Ethereum has been proof of stake chain for more than two years now. As a reminder the proof of work and the proof of stake chain merged in September 2022, almost two years after the launch of the PoS chain that runed in parallel with the PoW chain mainet. Finaly unstaking was enabled in March 2023, when everyone who had staked on the PoS chain could unstake if they wish so.

How is staking Ethereum going these days? After everything was finished and time has passed. Are more users unstaking or maybe staking now? It’s been a year since the unstaking is live so let’s check it out.

Here we e will be looking at:

- Staked Ethereum by date

- Staked VS Unstaked ETH since the Shanghai update

- Share of staked ETH

- Number of validators

- Top staking pools

The data presented here is mostly gathered from Dune Analytics and Ethscan.

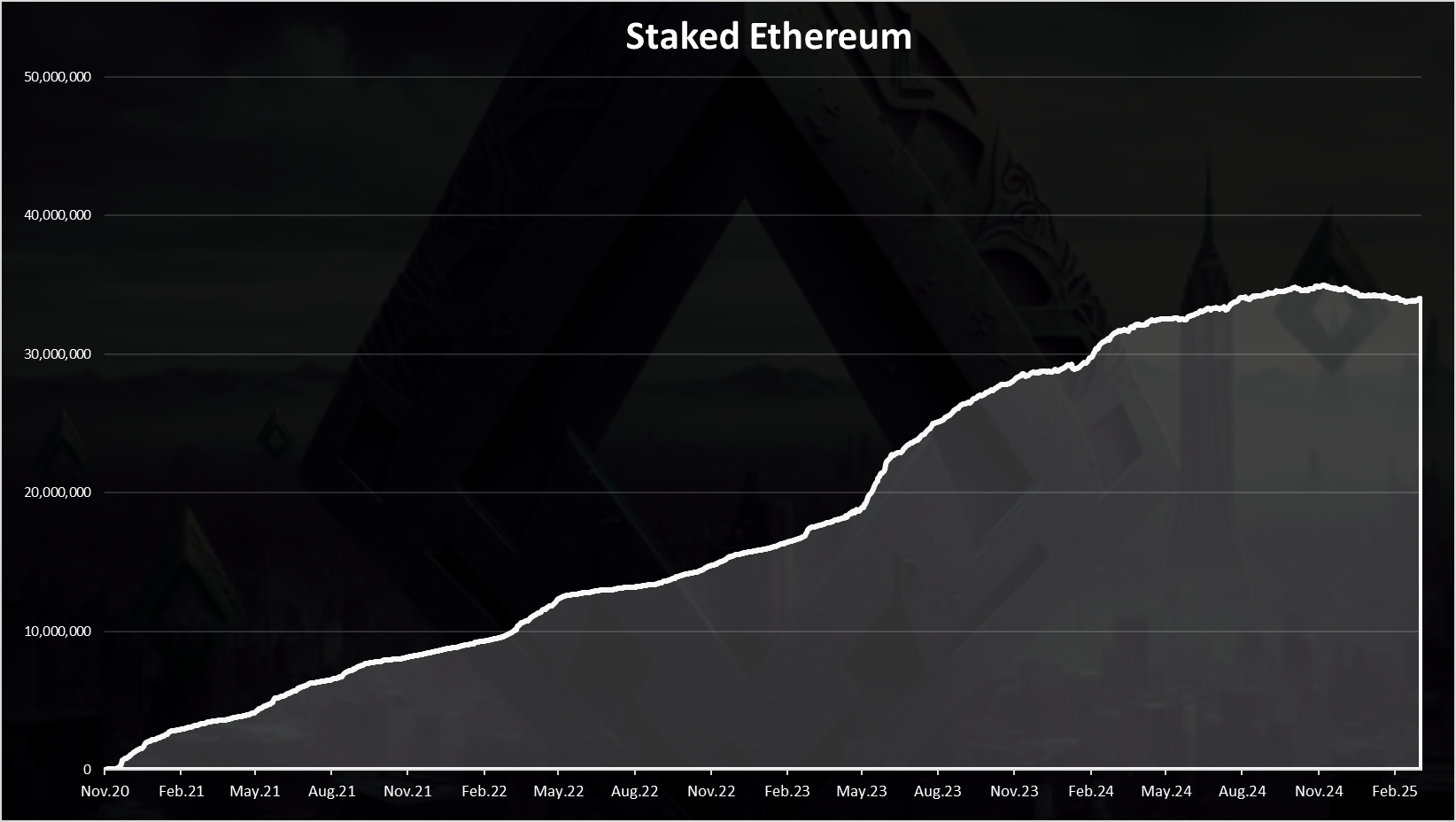

Staked Ethereum by Date

Here is the chart.

