Hey folks, if you’ve been following me for awhile, you’ll know that I’ve been a pretty big fan of Liquity — a protocol built during DeFi summer that offers interest free loans of $LUSD against your collateralized $ETH. And as I’ve written about in the past, the Liquity team has been working on some fundamental shifts as to how to build a better and more market-resistant V2 model, and within the past couple of weeks, details of a brand new model has been released as to how Liquity V2 will be able to solve the limitations that V1 had — flexibility.

Why immutability has its costs

Liquity was designed from the get-go to be immutable, meaning that the developers designed it so that the code couldn’t be changed. Technically speaking, Liquity never broke and even to this day, it’s been continuing to work as designed; unfortunately however, Liquity’s inflexibility has made it a product that doesn’t necessarily make it fit for today’s market.

Back in DeFi Summer when the US government was still printing tons of new COVID-19 money, interest rates on U.S. treasuries dropped to near 0%, meaning that it was significantly cheap to borrow money. With this in mind, when Liquity V1 was born it’s little surprise that they too, instituted a system where you could borrow against your $ETH with no interest (apart from an upfront 0.5% fee) as well.

Breaking 5%, interest rates on treasuries since then have come up to nearly the highest they’ve been so far this century, meaning that the cost of borrowing has come significantly more expensive. In response, many stablecoin competitors such as $DAI have tied themselves into Real World Assets (#RWAs, more specifically assets like US treasuries), which allows its stakers to earn at least 5%, even touching 8% last summer with the Dai Savings Rate. As long as these significantly high interest rates exist, and because Liquity V1 continues to lend $LUSD risk free, it continues the incentive for many $LUSD holders to trade for more interest bearing stablecoins, continually driving downward pressure to $LUSD’s peg. And as long as $LUSD remains below peg, it continues to incentivize people to redeem their cheap 1 $LUSD (which at time of writing is worth $0.99 USD) for $1 USD worth of $ETH, with the riskiest trove getting redeemed first.

As more people buy $LUSD in order to receive $ETH, the buy pressure would normally raise the value of $LUSD back above peg, however the problem that Liquity has encountered over the last several months is that with the high interest lasting for so long, it’s highlighted a prolonged problem with Liquity’s competitiveness in the borrow/lending market.

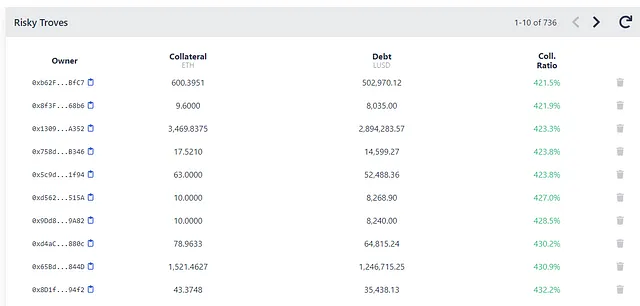

Currently the least “risky trove” sits at 421.5%, which means that roughly for every $4 dollars worth of $ETH that is put up at collateral, only 1 $LUSD can be borrowed.

Due to the peg of $LUSD being under 1 $USD for so long, the non-stop amount of discounted redemptions has caused the normal “safe” collateral ratio to balloon from around 120% to more than 400% we see today. Once again, technically the fundamentals of Liquity have continued to work soundly, but given that different lending protocols offer such a more profitable LTV (loan-to-value) ratio without the fear of liquidation/redemption, it’s no wonder why many people wanting to borrow against their $ETH have gone to one of Liquity’s many competitors.

Enter Liquity V2

In order to make borrowing attractive yet still safe in Liquity V2, the team has incorporated some of the best parts about Liquity V1 (such as the 1:1 $LUSD redemption), but added some significant changes to continue to allow the protocol to attract new troves. These include…

The cheapest debt gets redeemed first

As I mentioned before, in Liquity V1, the person with the most risky trove (a.k.a., the lowest LTV ratio) gets redeemed first. However in V2, the trove with the cheapest debt gets redeemed first, regardless of what their LTV may be. The debt’s “price” is determined on a set interest rate decided — a set interest rate that the trove owner can change at will.

For example, let’s say that there’s two troves, one with an LTV ratio of 140% yet with a set interest rate of 10%. The second trove has a much higher LTV ratio of 200% but is paying a set interest rate of 1%. Because the debt on the second trove is much cheaper than the first, when someone comes to redeem the some of their $LUSD, it will target the lower interest rate trove first.

The beauty about this model is that the interest rate on each trove can be adjusted by its owner, or in other words, if they find themselves next on the redemption list, they can set their interest rate higher so that they will no longer be the ones at risk of getting redeemed.

user-set interest rates.@CupOJoseph is bullish @LiquityProtocol v2

— Sam | Liquity (@SamExotic3) February 29, 2024

Thanks to @stable_summit for having us! pic.twitter.com/JFW4Mwajdr

Given that the main problem for Liquity V1 was rising yield rates on $USD, if the rates for U.S. Treasuries for instance get even higher, say 7–8%, trove holders can set new rates accordingly so that they won’t be at risk for redemption.

