3.1.3. Crypto-asset-linked actors have now a law to abide by

-14. As explained in Part 1 and underscored again in the previous section, crypto-assets are primarily an institutional and economic (rather than technological) innovation. Yet the peer-to-peer “crypto-economies” are still small and poorly integrated with the traditional economies, built in a legal framework which consecrates the role of financial intermediaries. It is precisely the power and economic rents of these intermediaries that the blockchain innovation most threatens, and it is thus to be expected that they will fight against it tooth and nail.

-15. It is useful in this context to assess the situation through the prism of game theory, and specifically the “Prisoners’ dilemma” game mentioned in Part 1 par. 26 and illustrated in Figure 1. Against the threat of a disruptive innovation, any individual financial actor can hope to reap the benefits of the “first mover” by “defecting” (or “confessing” in the terms of Figure 1.), i.e. acting as a bridge allowing the retail consumers to interact with an otherwise isolated and hard-to-reach offer. But since they owe their power and economic benefits to existing laws and regulations, it was easy for them to “cooperate” (or “remain silent” in the terms of Figure 1.), without a need to actively coordinate, as long as crypto-assets were “outside of the legal framework”. Subsequently, in most European countries innovative start-ups would see their demands to open a bank account refused by incumbent banks as soon as the words “blockchain” or “crypto” popped up in the documentation submitted.

-16. With MiCA, and especially once the ESMA and EBA regulatory technical standards and guidelines reach the financial actors, the risk of forgoing good business opportunities to rivals who take the jump and develop a line of services to crypto-asset companies increases significantly. As compliance departments gradually incorporate the new rules in their books I expect a tipping point to be reached. Dabbling in crypto-assets should not be a suspicious behavior anymore, as there is now not only a “profit and loss” to look at, but also a law against which the seriousness of the actions can be judged.

-17. In a recent article on the topic which I quoted previously, Patrick Hansen expects MiCA to “lead to more institutional adoption and activity in the EU crypto market” , especially since 60% of investment managers recently surveyed had cited “regulatory uncertainty as a barrier to greater crypto adoption in portfolios” . As is often the case when new EU regulations enter in effect, it is likely that the “Big Four” consulting companies will play an essential role devising and offering to the financial institutions “turnkey” business processes tailored to MiCA’s provisions.

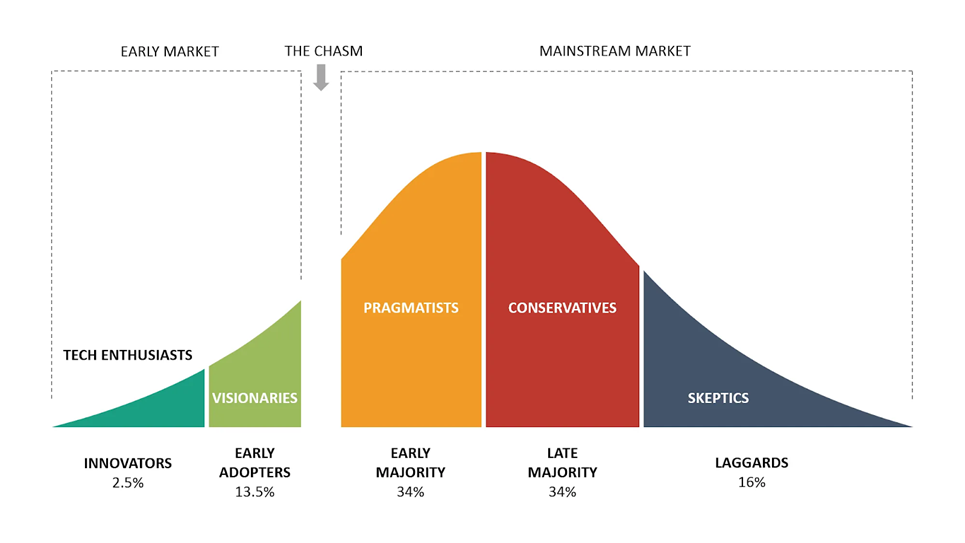

-18. Moreover, it should be noted that the potential addressable market was and is still small, as the crypto-asset innovation has not yet managed to “cross the chasm” and is still confined to “innovators” and “early adopters” . The biggest promise implicit in MiCA is that, once the traditional financial institutions deploy crypto-asset services for their retail customers, blockchain and crypto-asset innovation will become accessible to the mass market.

Figure 6. MiCA could well prove a successful bridge helping the consumers to "cross the chasm" - image from the "diffusion of innovations" theory of Geoffrey Moore

Figure 6. MiCA could well prove a successful bridge helping the consumers to "cross the chasm" - image from the "diffusion of innovations" theory of Geoffrey Moore

-19. In this chapter, I presented the main sources of criticism toward blockchain and crypto-asset innovation and noted that MiCA addresses them, using an evolutionary approach similar to how the Union legislation deals with risks and challenges in the area of traditional finance. In so doing, it explicitly includes crypto-assets in the sphere of Union regulated activities and thus legitimizes them.

-20. In the next chapter, I will specifically explore MiCA with the eyes of a traditional financial actor.

| Table of Contents | |

|---|---|

| <previous> | <next> |

[186] P. Hansen, “The EU's new MiCA framework for crypto-assets - the one regulation to rule them all”, op. cit.

[187] The Bitwise/ETF Trends 2022 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets, 2022 https://static.bitwiseinvestments.com/Research/Bitwise-ETF-Trends-2022-Benchmark-Survey.pdf

[188] G. Moore, “Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream”, Harper Business Essential, 2014