This is the amount of staked ETH since the launch of the Beacon chain and the option for staking Ethereum in November 2020.

We can see a constant growth in the amount of ETH staked and, on some occasions, a sharp increase. A total of #$M ETH staked just below the ATH of 35M reached in November 2024.

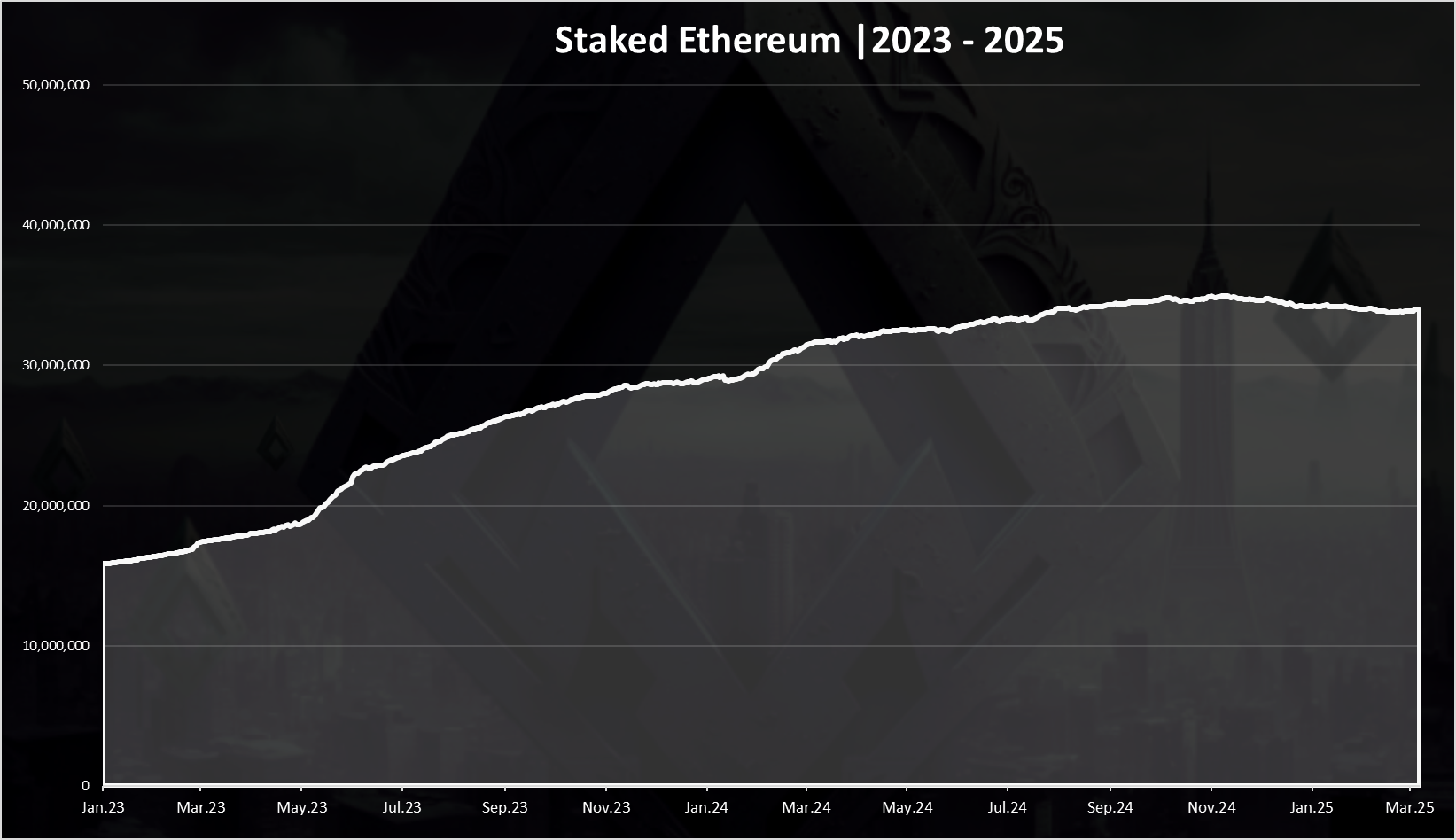

If we zoom in 2023-2025 we get this:

Here we can notice a strong growth in May 2023. The unstaking option has caused more Ethereum to be staked than unstaked. Probably users felt more comfortable staking now knowing that they can unstake at any moment if needed.

