And you're still bearish, anon?

There's been a mad dash recently to completely deregulate crypto. This is objectively a good thing, as crypto can not be regulated in the first place. No one can stop anyone from spinning up a token (including BTC apparently). Crypto is inherently self-regulating. The SEC went after "utility" tokens as if they were unregistered securities (they were not) and in turn memecoins were created, and memecoins can not possibly be willfully misinterpreted as an investment contract. They are self-proclaimed garbage.

No matter what the establishment does, crypto can maneuver around it ten times as fast. The establishment has finally learned they just need to capitulate and make as much money as they can off this technology. The standing theory until now was to impose harsh taxes and regulations. Now they realize they need to employ the exact opposite strategy. 2025 has just begun; nobody said it was going to happen immediately right at the start.

Czech gov’t moves to exempt crypto held for 3+ years from being taxed

would “guarantee that if you hold cryptocurrencies for more than three years,” any sale would be exempt from capital gains tax. In addition, taxpayers would not be required to report transactions valued at less than 100,000 koruna — roughly $4,200 at the time of publication — per year.

“This means that, for example, buying coffee with Bitcoin [...] will no longer be a tax transaction,” said Fiala.

We've all heard of long term capital gains...

But what about long-long-long term cap gains? Rather than waiting 1 year for an investment bonus, Czechia has opted to allow citizens to wait three years for a completely tax free investment. This is an amazing incentive, because it allows people and companies to do a lot of cool things with their Bitcoin.

A policy like this is really the best of all worlds when it comes to results. First, it creates a huge incentive to HODL. 3 years is a long time; almost an entire 4 year cycle. Many entities will not have the discipline or the bankroll to make it that long and will end up paying taxes, and that's totally fine. Those who know what they are doing (aka the rich) will be just fine.

Easy exploits

If one only has to wait 3 years to sell their Bitcoin tax free, such a policy greatly increases the value of collateralized loans. For example if I wanted to sell a million dollars worth of BTC... I could take out a tax free loan against my Bitcoin first... kind of like a reverse down-payment. Then when three years goes by I can liquidate the entire position and pay back the loan without having ever paid any taxes whatsoever... while also having the ability to create a liquidity event today. That's a powerful tool.

It's very clear to me that banks will start doing what Thorchain tried to accomplish with their strategy of "risk free zero liquidation" loans. Except banks will actually be able to offer this feature without bankrupting themselves like Thorchain did. Why? Because instead of going long on a low liquid "shitcoin" they will simply do what they always do: which is short the dollar.

It's only a matter of time before institutions themselves begin to have a little more faith in the 4 year cycle. Bitcoin has never been a lower price than it was four years prior. That's a massive statistic to put in play. All anyone has to do is make it four years and they'll be back in the green. Compare this to something like a 30-year or even 10-year bond and it's superior in almost every way.

