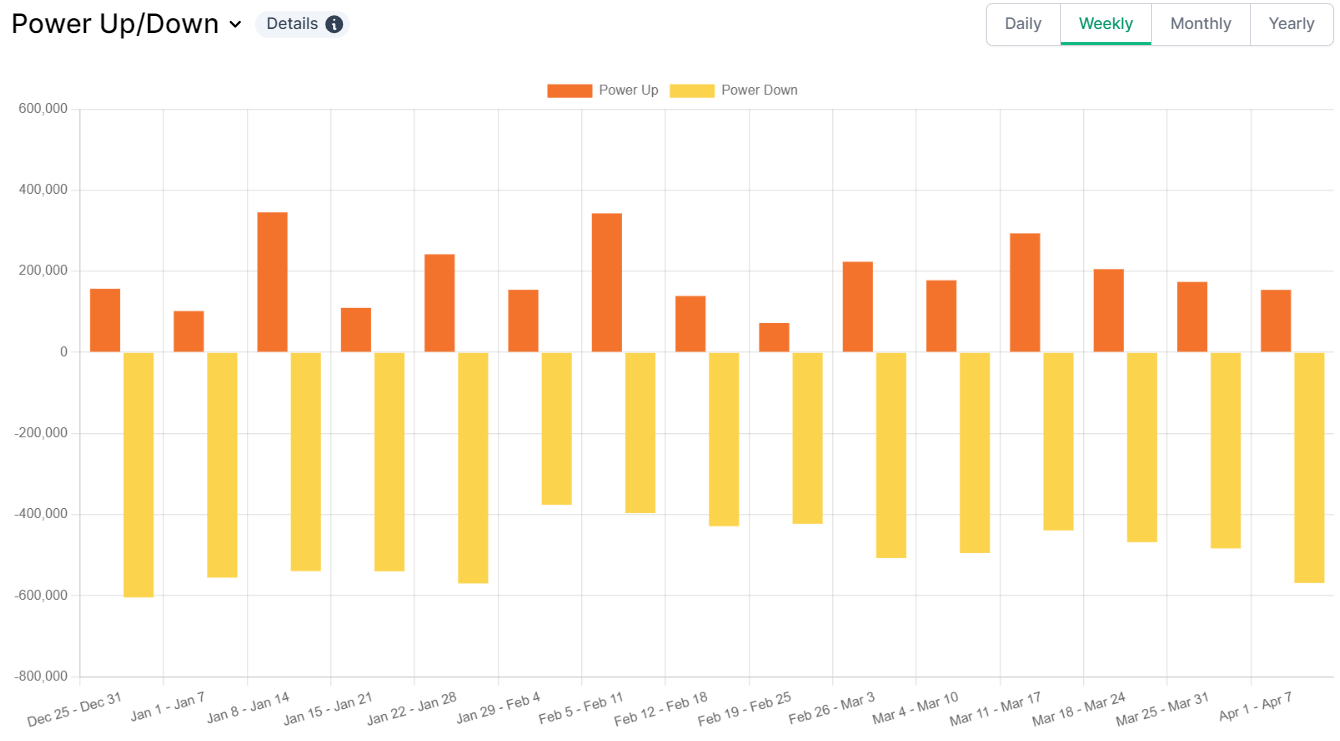

And the data says there's more Hive being powered down than up since December 2023 on the weekly timeframe. If you go as far back as in months, there's been a consistent trend of accounts powering down. So that's a plus point on the bearish side. And below is a graph showing a steady increase of more liquid Hive sent to exchanges.

Why does this matter? In anticipation for the bull market, sellers will provide more liquidity to willing buyers and this is providing more supply to exchanges. Remembering law of supply and demand, if more supply is available, you know the price would go higher unless there's is more demand. And since on chain data shows that there are less Hive being staked, it supports the idea that there is a lack of demand going on. But how to support this idea further?