At the beginning of 2024 there were close to 29M ETH staked while the year ended with 34.2M ETH staked or 5M more. In the last month of 2024 there was more unstaking happening.

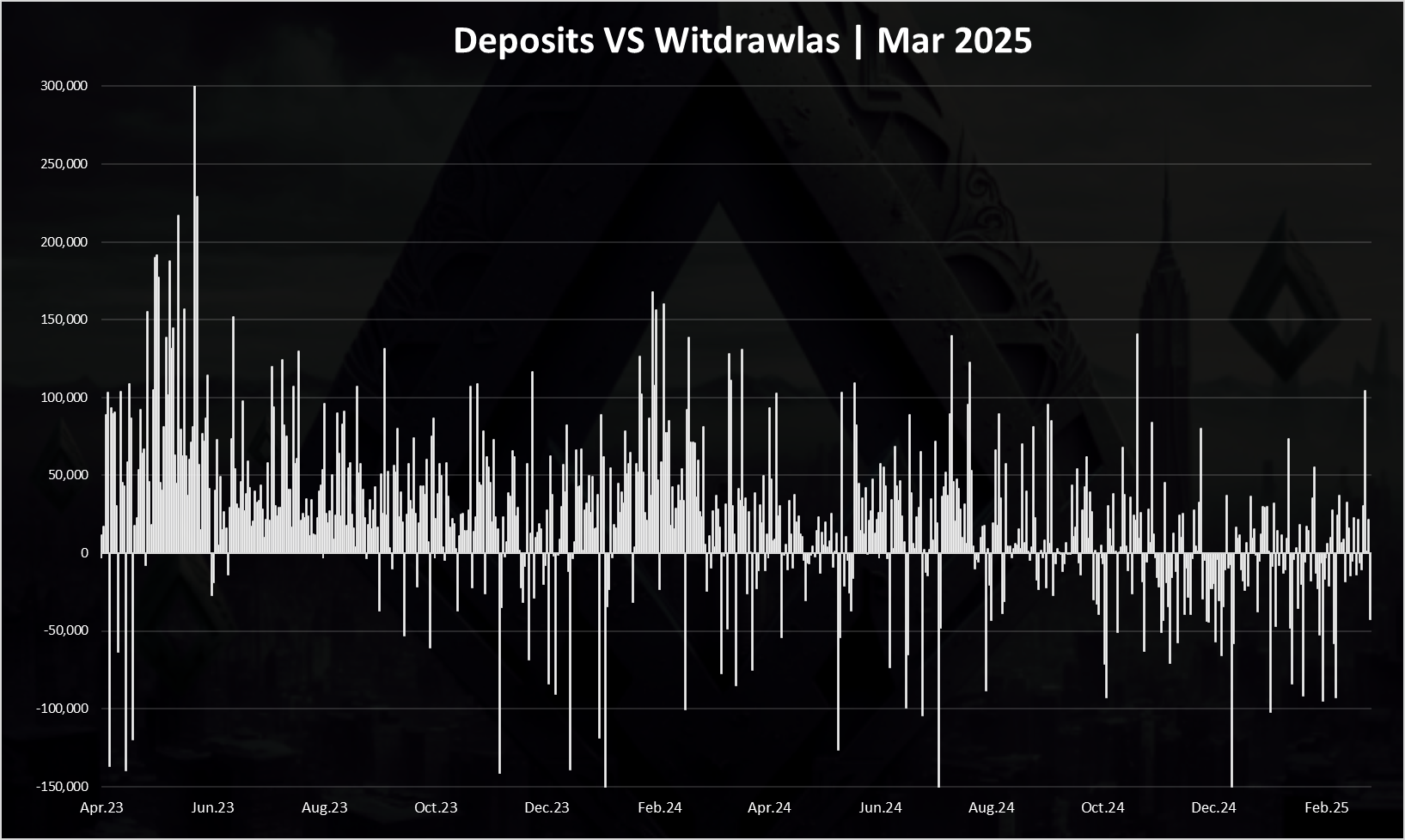

Deposits VS Withdrawals Since the Shanghai Update

If take a look at the daily deposits vs withdrawals since the update, we get this:

Most of the days are in positive, meaning that more ETH is being staked in general that ustaked, even with the ustaking option enabled. There are few big unstaking events in April 2023, where more than 100k ETH was unstaked in a day.