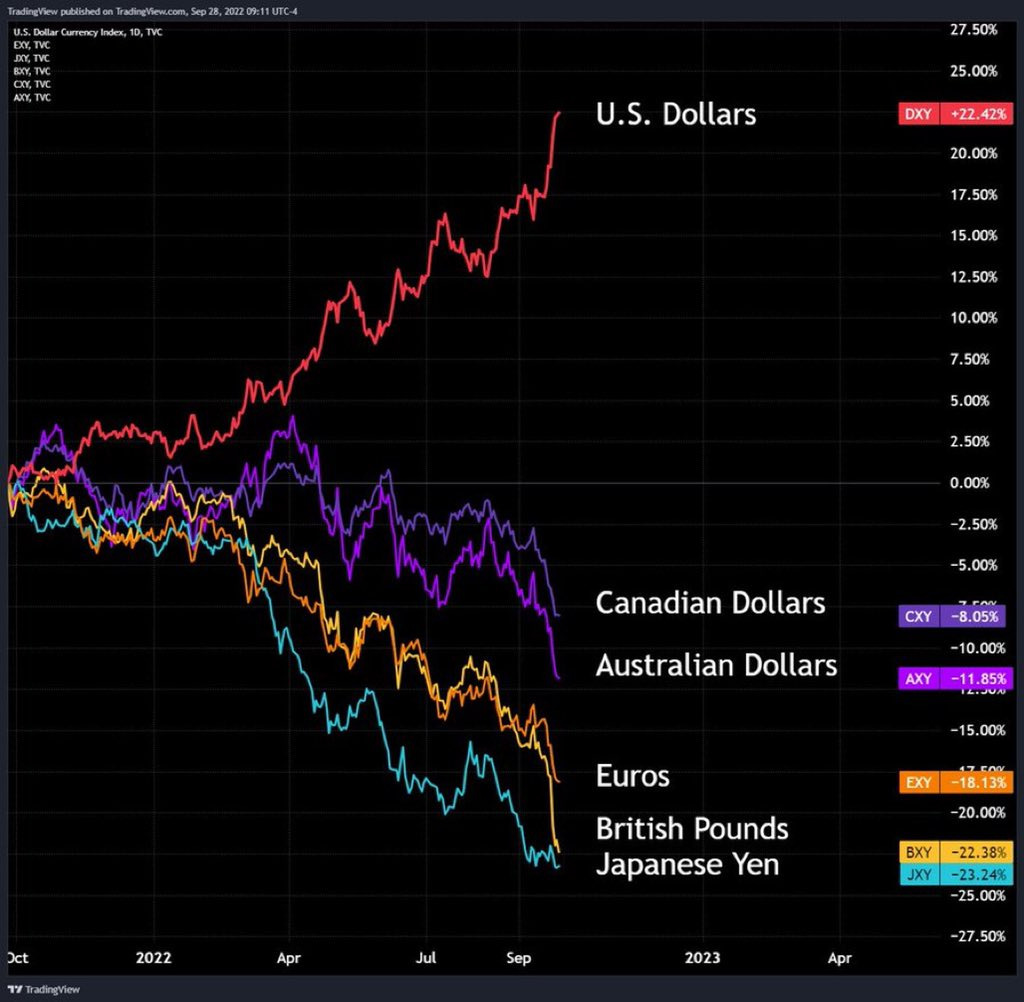

A bank's entire business model revolves around shorting the dollar. This is why a strong dollar often rampages the entire world economy. The smartest thing to do is almost always to short the dollar and leverage that short into buying assets that are actually going to go up in value... and nothing goes up against the dollar more predictably than BTC over these 4-year timespans. Four years is a nothing amount of time to a bank. They're going to love these trades.

Example bank trade:

They take your overcollateralized BTC and give you a low interest loan. If your collateral falls under the loan they do not liquidate it... you still legally owe them all the money you owe them. This is the difference between WEB2 and WEB3. A bank can come after you legally within the system, and ThorChain can not. It's a completely different ruleset.

These secured loans will be very powerful, especially because they don't even have to be overcollateralized for the reason described above. If the bank gives you a loan for a car, is the car worth more than the loan? Same question for a house or a business loan. The value of the collateral can fall lower than the amount owed back and it doesn't matter to the bank: they make money on average regardless and they do it at scale.

This means we could be allowed to borrow/short 100% or more of our Bitcoin collateral completely tax free whenever we want using traditional banking. In fact the interest on these loans is probably tax deductible so you could actually pay LESS taxes in a fiscal year by employing this method. These things are coming sooner than you think.

What does the Government have to gain from this deal?

When a country like Czechia allows these types of frictionless systems to thrive they engage in the event I like to refer to the race to the bottom. Check out that blog post. It's from Summer 2018 when I was an unknown lowly pleb on this platform. It's one of the few ideas I've had that's really held up over the years.

As crypto continues to expand outwardly and increase in price at exponential levels, the only way for fiat to capitalize on this is to create suitable environments within the attention economy that will syphon liquidity into that physical location. There's no better way of saying "hey hey hey look at me" at this stage of the game than to offer 0% capital gains and the prospect of a tax free environment.

Moves like this will make countries rich in both crypto tourism and the incorporation of legit businesses within their legal boundaries. This is what actual healthy competition looks like within a free market, and it will shock many to see it because it's been so long since we deviated from artificial nonsense, privatized gains, and socialized losses.

Conclusion

The Czech Republic is only the beginning. Even here in USA there is already a 0% long-term capital gains bracket up to a shockingly large amount (like $60k/year). Before we know it crypto will be legally declared currency and it will no longer be possible to tax it under property, commodity, or securities law. A huge tidal wave of liquidity is coming, but degen plebs can only seem to see what's right in front of them and complain about today's price action. This is not the way. Do better, or get fleeced by someone who will.