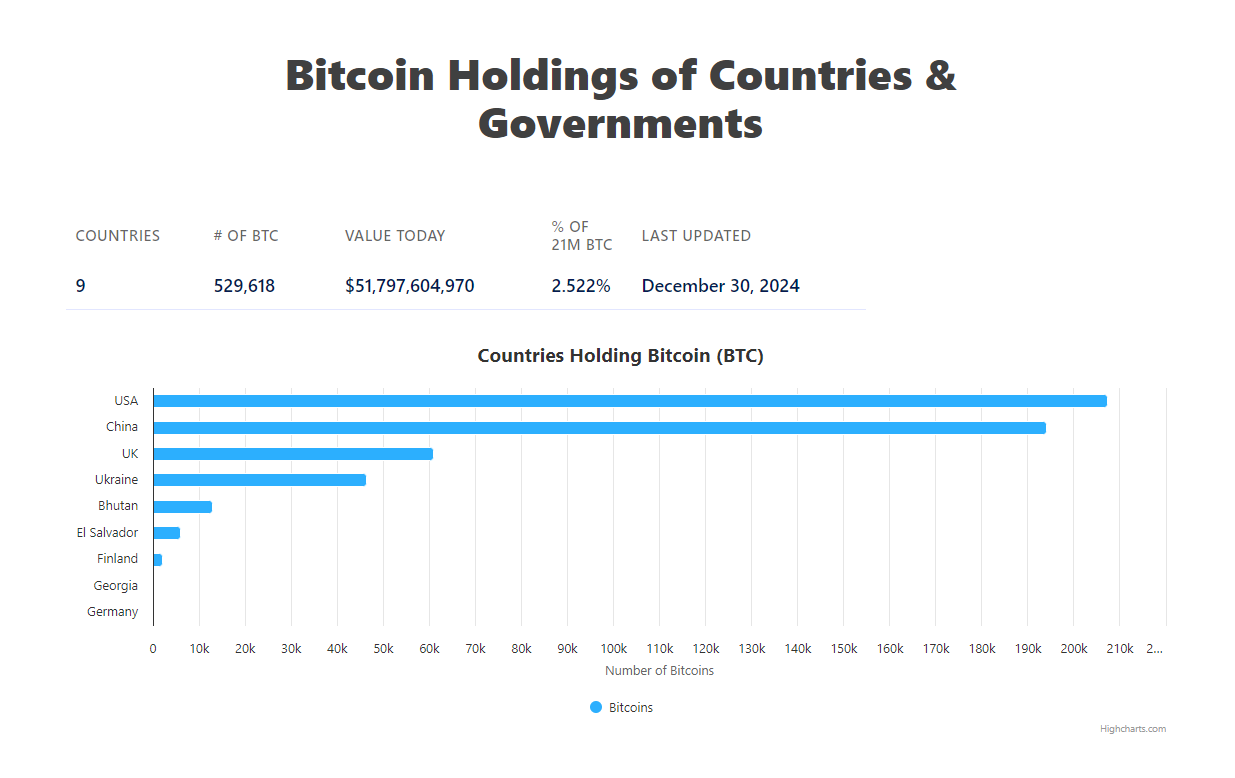

I suppose it should come as no surprise really that the United States holds the most amount of Bitcoin. In December 2024 the country as a whole held a total stack of just over 198,000 Bitcoin. That's a huge amount of money when you consider the value nowadays of just 1 BTC, in total the USA holds $19,756m Bitcoin and counting.

However, in terms of the total supply of Bitcoin it's actually only a small amount given that currently just over 19m Bitcoins are in circulation, with the total never exceeding 21m when all Bitcoin have been mined.

Now as we actually don't know the country where the creator/s of Bitcoin comes from, despite the name, Satoshi Nakamoto, signalling Japanese descent, as we can see it appears to have made no difference to the global economic hierarchy, at the moment. This is not to see it has not changed the lives of millions of ordinary people for the better, because we all know it has, it's just to point out that the economic superpower has sustained its superpower status even when it comes to crypto.

Take a look at the second biggest holder of Bitcoin by country and we see that it is China with an aggregate holding of 190,000 BTC, not far behind the USA. Again this syncs with the economic powers of the world where China is now the second biggest economy on the planet and the second biggest holder of Bitcoin.

The next biggest stacker of Bitcoin is the United Kingdom which currently holds just over 61,000 Bitcoin. Whilst the UK is not the third biggest economy in the world it is though the 6th largest economy and therefore it isn't that surprising it holds such a large amount, especially when you consider the population is far smaller than the US and China.

Interestingly the fourth biggest stacker of Bitcoin is Ukraine. While both Ukraine and Russia were big early adopters of BTC the expansion of the war in Ukraine in 2022 has hastened Ukraine's BTC ownership, with millions of pounds worth of Bitcoin pouring into the country from donations. The Ukrainian government has used Bitcoin extensively to fund its response to the war.

However, when you break down the individual ownership of Bitcoin within a country things get more interesting. In Brazil for example, a country that doesn't feature in the Top 10 BTC holders, 44% of Brazilians own cryptocurrency, which is 26m people.

Another 45% say they have intentions of purchasing crypto as a result of the devaluation of their national currency. Bitcoin and crypto is very popular in Brazil and the adoption of crypto will continue to increase in the country as a result of government adoption and largescale digital finance literacy within the country.

Compare this with America and actually the percentiles reveal something similar. It is now estimated that 40% of Americans own some form of cryptocurrency, an increase from 30% in 2023. And of those crypto owners nearly two thirds intend to buy more. Interestingly 21% of non-owners of crypto state they are now more likely to buy into the crypto markets as a result of the launch of Bitcoin ETFs.

In many ways when we look at the wider picture of global Bitcoin holdings yes a conventional pattern emerges to some extent when assessing each country's holdings, but actually what we also learn is that there is generally a sporadic uptake of Bitcoin and crypto adoption. There is no clear conclusion to draw other than the fact Bitcoin is now widely accepted as a legitimate currency and trading asset in many countries around the world. Let's hope it continues!

Peace!