We can notice that in the last period we are seeing more bars on the downside then previously that represents the usntaking that has happened in the last months.

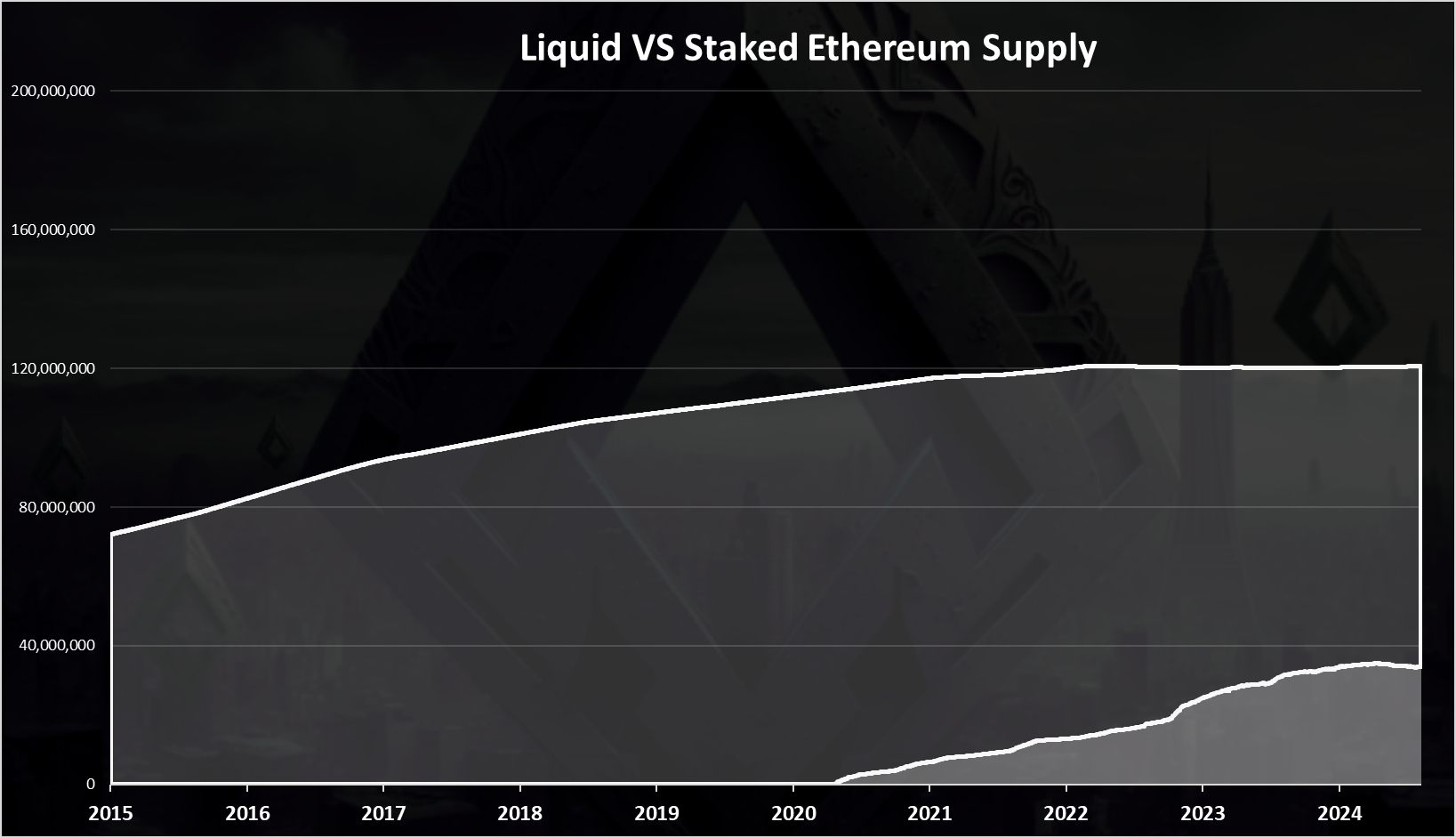

Share of Staked Ethereum

What is the share of staked Ethereum? Here is the historical trend.