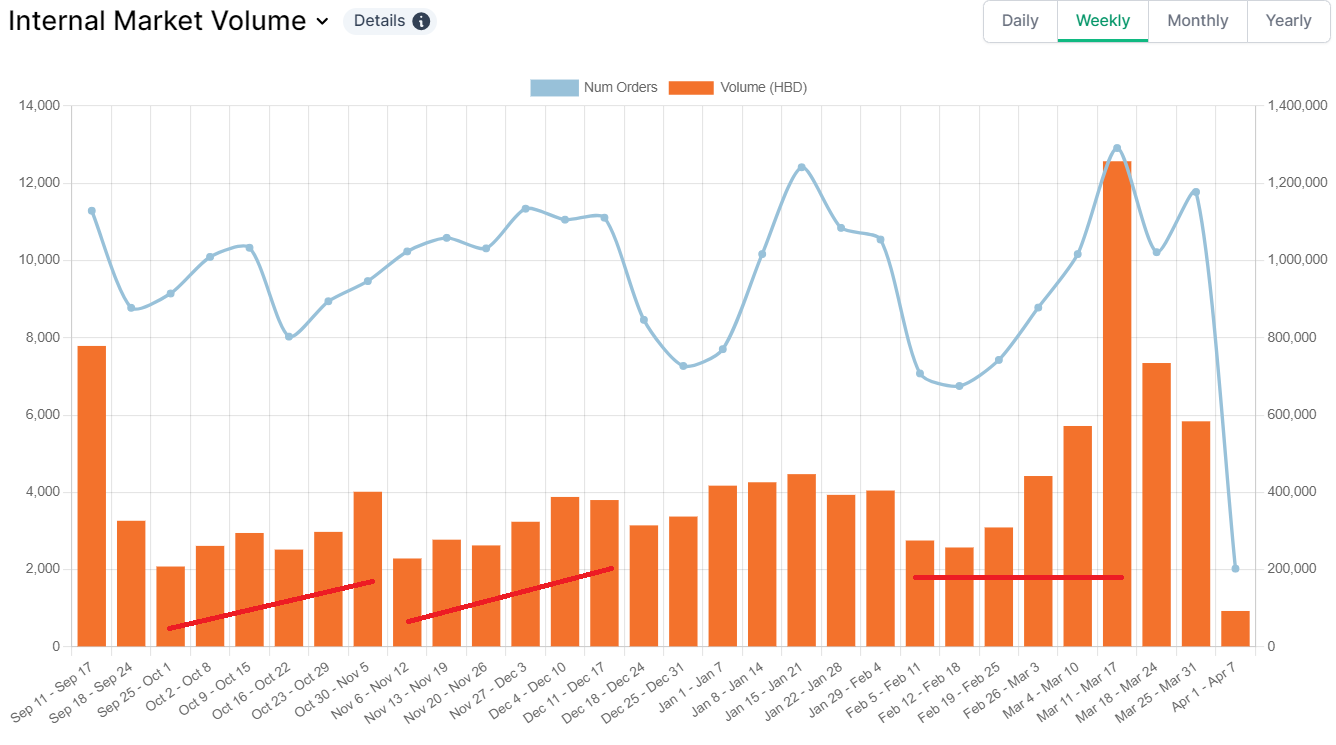

I checked with the HBD in Savings and within the same time frame where the price of Hive rallies, more HBD is withdrawn and traded for Hive and it shows on the graph for the internal market volume.

I marked the red lines to indicate the trend of the price rallying up within the period. Looking at it from the broader picture, the data gives me an indication that there's a lot of selling pressure going on for Hive than. And whatever price movement it has, it only follows the BTC rally like how automated market makers and trading bots are set to follow.

Do I think Hive will go higher now that BTC had its recent correction? what about post halving?

I don't know. I'm not sure. But I'll definitely check the market and on chain data to help me arrive at my market bias.

For my personal trading notes:

HiveHub.Dev will be the site that I'll be using for future price analysis on for on chain clues. If I see the same trend patterns again on chain, I can now have a historical comparison with this post in the future.

Thanks for your time.