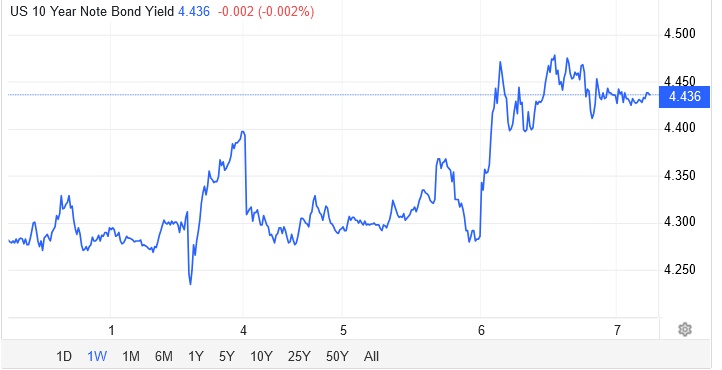

Well, the bond markets think his Presidency could be inflationary, leading to higher interest rates. Here is what happened to the 10 year US Treasury bond yield on Nov 6th as the results came in:

Why do the markets think this? Well, Trump has promised to put 10% tariffs on all America's trading partners, apart from Canada and Mexico who are in USMCA (which Trump negotiated when he was last in office).

Tariffs usually get passed to consumers in the form of higher prices, unless there is a lower cost domestic substitute.

In addition, the Republicans have won the Senate and it looks like they will win the House of Representatives too. Congress controls the budget, and with Republicans in control, they could give President Trump the tax cuts funded by borrowing that he wants.

Anything funded by borrowing is inflationary, whether spending or tax cuts. The markets are sending a warning that they will make borrowing expensive.

The Trump administration will then have the choice of

a) funding the tax cuts with spending cuts instead

or

b) asking the Fed to print money and buy the bonds the market won't.

Option b) is super-inflationary. But it will be good for gold and bitcoin.

But it's early days. The Trump administration could surprise everyone by tackling the deficit and making spending cuts first, and only cutting taxes when the deficit is under control. In which case, both inflation and borrowing costs will be lower. That would be good for America but bad for gold and bitcoin.