We can notice that the staking was activated later in the Ethereum lifecycle and since recently it has started to gather more momentum. It’s worth noting that since last year Ethereum cut their inflation down as well and is deflationary in the last period. What this means is that the ETH issuance is lowered, and at the same time the staking is locking more ETH, basically lowering the liquid supply from both ends.

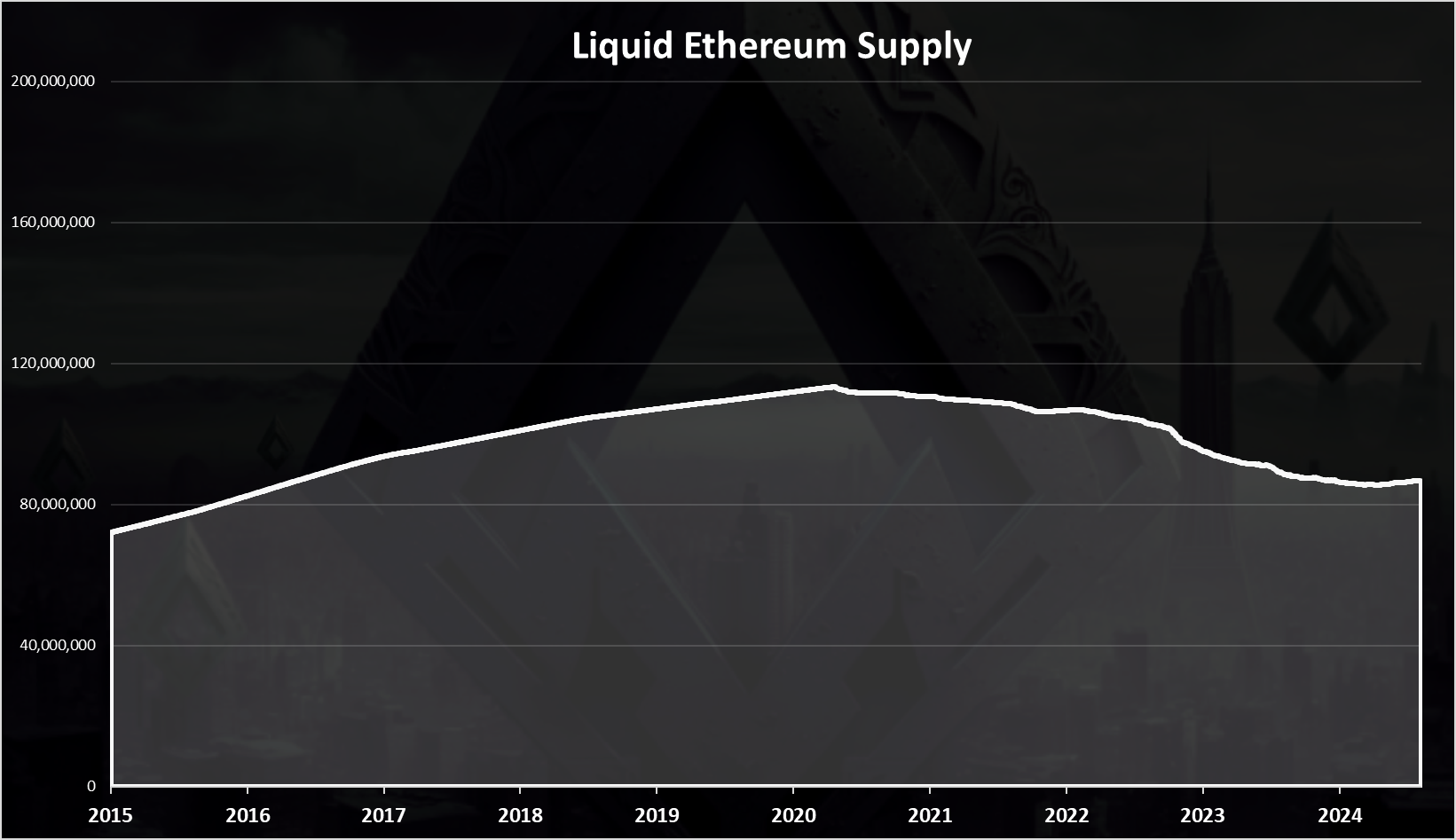

The liquid Ethereum supply looks like this:

We can see the drop in the liquid ETH supply, from 113M at the top in 2020 to 85M now. It seems that there is finally some slowdown in the amount of ETH staked. Will see where the balance is found. Staking provides APR, but if more ETH is staked this APR goes down. Also, the APR for staking depends on the network activity and the fees paid by users.