Conversely when $LUSD goes back above peg, there should be no more demand for people to redeem it for $ETH, meaning that if they choose to, people can reset their interests rates lower.

Stability Pool V1 vs. Redemption Pool V2

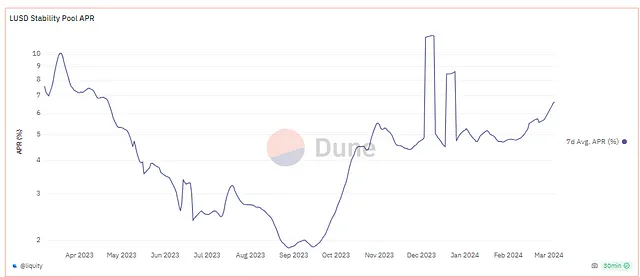

The Stability Pool in Liquity V1 served primarily as a source of liquidity to help Liquity repay on debt for redeemed troves. Users would deposit $LUSD where once a trove redemption occurs which would get proportionally burned in exchange for the entire collateral (in $ETH) from the redeemed trove. In other words, the $LUSD in Stability Pool V1 was primarily used to help make Liquity remain solvent, yet also benefitting the liquidity providers themselves by awarding them discounted liquidated $ETH. At time of writing, the average 7-day APR for $LUSD Stability Pool providers has been around 6%:

In V2’s Redemption pool, liquidity providers will have the added bonus of earning additional yield from the the interest rates provided by the trove owners — 80% of it going to the Redemption Pool, the remaining 20% going to governance (more on that later). Given the fact that Liquity’s V1 Stability Pool already earns around 6%, I’d imagine that with V2, we’ll easily see average APRs of at least 10% or greater depending on how many troves are opened up and how small the Redemption pool may be. Let’s break down some quick math:

▹Currently in Liquity V1, there’s roughly $800 million in TVL (excluding the Stability Pool).

▹If that amount was accruing roughly an average of around 5% APR in interest rates, that would mean that over the course of 1 year, the protocol could earn around $40 million dollars in interest, 80% of that ($32 million) going to the Redemption pool.

▹At time of writing, there’s roughly $70 millions dollars worth of $LUSD in the V1 stability pool.

▹Supposing that there was also $70 million dollars worth of $LUSD in the V2 pool, an annualized return of $32 million would mean that V2 redemption pool stakers could expect to make around 45% APR.

All of this may be napkin math, but what the figures highlight is that there’s a pretty big potential for all actors to come out pretty profitable in Liquity’s V2 borrowing and lending, especially considering that it currently costs an APR of 6.2% to borrow against your $ETH on Aave.

Governance

As I alluded to before, the remaining 20% of interest generated from user debt will be allotted to governance, more specifically governance-decided incentivized liquidity pools. Much like how different solidly models work offering bribes to different liquidity-pool pairs, Liquity aims to directs the 20% to different protocols to as a bonus, further incentivizing people to hold to their $LUSD on different DeFi applications.

For all the stablecoin yield hunters out there, depending on the size of the LP pool this could mean that we could see significant incentives (up to triple figures) on different major AMM protocols such as Velodrome or Curve.fi.

Other things to note…

Liquity V1 isn’t going anywhere — the beauty about Liquity V2 is that depending on market conditions, it may very well work in tandem with V2, especially once interest rates go back down. In other words, once it becomes cheap to borrow money again we could see a future rush of in-flows back into V1.

$LUSD V2 will be called something else — you’ll notice that throughout the article I keep using “$LUSD” as the stablecoin of V2, but as they referenced in a recent interview with Leviathan News, it will be called something else. (In the same vein, Liquity V2 won’t be called V2 either, and will likely be introduced as a new product with a new name.)

Introduction of LSTs as collateral — As many of Liquity’s forks have found success with such as Prisma.finance, V2 will also introduce the ability stake other tokens besides $ETH as collateral when opening up a trove, namely liquid staked-derivatives such as $stETH or $rETH.

Gas on mainnet still sucks — The major gripe I have with not just Liquity, but with all of Ethereum mainnet in general, are the potentially insane gas fees which really makes Liquity (and Liquity V2) only lucrative for people who are wanting to supply or borrow in significant high volume. Unfortunately for us non-whales, V2 will still be operated on Ethereum mainnet, just like V1.

Conclusions

As one of the OGs of DeFi, the Liquity team has already proved their innovative prowess by building one of the most trusted and immutable products out there, and following the spirit of true decentralization, I’m extremely excited to see the possibilities that V2 may bring to people’s availability to hold on to their $ETH while allowing them to maximize on its gains. In their most recent blog post, they stated that V2 will be released sometime in late Q3 this year, which will probably put us right in the middle of this bull market, but in the mean time I’ll definitely be following up about what details get released next.

As always thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: This is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!