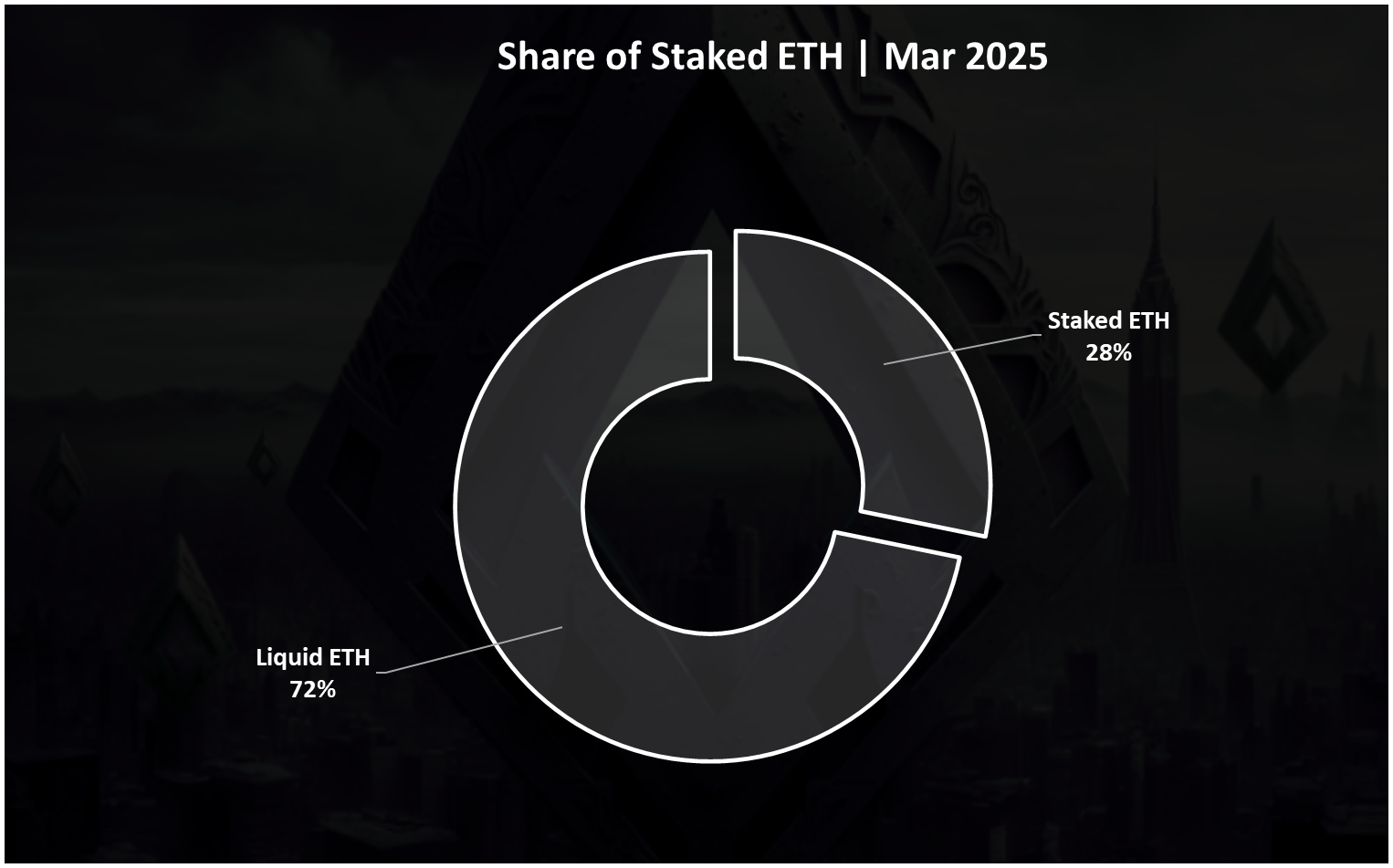

The current share of staked ETH looks like this:

When compared to the total ETH supply that is around 120M now, the 34M staked ETH represents a 28% of the supply. It seems that there is some equilibrium around this mark.

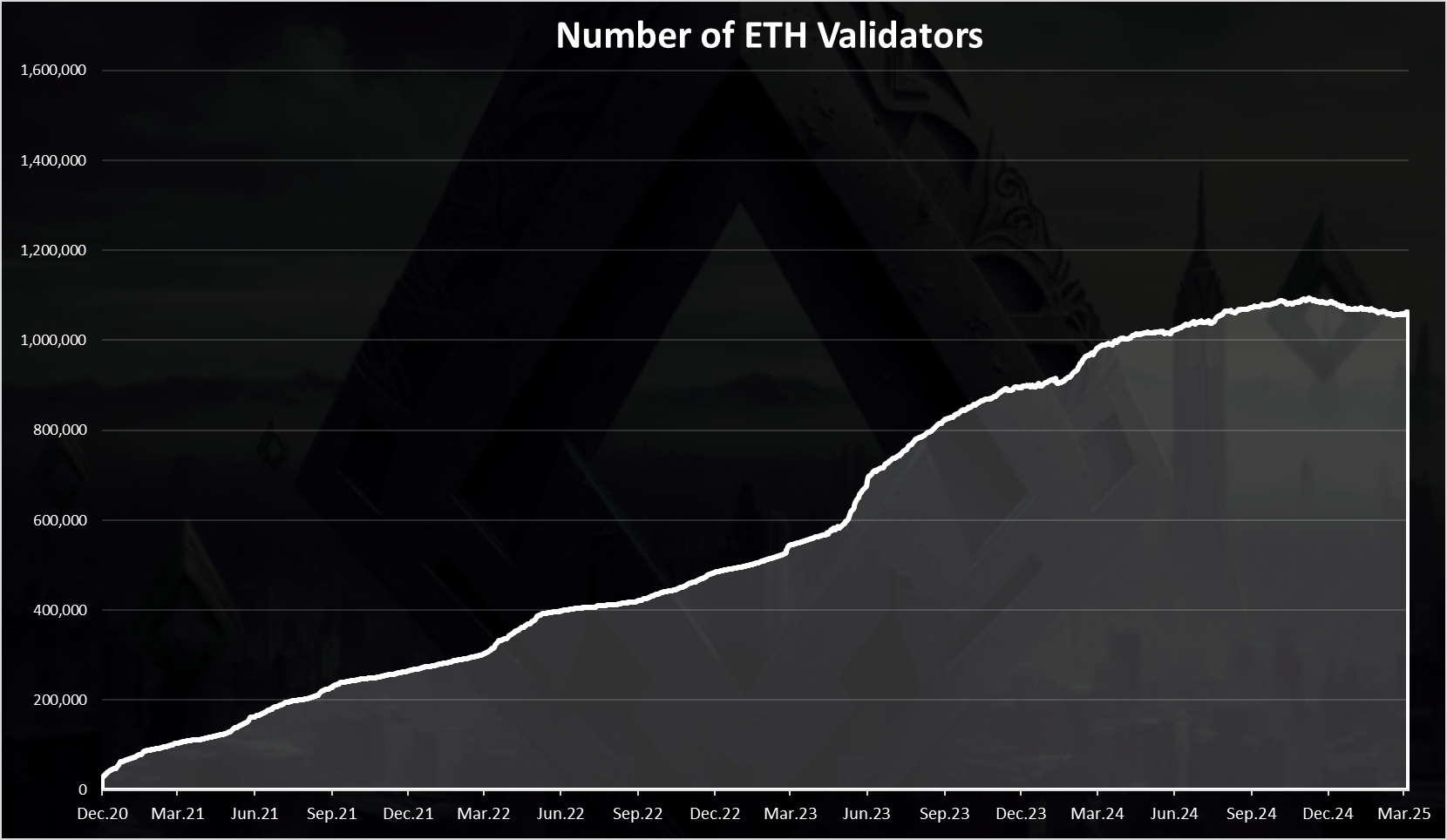

Number of Validators

Here is the chart.

The number of validators has also continued to grow. At the moment there are 1M validators. This number was even slightly higher a few months ago.

Note that these are not unique validators, as most of them are represented by a pool or some type of CEX. There is now even a proposal to decrease the upper limit for a validator from 32ETH, so at some point the number of validators might consolidate.

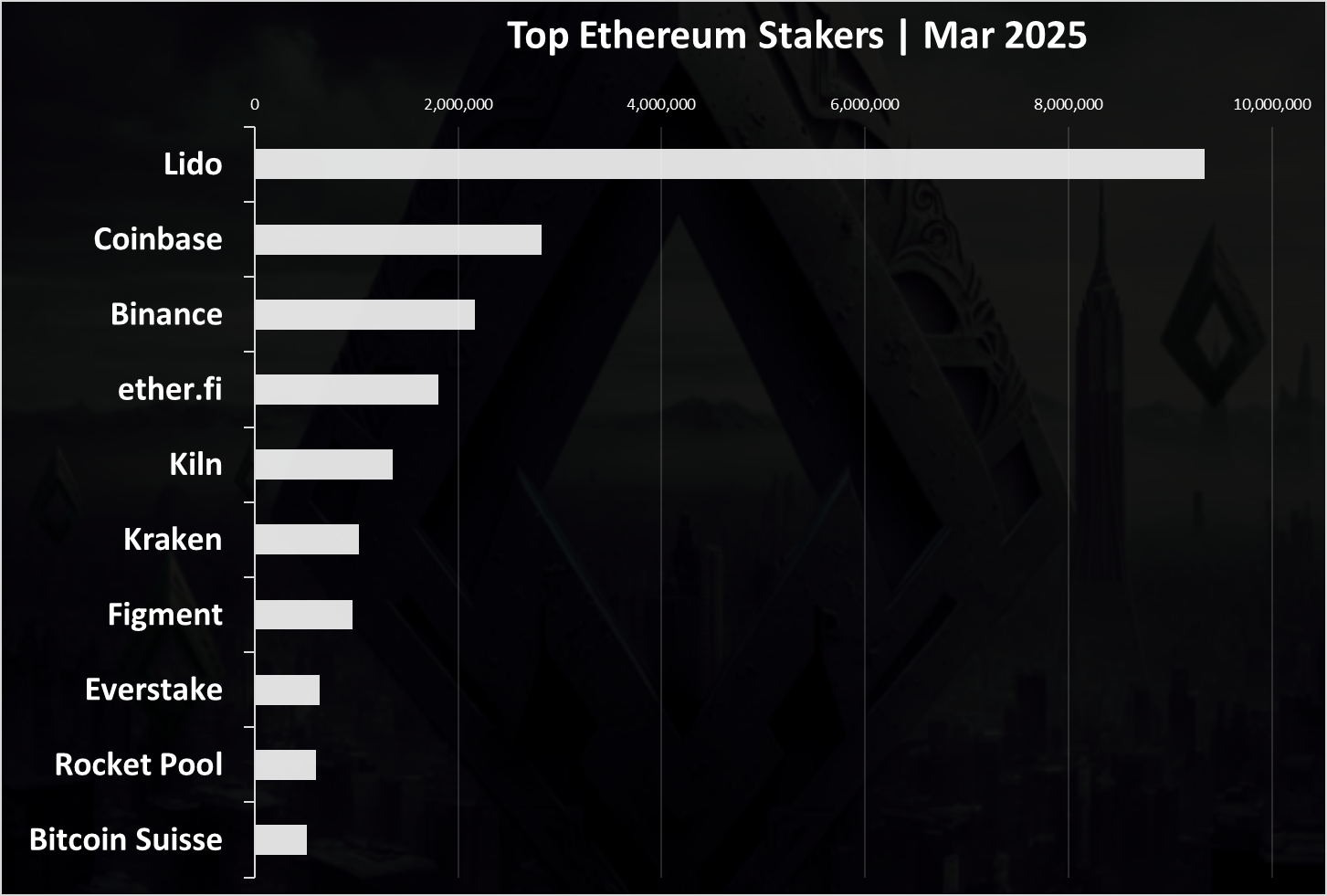

Top Ethereum Stakers

Who is staking the most? Here is the chart.

The Lido pool is on the top with almost 9.3M ETH staked. This pool has even its own token for governance. On the second spot is the Coinbase exchange, followed by another exchange Binance.

Lido has dominated in the past, but it seems that it has peaked and now has an even lower amount of ETH staked from the beginning of the year. Probably some of the tokens went to ether.fi.

Overall we can conclude that we are finally seeing some downtrend in the amount of staked ETH. The peak seems to be around 34M staked ETH or a 28% share. The APR for staked ETH has also been going down in the period, and is now around 3%. Will see how things evolve in the future and will this amount and share of staked ETH is the balance for the ecosystem.

All the best

@dalz